Earlier this month Property Week, in association with Freeths LLP, published the results of a survey exploring the industry’s attitude towards the nascent proptech sector and technology generally. A roundtable discussion was then held at the law firm’s London office to discuss the survey findings and look at the current role of technology in the property industry and how it might evolve in the future.

Our panel of experts

Nicky Wightman, director worldwide occupier services, Savills

Eoin Condren, managing director UK, VTS

Tom Cheesewright, futurist speaker

Joe Cohen, founder, Property.Works

Matthew Flood, commercial director, Landsec

Stephen Walker, deputy head of asset management - UK, Aberdeen Asset Management

Guy Berwick, head of innovation & delivery, Freeths LLP

Simon Creasey, Property Week (chair)

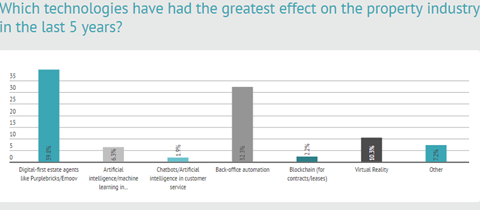

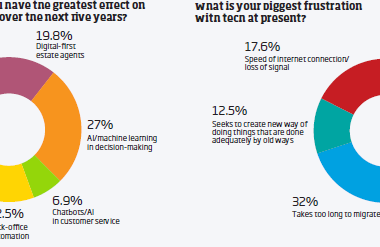

According to the survey nearly 40% of respondents said digital-first estate agents have had the greatest impact on the property industry in the last five years. Proptech seems to be more mature in the residential sector. Why is that?

SW: I think it’s for two reasons. The guys who have developed the technology have experience of residential so they understand how it works and they don’t necessarily understand how commercial works. Also, residential by definition is a simpler concept than commercial real estate. So if I’m buying or selling a commercial building there might be 14 or more different steps and they all involve friction points.

Selling a house requires fewer of those friction points so therefore it is easier to streamline. There is also an issue around the sharing of data. If you’re a commercial investment agent and you’ve done very well for 30 years by not sharing your information you don’t want to start now, whereas in residential it is available to everyone.

GB: When you talk about commercial real estate agents wanting to hold onto their proprietary information I love that because anyone who has got that mindset is toast. Get with the programme, folks. The world has changed in the last few years. It’s about transparency. We are all naked - for want of a better word - in terms of who we are and how we interact in our business supply.

JC: I would add to that the fact that the residential property market is a £9trn asset class, so when investors are thinking ‘Where am I going to put my money?’ it jumps out. It’s traditionally been a classified vertical so when you go to an investor and say ‘Do you want to build something that is a big business in print and it’s going to make this transformation to digital and it is very clear we can replicate it?’, investors will say ‘Where do I sign up?’.

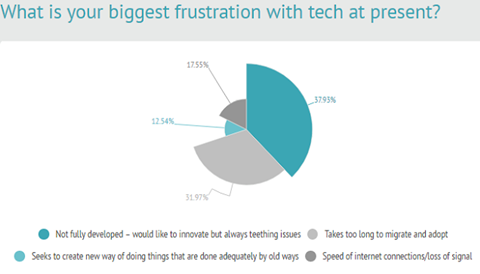

The survey found that 41% of businesses only embrace technology where it is market proven and 38% of respondents said that their biggest frustration is that technology is not fully developed. Do you think the industry is really ready to embrace technology and change?

MF: That statistic about the frustration of technology not being developed is staggering. If you’re waiting for the product to be fully adopted you’re never going to adopt anything.

JC: I think it’s really easy to say ‘I’m willing to embrace technology’. The hard part comes when there is cost attached to it. So I think to a large part no, people haven’t really been ready to embrace technology. To be fair, sometimes people don’t do things not because they don’t want to, but because they don’t know how to. What we are seeing is a lot of people who don’t know how to change because they have never really had to. That muscle has atrophied because it’s never been used.

EC: When we go in to see potential clients and explain what our product does we can tell very quickly if they’re going to use it or not, because the ones who get it see the opportunity right from the very beginning. It’s an easy value proposition. It brings all your information together in one place and you can do some really interesting things off the back of it.

But you often see people nodding along who sort of get it and then towards the end you say ‘Here are your competitors who are already using our product’ and then they go ‘Oh, we should really start looking into doing this’. So you have people who see the opportunity and people who are driven by fear to do something.

TC: The problem is there are a lot of people in law, property, accounting, finance and banking who are in a nice warm bath at the moment. They don’t want diversity because they don’t want the challenge. They don’t want the technology because they don’t want the challenge. They are living like this is a lifestyle business. They might work very hard, but they like where they are and consciously or sub-consciously they don’t want things to change.

Where do you think property is in terms of technology adoption compared with other industry sectors?

TC: Every sector I talk to thinks that other sectors are doing better. You talk to the lawyers and they think accountants are ahead of them, you talk to accountants and they think bankers are ahead of them. For a relatively staid industry built on a fairly homogenous demographic with limited external influence coming in, the property industry is kind of where you would expect it to be.

Adoption is happening, but if the established players don’t move fast the incoming players will find ways to overcome the barriers to entry.

Find out more - Power of proptech: talking ’bout a revolution

NW: Part of the issue for organisations is the corporate change management piece. How do you take something exciting like technology and distill that down across a very large organisation? That is one of the biggest challenges.

How far away do you think the property industry is from reaching a tipping point in terms of technology adoption?

MF: I think we are at the tipping point or we have just passed it on the process side. We’re probably not there on the aspirational completely game-changing front, but I think that will come.

NW: The future is here - it’s now. It feels to me that we’ve come quite late to the party and my sense is that we will start to see technology having an even greater impact because of what’s happening in other sectors.

GB: For me the tipping point has already happened. It’s about where you rank within your particular part of the industry.

EC: I think there is a danger that we can look too far down the line. You would be shocked by the number of owners out there who don’t know how many buildings they own, let alone how many tenants they’ve got or what those tenants are paying in rent. That’s insane. That sort of low-hanging fruit is just begging to be picked.

In association with:

No comments yet