By Emanuela Barbiroglio

Large investment deals buoy commercial market in Q3

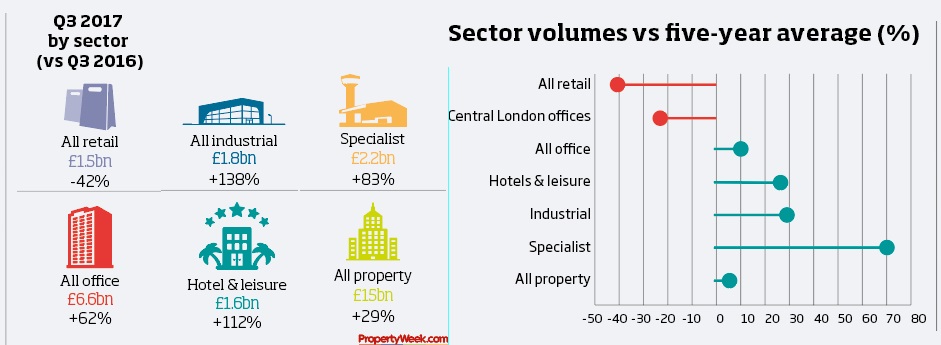

An unusually high number of large investment deals helped boost volumes in Q3 to £15bn, up 10% on the previous quarter and 53% on the same period last year, the latest Lambert Smith Hampton (LSH) UK Investment Transactions report shows.

Nine deals above the £400m mark concluded during the quarter, including LKK Health Products’ £1.28bn acquisition of the Walkie-Talkie and Aprirose’s £525m purchase of the QHotels portfolio. The market below the £50m level was also relatively buoyant, with volumes ahead of last year and slightly above the five-year average.

However, the market was quieter than usual between the two extremes.

“This is partly down to more cautious activity among institutional buyers who, in the 15 months since the referendum, have bought only 10 assets in excess of £100m,” says Oliver du Sautoy, head of research at LSH.

Although UK institutions bought more than they did in the same quarter last year, they were net sellers to the tune of £1.2bn in Q3 and their buying activity was 40% down on the five-year average.

By contrast, overseas investors accounted for all 15 of the largest deals in the quarter and their buying activity was up 31% on the five-year average. Far Eastern investors were particularly active, accounting for 40% of the overseas deal volume.

Investor appetite varied significantly by sector during the quarter. Retail was out of favour, with volumes 44% below the five-year average, and despite the sale of the Walkie-Talkie, central London office volumes were also down on the historical average, by 26%.

However, investment in specialist assets was up sharply, driven by interest in long-let assets, and industrial deal volumes were 31% up on the five-year average.

LSH expects 2017 to be a record-breaking year for the industrial sector with volumes on track to beat the £6.7bn recorded in 2014.

“With industrial returns considerably outperforming other sectors, it’s hardly surprising that some investors have opted to capitalise on this demand and bring stock to the market,” says LSH chief executive Ezra Nahome.