By Sam Horti

Number of BTR homes soars as developers turn to regions

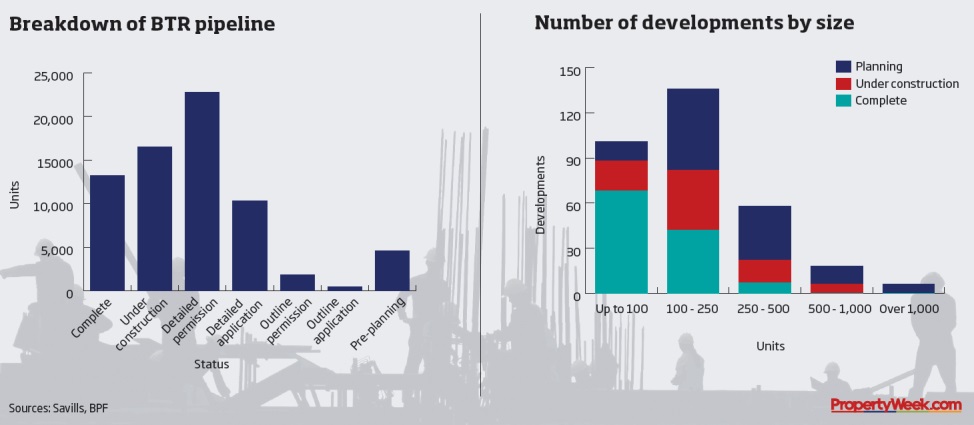

The number of build-to-rent (BTR) homes under construction or in planning is more than four times the total that have so far been built – showing how rapidly the sector is growing.

New research from the British Property Federation (BPF) and Savills reveals that the number of homes currently under way has reached 56,547, compared with 13,277 that have already been developed.

Not only is the number of schemes growing; the geographical spread of developments is widening, too. London accounts for more than two thirds of the 13,277 existing BTR homes, but little more than a third of the 16,506 being built.

Manchester and Salford collectively boast the largest number of BTR homes under construction outside London.

Ian Fletcher, director of real estate policy at the BPF, says the growing number of regional BTR homes is hugely positive for the sector.

“The UK’s build-to-rent sector has reached a significant milestone, proving for the first time that the sector is making its mark across the regions,” he says.

Larger developments

The research also highlights a growing trend towards larger BTR developments. The majority of completed schemes – 68 out of 117 – have fewer than 100 units, while 42 have between 100 and 250 units and a handful have between 250 and 500.

By contrast, most of the sites under construction or in planning will deliver more than 100 units. Out of a total of 121 projects, only 33 projects feature fewer units than that. Six schemes of more than 500 units are under construction, with a further 18 in planning.

The research also reveals the breadth of organisations delivering BTR units in the UK.

Major UK developers make up the largest group of providers, accounting for a quarter of BTR units currently being built, while local developers, contractors and UK housebuilders deliver roughly a fifth each. Twelve per cent is being developed by registered providers, while just 7% of stock is being delivered by international developers.

Andrew Stanford, head of UK residential at LaSalle Investment Management and chairman of the BPF’s BTR committee, says the growth and breadth of the sector is “encouraging”.

“Options for investors have noticeably increased across the country for those willing to be involved in the development process. This bodes well for the rapidly maturing sector,” he says.