Irwin Mitchell’s expert guests discuss the impact of the EU referendum, momentum for the northern powerhouse and practical solutions to the housing supply shortage.

Our Panel of Experts

Rob Bould, chief executive officer, Bilfinger GVA

Paul Clark, director of investment and asset management, The Crown Estate

Mark Collins, chairman of UK investment and senior partner, Patron Capital Partners

Alan Dornford, managing director of real estate, Capita

Patrick Duffy, partner, Irwin Mitchell

Paul Firth, national head of real estate, Irwin Mitchell

Liz Hamson, editor, Property Week (chair)

Jamie Hopkins, chief executive officer, Workspace Group

Bill Hughes, head of real assets, Legal & General Investment Management

Christian Jamison, chief executive, Delin Capital Asset Management

Duncan Owen, chairman, head of real estate, Schroders

Richard Tice, chief executive, Quidnet Capital Partners

Rob Thompson, head of real estate London, Irwin Mitchell

Rob West, partner, Clearbell Capital

Finding a new balance

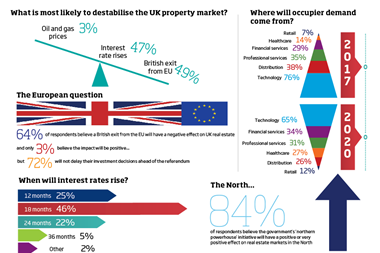

This year, following the recent general election, our panel of experts debated how much stability the Conservative return to power gave to property. Opinions differed about the impact of a forthcoming referendum over Europe, with some of our experts believing it will have little impact on the attitudes of overseas investors, given that the UK has a strong economy and transparent real estate market. Others thought it would impact on some decision-making and not just from investors but from occupiers too, many of whom are delaying making decisions about their property and business needs pending the outcome.

In particular we discussed the impact on Chinese investment in the UK- not only with the potential for massive capital flows from China to London, but also the big corporate occupiers who may have located to the UK to help them access the European markets. What will they do when the referendum issue approaches?

We also discussed the uncertainty for property in Scotland given the strength of the SNP and its separatist views. And we inevitably turned to the question of the chronic undersupply in the housing market, with more than one of our experts saying the government is doing too little to house the nation effectively. The planning system also came under attack, with most of our panel agreeing that the system needs to be made more efficient. There is a massive resource issue resulting in it being ill-equipped to cope with the current growing planning need. This issue was one highlighted by Irwin Mitchell in its recent survey of office occupiers. Some of our panel felt that, given all the recent changes in planning legislation, the system should be allowed to

settle down.

Growth on the horizon

A topic that caused great debate was whether the proposed northern powerhouse will really take off. Most of our panel felt it would be beneficial for the UK if there was some counterbalance to London in the north, and supported government encouragement to improve infrastructure, investment and spending to get this going.

However, it is clear that any effective regional democracy needed to be thought out and consistent in approach - for example can Leeds, Manchester and Sheffield work together rather than against each other - and implemented not just across the north but in other areas such as Birmingham and Bristol. This may of course lead to the exclusion of certain fringe cities in the regions.

Currently, although the expense of London is encouraging some business decentralisation elsewhere, it is mainly for support services and satellite offices rather than to set up corporate HQs. Everyone agreed that to get the northern powerhouse working effectively the government or councils need to guarantee support - to encourage institutional money to flow into the region. Hopefully the budget on 8 July and the Autumn Spending Review will throw more light on strategy and as the northern cities strengthen their branding and educate their audiences, the opportunities from international capital, currently focused on London, should grow.

Finally, we discussed development finance and the fact that although funding for speculative development has returned to London and certain other key locations in the South East, there is little availability elsewhere - although this pattern may change if rental growth comes through outside of London. There are concerns, however, that we are currently benefitting from an economy based on exceptionally low interest rates and quantitative easing. How will the property market fare when interest rates and the cost of capital rises? As one of our panel concluded: “Money today is more global than it has ever been, and if we become too expensive… investors have the choice to find better value elsewhere”.

So overall a positive discussion on the post-election real estate landscape, but as ever, with some caveats along the way!

Rob Thompson, head of real estate London, Irwin Mitchell

The new political landscape

Liz Hamson, Property Week: In the immediate aftermath of the general election there’s a sense that bullets have been dodged, concerning mansion tax, non-dom status, rent controls. But we’ve got Help to Buy, Right to Buy and an EU referendum on the cards. I’m wondering whether this outcome is the good news people first thought it was.

Duncan Owen, Schroders: The outcome is clearly good in terms of simplicity. If you are running a business what you want is consistency, and we have that. Estate agents say it has made a difference already; houses are trading. Fear has been removed.

LH: We also have a situation where there’s no longer that natural check on Tory policies that the Liberal Democrats provided.

DO: From a listed company perspective, a coalition worked quite well. There’s an element of balance to it. It will be interesting to see what happens without the checks and balances of a coalition.

