By Emanuela Barbiroglio

Healthcare real estate investment activity picks up

Investment activity in the healthcare real estate market has picked up again this year following a relatively subdued 2016, according to CBRE’s latest market review.

The firm expects investment volumes in the first half of 2017 to top £700m, which is not far off the total recorded for the whole of last year. The wider asset-backed healthcare market has been more consistently buoyant thanks to some major deals including Bupa’s purchase of Oasis Dental and Acadia’s acquisition of Priory. Last year, £5.3bn of deals closed.

Notable transactions this year include the acquisition by Impact Healthcare REIT – which floated in March – of a portfolio of 56 care homes for £150m. Other large deals this year include St Cloud Care’s acquisition of LRH Homes, which had a portfolio of 13 homes in London and the South East, for a price reportedly in excess of £70m.

UK trade buyers, such as St Cloud Care, are becoming increasingly active in the care home market, which CBRE says is an encouraging sign for the sector.

“This suggests that good operators are managing in the face of sector headwinds and that the sector is more sustainable than some of the negative headlines would imply,” the firm says.

As for real estate investors, the healthcare sector continues to prove attractive because of the long leases that are typically on offer. This has put upward pressure on pricing.

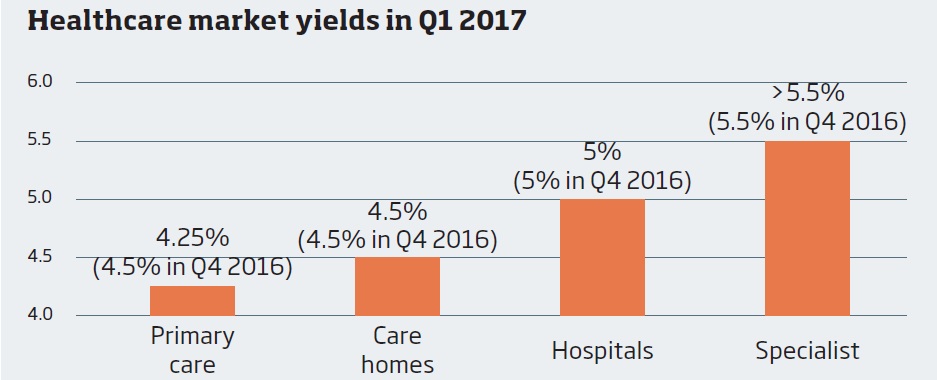

Prime yields in the first quarter remained consistent with the previous quarter, with the exception of the primary care sector, where yields tightened from 4.5% to 4.25%.

“The UK healthcare real estate sector remains extremely buoyant as investors seek secure, asset-backed, long-term income streams in a market sector underpinned by a widening gap between supply and demand,” says Tom Morgan, senior director of healthcare advisory at CBRE.

“Health and social care has proven itself to be a dynamic sector over the past 10 years and investors are learning to underwrite different business models and price operational risk alongside real estate and tenant credit risk.”