By EMANUELA BARBIROGLIO and GUY MONTAGUE-JONES

Industry in good spirits despite Brexit-induced slowdown

The property industry is still remarkably upbeat despite the market slowdown since the EU referendum, according to this year’s Smith & Williamson survey

The detailed survey, based on the views of senior professionals from across the industry, found that although confidence levels have fallen since last year, most are still confident about the sector’s prospects.

Some 62% were confident about the outlook for residential property over the coming year, while 54% were confident about the outlook for commercial.

On some points, respondents were just as upbeat or more upbeat than they were a year ago. Notably, 74% said they saw residential as a strong five-year investment, a 10-percentage-point rise from 2015.

“People are a lot more positive about residential than commercial,” said Jacqueline Oakes, chair of the property and construction group at Smith & Williamson. “This may reflect the lack of supply. We obviously have an enormous shortage of housing, and it is difficult to see that changing any time soon.”

One of the most striking findings from last year’s survey was that for the first time, people were more optimistic about Greater London than central London.

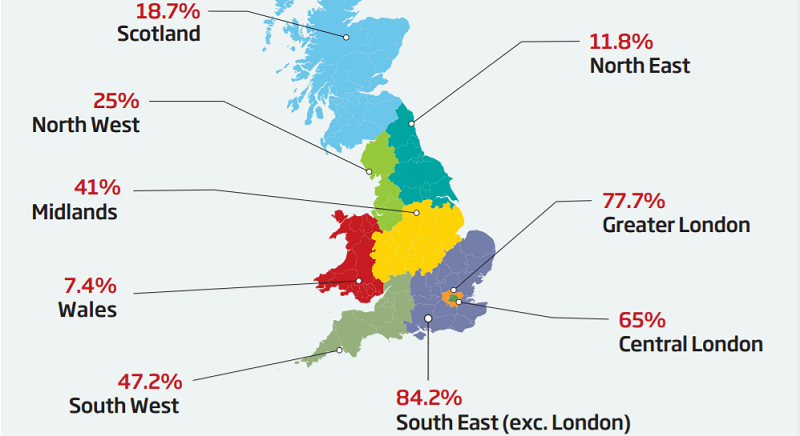

This year, although overall confidence in both markets has fallen, the gap between the two has become even wider, with the percentage of those confident in central London down and Greater London markets down 15 percentage points to 65% and eight points to 77.7% respectively. Confidence was strongest in the South East at 84.2%.

Changes to stamp duty were partly to blame for the weaker outlook for central London, Oakes suggested.

“There is a lot of uncertainty. Tax changes have really begun to hurt prime central London property, while Brexit insecurity has affected the investment potential of some Greater London property,” she said.

Get involved

For Call Off Duty to be a success, we need your help. A dedicated survey is ready and waiting to receive your comments and recommendations.

Please lend us your support. Add your voice to the industry heavyweights backing the campaign and help us put such a persuasive case to Philip Hammond that he is compelled to Call Off Duty in the March Budget.

Source: Call off Duty

A number of the questions in this year’s survey related specifically to Brexit. While only 27% thought the vote to leave the EU would be positive for the industry, the majority were not letting the vote hold back their business plans: only 29% said they had put key decisions on hold.

Ultimately, it was the health of the UK economy that loomed largest in respondents’ minds, with more than 80% ranking it as one of the biggest factors likely to affect their businesses over the next year.