Paul Clark, The Crown Estate: To think the property industry has dodged a bullet in terms of taxation - that is wrong. Issues that were raised during the election around taxation or what the regime for a growing private rented sector (PRS) will be won’t go away. These issues will continue to be of concern to all regulatory parties.

LH: Does anybody feel that element of uncertainty still lingers?

Rob West, Clearbell Capital: It will be replaced by uncertainty over UK membership of the EU. That will continue to build until there is a resolution. It might not make a difference for a UK investor, but as you see that referendum approaching overseas investors might be more hesitant.

Rob Bould, Bilfinger GVA: There were a number of polices in the manifesto that were included to trade, as everyone thought we were headed into a coalition. So we now have a position where there is a 12-seat majority but we haven’t got stability in the backbenches when it comes to Europe.

Richard Tice (RT), Quidnet Capital Partners: It is good for democracy that we have this debate, the country wants it. Four million people voted for the UK Independence Party. There might be a bit of uncertainty, but it may be less than people make out. Global business has been investing in the UK in the full knowledge that this will happen. Economically it will be the same, or better, by being out. We’ll have more influence, not less - we’ll get a seat back on the World Trade Organisation.

Bill Hughes, Legal & General Investment Management: The significance of whether the UK stays in or out has been over-debated. I’ve observed that international capital either doesn’t think the UK will exit, or that it matters that much. We are seeing capital flowing into the UK in a decisive way.

PC: I don’t feel international capital is thinking about it much at all. In any event we don’t know the nature of what it will be like if the UK exits.

BH: We don’t know the terms of trade agreements. But uncertainty aside, the UK is a strong economy and has a transparent real estate market. I see international capital backing that under any circumstances.

PC: The terms of [an exit] matter. Most capital assumes we’ll stay an open market. I don’t think international investors have given it a lot of thought yet.

BH: The first question I get in Asia is about the EU.

RB: We’ll see the effect in the occupier market. The CBI is starting to pick up nervousness in [terms of businesses] deferring decisions.

LH: That’s what we saw in Scotland, with big occupiers saying they’ll move.

PC: David Cameron will get a deal that is acceptable to the vast majority of the electorate.

Jamie Hopkins, Workspace Group: Running up to the general election the commercial market carried on, but the outcome brought a huge amount of relief.

Christian Jamison, Delin Capital Asset Management: What if Greece exits before the referendum? That hasn’t gone away entirely and it could make the EU look weak.

Rob Thompson (RTh), Irwin Mitchell: That might strengthen Cameron’s hand; the EU would be so worried about stability.

RB: Greece is bust; nothing will change that. What they owe is small fry. It is the symbolic nature of it. The European community will work very hard to make sure it won’t have an impact.

Alan Dornford, Capita: It will be relaxed until a few months before - people are working out whether they are in or out.

BH: The British workforce and productivity is going to be largely unchanged, trade agreements will be what they will. I am more interested in issues like ‘can we invest in regeneration?’ and ‘what do we do about skills?’. There are more important issues.

RW: People vote for what they know.

JH: I’m not talking about global headquarters, that is a different dynamic. We represent fast-growing, mid-sized companies in London, which will have a point of view if they are in or out but I don’t think they will be disruptive

[about it]. Entrepreneurs will take a very different view.

RB: Occupiers - bearing in mind [the EU referendum] will be 2016 - will opt to stall a decision. Why take the risk?

BH: There will be an interlude but not necessarily with damage.

RT: The pro-business environment won’t change; banks are gone if they don’t hear the right noises being made.

Revisiting an independent Scotland

RW: Will the prospect of increased devolution [in Scotland] have an impact on capital flows? Our feeling is it won’t for the very best. But for secondary or poor secondary it has eased out in pricing terms, or not kept pace with the rest of the country.

DO: I’m not sure you can get as good a return on a risk-adjusted basis in Scotland with the uncertainty as it affects the employer base, which affects occupational demand. It is a pure economic decision, not political. The uncertainty around Scotland is linked to the referendum. If that goes one way it could hasten speedier levels of devolution in Scotland. We have one or two big assets in Scotland. But there are concerns that have been created by uncertainty.

LH: So is a Scottish referendum back on the agenda? Cameron said “no”.

DO: They’ve all said no. But something could trigger it.

BH: But given the way the Scottish Parliament and the SNP behave, we’re already seeing things happening differently. Transaction tax is different. The fact it is different matters. They are talking about rent control north of the border. So as long as the SNP, the most influential party, considers it is more important to act for independence than for what matters to investors they’re creating inappropriate risk. I am pro-Scotland. But there are warning signs there I find worrying. We own assets north of the border. I have reservations about north of the border as there are signs of unproductive behaviour.

DO: It may be that Scotland will end up with higher degrees of fiscal autonomy. I can see it having its own tax revenues and fiscal budget. It will need to behave differently if that happens, there will be lots of consequences - some unintended. I don’t know where Scotland would have been if they’d had autonomy during the financial crisis.

