Those twitchy-footed folk at the British Property Federation (BPF) have been on their travels again.

But far from jetting off to exotic climes for a pre-season getaway, the team spent three weeks touring England to take the property industry’s pulse from different regions.

Fittingly, infrastructure was the key theme at this year’s BPF roadshow.

It was an interesting period to be traversing the country, with some of the sessions taking place prior to the EU’s referendum and others after the vote for Brexit.

However, if anything, the referendum result served only to amplify the main message that had already emerged from earlier roadshow pit stops.

Public and private sector participants in all six cities visited were unanimous in their call for the government not just to maintain its focus on transport infrastructure, but to put the pedal to the metal.

Across the M62 corridor, speakers enthused about the benefits that upgrades to links between Liverpool, Manchester and Leeds would bring, not to mention the arrival of HS2.

Manchester (15 June) - integration is the way to transport success

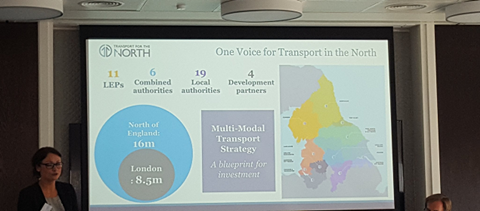

At the Manchester seminar, the panellists focused largely on transport, led by TfN’s head of policy and strategy, Amy Harhoff.

TfN aims to improve rail and road connections and halve travel times between the core cities of Manchester, Leeds, Sheffield, Newcastle and Liverpool.

“That will transform the economic geography of the north and allow businesses to function in a more integrated way,” said Harhoff.

TfN’s economic vision is that, while there is capacity and impetus for the north to grow, infrastructure is needed to capitalise on the opportunities.

“The north can perform on the world stage, but we need to be consistent in our approach and in the way we communicate with overseas businesses,” she said.

Pete Gladwell, head of public sector partnerships at Legal & General, spoke of the importance of viewing property and infrastructure as a single entity. “We create a false dichotomy when we view property and infrastructure separately,” he said. “The two are so inter-related now that, for the success of our industry, we need to view them as a whole.”

He added that in the past, society had not appreciated that new infrastructure made property more valuable, and that the model needed to change, with greater private sector investment.

“There’s no point us sitting in London and hoping someone else is going to do it. Actually, we have a corporate, social role to invest in it ourselves and to try to make it happen,” he said.

Cushman & Wakefield director Caroline Baker said she believed that significant infrastructure improvements were absolutely critical for various sectors of the property market, including industrial, retail and residential.

She recognised that much had been done already to improve connectivity but said “there is still a long way to go in terms of making sure we have efficient mechanisms in place to support businesses to thrive”.

Liverpool (15 June) - investing in a brighter future for the north

In Liverpool, a congregation of soggy property professionals - who had braved a downpour of biblical proportions to attend the event - heard from representatives from TfN, Peel Land & Property and Deloitte.

“It’s heartening and important at this time in the evolution of the UK that the north is emerging with a single voice,” said Simon Shrouder, TfN’s head of stakeholder engagement and communications. “Serious investment north of Watford has been long awaited and much needed.”

By creating synergies across the region between road, rail, air and sea, TfN hopes to build a case for lasting sustainable development that helps maintain and improve employment levels in the north.

Cathy Wignall, urban strategist at Deloitte, talked through the three steps for successful infrastructure-led development, starting with the “incredibly important aspect” of aligning partners in what can often be complex projects involving various stakeholders.

“Secondly, create value uplift,” she said. “Whether you’re a private sector or public sector partner, it’s necessary to see where value can be derived from a development.”

She also stressed the importance of maximising the impact of infrastructure-led development, which could enable investors to justify and prioritise projects involving infrastructure over others that do not.

The north/south divide was addressed by Richard Mawdsley, development director at Peel Land & Property, the developer behind the Wirral Waters regeneration project.

