Crossrail is the leading and most ambitious infrastructure scheme in London since the 1990’s when the Jubilee Line opened, creating a land revenue of £9billion.

London is under constant development; whether it be commercial or residential ventures. It is no surprise that 91% of tenants in London have asserted a desire to live within 1km of a transport link; making Crossrail an even more exciting project for Londoners. Crossrail is expected to run a full service by spring 2019 and will have cost an estimated £14.8bn which includes running an additional 24 journeys per hour at peak times of the working day. Crossrail trains are to be one of the most advanced trains in the world and to run this unique service, 73 miles of track length is being added to some of London’s busiest tube stations.

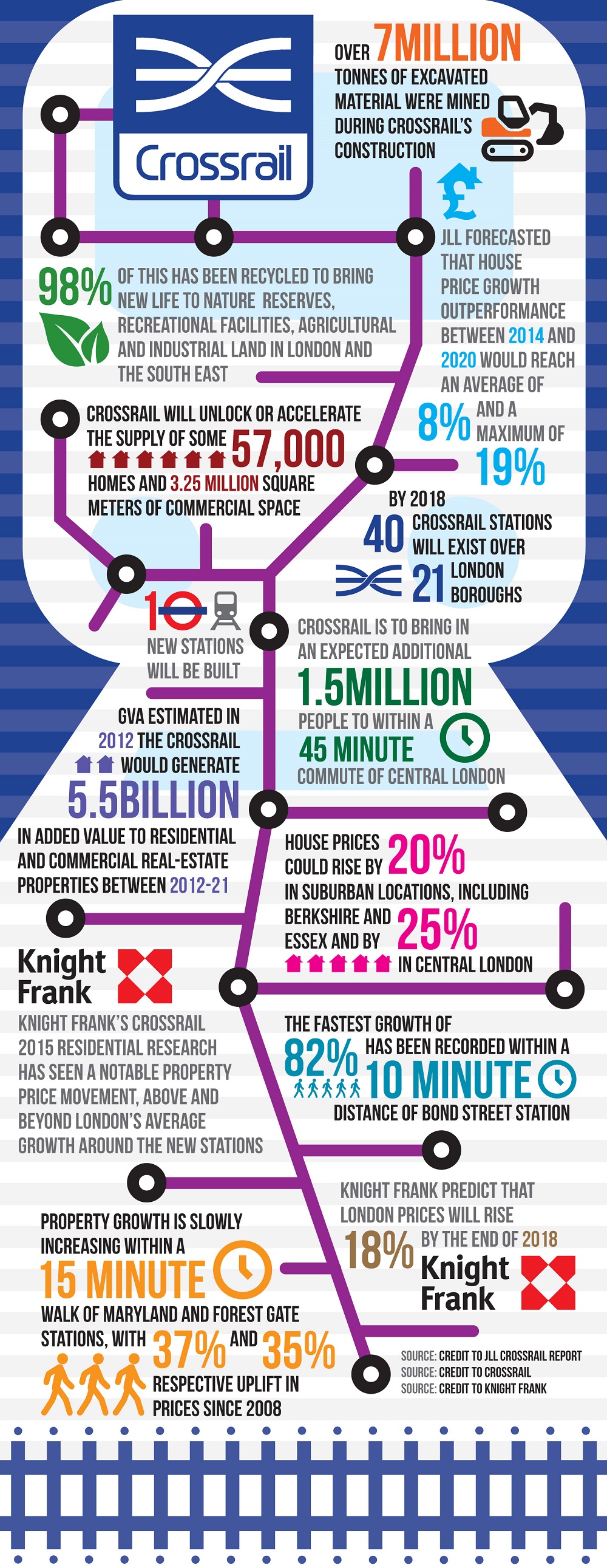

Crossrail has boasted an incredible housing market shift; with house prices in and around the city and its suburbs increasing in value. Research conducted in collaboration with Sell House Fast has shown that some of London’s most prestigious areas to live have become a gateway for home and international investors, with many toying with the idea to sell up and move closer to London’s hotspots. Not only have house prices soared since construction started in 2009, but Crossrail has provided an opportunity to ‘regenerate’ and ‘rejuvenate’ London.

Gráinne Gilmore, head of Knight Frank UK residential research has identified key factors for this radical shift in property prices. Knight Frank have predicted that by the end of 2018, house prices across London will have risen by 18%. What is important to note is not that Crossrail is causing an increase in property prices; but an emphasis that regeneration projects are underway to restore areas of London once neglected. Crossrail will add economic growth to the capital as well as placing London on a path of rebirth. Gráinne Gilmore claims: “It is worth noting that these stations have undergone, or are undergoing, serious re-development, with an overhaul of the public realm surrounding them, underlining the part played by regeneration in underpinning property price growth.’”

