Traditionally, logistics has been viewed as the ugly duckling of the real estate investment market, but it’s rapidly turning into a beautiful swan. It takes a team of experts to identify the swans, however, and to help investors turn a profit from them.

SPONSORED CONTENT FROM PATRIZIA

This transformation is driven by developments towards omni-channel retailers and the boom in e-commerce. Behind the scenes, dramatic upheavals are underway throughout the supply chain. Which is why there is an urgent need for more logistic properties with advanced technology to complement the retailers in their store sales — and to meet the call for same-day deliveries. A new investment asset class of logistics facilities is emerging. But what makes such a building attractive for investors? Where are they — and who should be investing?

Logistics belong in the international portfolio

“Logistics is the ideal cross-border product, which is good for risk and market diversification.”

The inherent global nature of logistics makes it a natural investment choice for internationally operating, institutional investors. Logistics is the ideal cross-border product, which is good for risk and market diversification. Our pan-European platform was set up specifically to address the growing global interest in the logistics sector.

Managed out of Amsterdam, the hub has local sourcing and execution capabilities. The core team, which is led by Roger Peters and includes Octavian Cristea, can call on over 50 years of experience in the pan-European field of logistics properties.

A European base with a focus on logistics is crucial. There is significant scope in Europe to grow in coming years as logistics providers reconfigure their networks to meet growing demand from e-commerce sectors especially in main metropolitan areas.

Hotspots across Europe

Where are the most attractive European regions for institutional investors? In-depth research by PATRIZIA confirms that the majority of investments in logistics are in three regions: the UK accounts for 40% of all investments, the Nordics for 18% and Germany for 20%.

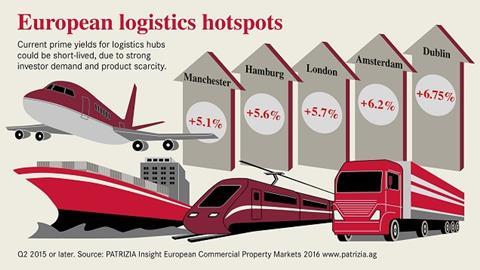

In addition, European cities with exceptional infrastructure currently achieve higher prime yield levels for logistics assets, even taking into account the decline in the market since 2010.

They include Dublin, Manchester and Hamburg. Strong investment and product scarcity is expected to impact the market further. But that shouldn’t scare investors away.

Shorter delivery, secure rental and flexibility

Just as customers can enjoy faster deliveries, so too can investors in today’s logistics market. The delivery time of a building is short, between 6-10 months. The capital volumes for a building are relatively low, too. In addition, the sector produces a stable cash flow to investors with modest rental and capital value growth.

Should the economy grow fast or become sluggish, logistics is able to respond fast

But it’s not just the short lead time and secure income that is drawing investors. The flexibility of logistics is attractive, too. Should the economy grow fast or become sluggish, logistics is able to respond fast within a few months or so, as this sector is directly related to the retailers and consumer spending.

Expert eye?

And where are the highest margins of all? Not with conventional logistics in rural areas, the experts conclude.

Our targeted focus on the ‘last mile’ in key European cities will deliver higher margins for our investors — higher than is possible with conventional logistics.

Arthur Tielens, managing director at PATRIZIA Logistics Management Europe B.V.

About PATRIZIA Immobilien AG

PATRIZIA Immobilien AG has been active as an investment manager on the real estate market in 15 European countries for more than 30 years. PATRIZIA’s range includes the acquisition, management, value increase and sale of residential and commercial real estate over own licensed investment platforms. As one of the leading real estate investment companies in Europe PATRIZIA operates as a respected business partner of large institutional investors and retail investors in all major European countries. Currently, the Company manages real estate assets worth around EUR 17 billion, primarily as a co-investor and portfolio manager for insurance companies, pension fund institutions, sovereign funds, savings and cooperative banks.

No comments yet