“Our ethos is to make the north a stronger, more economically vibrant place in which to live and work,” he said.

“The south propping up the north is not good for anybody and so there is a drive to make sure that the northern powerhouse does happen.”

Leeds (21 June) - the message is clear: ‘Infra-Penny, Infra-Pound’

Infrastructure was also the main talking point during the BPF roadshow’s pit stop in West Yorkshire in a seminar entitled ‘Infra-Penny, Infra-Pound’.

Angela Barnicle, director at Deloitte, highlighted several transport-based developments in the UK and overseas that are looking to use multiple partners to maximise the impact of infrastructure improvements and push up local property values. These include the Mayfield Quarter in Manchester and York Central in York.

“Mayfield is a redundant station that will be opened up for development by the arrival of HS2,” said Barnicle. On York Central, she said the dearth of grade-A space in the city could be addressed by the new development, providing the “infrastructure needed to allow York to continue on its economic trajectory”.

Also banging the drum for more money to be spent on improving infrastructure in the north was Owen Michaelson, chief executive at developer Harworth Group, who talked about the need to open up land for development.

“A lot of development land is constrained because of a lack of infrastructure,” he said.

He highlighted examples of public and private sector money being invested to great effect, including the 4km-long FARRRS road, which links the M18 to Doncaster airport and was 60% funded by the private sector with the rest coming from the public purse. “It’s only a short road, but £26m has pump-primed hundreds of millions of pounds of development,” he said.

Michaelson added that central government should not change its planning policy for another 10 years, as everyone “has to stop and learn for three years what they’ve done”.

The good news for the likes of Harworth is that infrastructure improvements are high on the agenda for the newly formed public body Transport for the North (TfN), the driving force behind infrastructure improvements.

Amy Harhoff, TfN’s head of policy and strategy, said the organisation recognised that the region’s economic output could be better. But she added: “We lag behind the performance of the rest of the UK and that’s something that we’re looking to improve.”

In Bristol, meanwhile, the council’s head of property waxed lyrical about the nearer-term upgrade to the Great Western Railway.

Bristol (29 June) - maintenance costs won’t hold back development

“Devolution deals are the main game in town: you are either in or you are out, and you will only get your hands on the £30m-per-year funding if you are in.”

That was the view of Robert Orrett, service director, property, at Bristol City Council - and it set the tone for the BPF’s session in the South West.

Extra cash was urgently required to maintain existing infrastructure and facilitate development, Orrett said.

“The public sector has as much of a problem maintaining and operating infrastructure as it does funding it in the first place,” he reasoned, alluding to Bristol’s famous floating harbour. “That costs £2m just to operate, so we don’t want to think about replacing parts.”

However, he stressed the council understood that “the quality and quantity of infrastructure in a city is directly related to development” and was therefore a priority.

The point drew nods of agreement from Robin Dobson, director of retail development at Hammerson, the developer behind Bristol’s Cabot Circus shopping centre. The first questions Hammerson asked before investing in a city related to infrastructure, he said.

“We need to know if the right road, public transport and public realm infrastructure is in place,” he added. “Cabot Circus has taken 15 years to develop and is still ongoing. The next phase will involve getting the infrastructure right for the highways and bus networks.”

The panel noted that Bristol and the wider South West received infrastructure funding below the national average. However, they were not overly concerned that investment in high-speed rail had been designed to provide a boost to the Midlands, the North West and Yorkshire. The electrification of the Great Western Railway, said Orrett, would reap economic benefits far sooner.

“The reduction in journey time is not as much as HS2 will deliver, but the process is 20 years ahead,” he said. “The quality of the trains is just as important as their speed. The electrification is an outstanding feature for Bristol’s office and employment prospects.”

Perhaps the most compelling voice was to be heard in Birmingham. Some experts have cast doubt on the new government’s commitment to HS2.

It would be a massive mistake to step off the gas now, says the organisation’s programme director for construction, who argues that the Brexit vote makes investment in transport infrastructure more important.