Source: sellhousefast.uk

3,000,000 square feet of space

Crossrail ‘will be the catalyst for regeneration in key locations and a driver of London’s economic growth, in particular from a property perspective.’ This was taken from GVA’s Crossrail – Property Impact Study 2012, claiming Crossrail will regenerate areas of London untouched. Not only improving the quality of living for many, new developments sanctioned in conjunction with Crossrail will help more Londoners move to London for their career.

Crossrail has granted construction of ten major stations to be built along the new route, with 12 development opportunities approved. Interestingly, in a bid to regenerate London and to add value to areas previously restrained by funds, the number of planning applications submitted to local councils has increased substantially. Noticeably, from 2008 to 2013, 41% of applications were made within one kilometre of Crossrail station. 3,000,000 square feet of commercial, retail and residential space has been allocated for development in response to Crossrail.

Areas with Crossrail stations built have also shown a significant house price increase. Within 500 metres of these stations, there has been a 54% rise in property prices. Paddington Triangle as it will be called is one of the largest over-site developments (OSDs) in the heart of London. Property developers have jumped at the opportunity to invest into this 325,000 square feet scheme. The aim is to rejuvenate the eastern end of Oxford Street and to include brand new office and retail space which will breathe new life into an old station in need of restoration. Areas such as Maidenhead, Southall and Ealing have been acknowledged as key long-term investment projects to oversee large improvements to the area; West Ealing was given the go-ahead for a new station to be built. The new station will help transform the area, adding value and community into a run-down area of London.

GVA, one of the largest commercial property advisers investigated exactly how much Crossrail could add to residential and commercial real-estate from 2012-21. Crossrail could add £5.5bn in added value to the property market in the space of nine years; a property marketing bursting with an opportunity to build and invest. This ‘ripple’ effect in the industry will help feed stronger price growth towards central stations and those within a short commute of London. In particular, areas such as Shenfield and Brentwood have seen a drastic upturn in the property market, with access to Liverpool Street with Crossrail only 40 minutes. Brentwood in Essex is drawing in a large number of buy-to-let investors as house prices are currently low. Shenfield’s house prices start from £360,000 for a two to three bedroom flat/house and for larger properties, house prices will be in the region of £1million and more.

Crossrail is to attract an extra 1.5million people to the capital, within a 45 minute commute of London; making areas such as Essex and Shenfield prime locations for investment. Property in Central London will increase by 25% and Knight Frank has understood much of the increase is due to large property developers lending their expertise to new housing developments. Crossrail is causing a noteworthy change and there has been an 82% price increase within a 10 minute perimeter of Bond Street Station. There was also a 61% growth in house prices within the same radius of Tottenham Court Road Station; since July 2008. The increase in property prices is in direct response to cut journey times into Central London. The average commuter is expected to see 25% cut off their journey time in and out of London.

London is regenerating

With over-site developments in full swing, many private developers have been investing their time into new housing schemes along the new route. Woolwich Station has recently had an impressive makeover with Royal Arsenal Riverside seeing the first wave of new builds completed. Ironically, Woolwich was not included in the plans for Crossrail and with funding by Berkeley Homes and The Royal Borough of Greenwich, the new apartments have transformed the area. Within one mile of new Crossrail stations, statistics have shown that one in five new homes sold in London 2009-2013 was due to Crossrail.

2000 new builds are to be completed within one mile of Canary Wharf and will account for almost one quarter of new property developments along the Crossrail route. Canary Wharf is set to become one of Crossrail’s largest stations; a priceless and invaluable area to develop. A recovering property market is fuelling the construction of nearly two thirds of new homes in the area. JLL, a professional services and investment management company has estimated a 44% property price growth (2014-2020) in Canary Wharf. JLL’s report; Crossrail: Identifying Opportunities forecasted areas which will receive the highest house price growth as part of a wider scheme to regenerate London. Galliard Homes, London’s leading property specialists is to develop Lincoln Plaza and Baltimore Tower. In 2013, a two-bedroom flat in Baltimore Tower sold off-plan for £607,000 and has recently re-sold for completion in 2016 for £800,000; a 32% property price increase. Over the period 2014 to 2020, Whitechapel (54%), Woolwich (52%) and West Drayton (51%) are to become major regeneration hotspots.

Tottenham Court Road was deemed one of four major Crossrail stations and so to develop was key. JLL estimate a 42% property price increase and so Galliard Homes are developing Hanway Gardens; a one minute walk from the station. Tottenham Court Road is part of a large network of stations that will become one of the main inheritors of Crossrail’s regeneration efforts. It will receive a £1billion makeover with 500,000 sq. ft. of office, residential, retail spaces as well as a new theatre and public gardens. Farringdon will also benefit, with a brand new station in the pipeline and will become Britain’s busiest train station; the only one connecting to three of London’s airports.

There is no denying Crossrail is set to take the housing industry by storm. Whether it be new developments in central London or its suburbs, what differentiates this brand new transport system is its ability to invest in areas of London in real need of regeneration. It will become a game-changer for the current property market and will only continue to highlight a rapid increase in property prices as more people flood into the capital.

No comments yet