Birmingham (7 July) - HS2 can unite the country post-Brexit

Brexit has made the much-anticipated arrival of HS2 all the more important, according to the speakers at BPF’s Birmingham seminar.

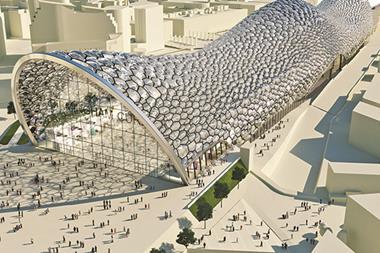

Construction on the first phase of the high-speed line, linking London Euston to a new station at Curzon Street in Birmingham, is due to begin next year and complete in 2026. “HS2 will be a catalyst for growth across Britain,” HS2’s programme director for construction Mike Lyons said.

“With the UK deciding to leave the EU, that is suddenly even more important than it was a few weeks ago,” Lyons added. “The stimulus for growth for the Midlands and the north is even more important than ever to rebuild and unify the country. The catalyst for growth starts now.

“We are spending millions of pounds driving the project and working with partners in this region and beyond. Businesses are expanding and changing their plans already and companies are relocating here to be close to HS2.”

Lyons said the government’s decision to locate HS2’s headquarters in Birmingham’s Snow Hill, employing 1,000 people in the city, meant the process of rebalancing the economy had “already begun”. In total, the construction of HS2 is expected to create 52,500 jobs across the Greater Birmingham area.

Tony Bray, area director for the West Midlands team of the Department for Business Innovation & Skills, added that the rebalancing of the UK economy needed to go beyond major cities.

Plans to extend the Midland Metro tram line were given the go-ahead by the government last month, with completion scheduled for 2019.

Bray said regional towns and cities both on and off the HS2 route should be following suit and making long-term investments in their transport hubs to make sure they too benefit.

However, he admitted that “we don’t really know what is going to happen” following the Brexit vote.

The vote revealed some deep divisions, not just between north and south, but between London and pretty much everywhere else, he notes. In that context, investment in projects that bring us closer together takes on a symbolic as well as an economic value.

Newcastle (22 June) - project funding likely despite power struggle

When the BPF roadshow stopped off in Newcastle, the talk was as much about politics as it was about infrastructure. Perhaps that shouldn’t be a surprise when the big-ticket items promised by the government in connection with its ‘northern powerhouse’ agenda won’t do much for the North East.

However, the speakers were not unduly negative. “There has been a move from the substantial to the conceptual, with the northern powerhouse more concept than substance,” said Ian Baggett, founder and chief executive of regional developer Adderstone Group, which is behind the first build-to-rent scheme in Newcastle. “However, if this marketing push draws investment to the region then it will be successful.”

More local political issues were also on the agenda. Infighting between the seven councils that make up the North East Combined Authority has delayed progress on the devolution of powers to the region and is an ongoing area of concern for the property industry.

Baggett urged the audience to “avoid negative PR and grumbling about regional discrepancies”.

Local authorities’ concerns that the government’s devolution plans could undermine their autonomy were also addressed.

Tim Foster, head of economic advice at TfN, said that the establishment of TfN wasn’t about overruling councils, but was about facilitating partnership working. “TfN’s focus is not on pulling powers away from local authorities, but about the north coming together to make decisions that are best for its growth,” he said. “The region’s local authorities have a seat on TfN’s shadow board.”

Foster added that the North East would benefit from transport investment, even if it won’t be directly affected by major projects announced by government.

“As well as major infrastructure projects such as the Trans-Pennine Tunnel and northern powerhouse rail [HS3], we are concerned about connectivity between local areas, and how that fits in with the bigger projects,” he said.

Investment was likely to flow into the North East in any case, said Baggett, as “there is recognition that investors can’t find value in London, and the North West is beginning to overheat with much more development”.

No comments yet