The future of inward investment

RB: I’m interested in the capital flows out of China, and the net effect of that. Growth will come down markedly, they have a totalitarian government that can switch off the flow and have a huge quantity of US debt - is this ever discussed in investment meetings? Do you get a feeling that it could have an impact on how it flows to the West?

BH: China can export capital away from domestic real estate. The most staggering thing I see is the quantum of demand they have for investing in developed economies. I don’t think it matters if China grows at a rate of six, eight or 10%, we’ve seen just the tip of the iceberg in terms of the scale of the influence it will have on any developed economy like the UK.

Chinese occupiers are in London, and there are a handful of them. But that is just the beginning compared with how many will be here in ten years’ time. London is a great place to benefit from that due to the time zone, financial services expertise and China’s willingness to get involved in interest rate and currency behaviour. There’s nowhere better for them to be in the world. I think it will be genuinely staggering.

DO: I agree. China has had a huge influence on Schroders in the broadest sense but especially on real estate. They do like unity and they don’t like change - that has come up in several discussions.

My experience suggests they are focussed on [the EU referendum]. Perhaps the bigger impact - and it may have a negative impact on investment markets - is what the occupiers do. They are mindful of immigration. I have 200 people spanning 14 nationalities - we couldn’t function without immigration. China has picked up a lot on that point. Equally, Japanese and Chinese investors are interested in whether Nissan will stay in Sunderland and whether Honda will stay in Swindon, and the effect that will have if we’re not in Europe. That is more clear-cut than the impact [of an EU exit] on financial services. Nissan wouldn’t have moved to Sunderland if we weren’t in Europe. It probably isn’t burdening investors now because they think London is superb but it might affect investors in a broader context negatively over a period of time.

Housing: a question of undersupply

LH: Going back to the manifesto, there was a sense a lot was electioneering and it was focussed on stimulating demand. Are those deliverable policies and are they the right policies?

BH: My biggest problem with the Tory policy towards residential is it seeks to stimulate ownership of property, which is thoroughly misguided and only increases house price inflation. The Lyons Housing Review, which I was involved with, says it must be about the supply side - you don’t see much innovation from the Tories on that. I will be continuing to bang on the Conservatives’ door about the issue.

PC: The only time we housed the nation effectively was in the 30 years after World War II. That was done with a combination of private and state housing. In 1969 we built 400,000 homes that way. It is unreasonable to expect the private sector to house the nation. We should go back to that period and learn lessons about supply. It is too easy, though it has plenty of issues, to blame the planning system.

LH: So what can be done?

RT: The rules for converting offices to residential should be extended. That is a simple way to help.

PC: I disagree. There needs to be a managed balance between different use classes. In the centre of London, for instance, we need to ensure we build enough world-class commercial buildings and there’s an awful lot of office space that’s been lost to residential.

RT: For the rest of the country, in terms of supply, it is an easy way to get through the planning system quickly. In the last couple of years it has increased supply and asset values and that has helped banks and property companies.

PC: The dial hasn’t moved that much.

DO: But it isn’t just about conversion. It is also about extensions, adding extra floors, and turning single into multiple dwellings. It is about making more residential units.

RB: But Paul’s point about the social impact of creating social housing as part of that system, the supply side needs to be addressed. There are 240,000 new households being formed a year but in 2014 there were 118,000 new houses built - that is out of balance. It won’t be solved by the private sector alone.

RW: In Edinburgh we have spent four years trying to get consent to enable us to deliver houses the city needs and now we’re subject to a Judicial Review. As a business we won’t do that again. Until the system is freed up you won’t get capital flowing in to deliver the houses.

AD: There is a whole load of residential locked up with people that don’t need it. A big thing for local authorities is how they unlock the big homes only lived in by two people and how they provide more suitable accommodation. It is the whole range that needs to be thought about.

DO: But how do you regulate that - if people don’t use the space, then they should sell it?

AD: It is about dealing with both ends of the spectrum.

DO: I can’t see how anyone can defend the planning system.

LH: Does it need radical reform?

DO: Even if it were set out on the right principles it is under-resourced. People say we need to pay for it. That’s fine. But something efficient is needed. Democracy doesn’t work in the planning process.

BH: There are few politicians I talk to that want legislation about planning. Clearly it doesn’t work, the system is massively under-resourced and there are lots of issues to resolve. I think let’s live with what we have but ensure it works well. I’d rather that than be radical because I can’t wait five years. Let’s get some talent into it and enough resource and get it moving more quickly. There are all sorts of things that can be done.

DO: Professionals should run the system. How many of us have been in a situation where you meet something that is needed but local nepotism doesn’t want 200 homes, it wants six mansions and a lake. That doesn’t work from anyone’s perspective. To say we shouldn’t change that - I wouldn’t go along with that.

BH: But what is the exemplar - which country has got it right?

DO: Best practice would be to pinch from a number of areas. I think Singapore has a lot of merits. It is trying to balance demand and supply. There are areas you can pick out of the legal system in Europe and North America that work more effectively. We have a big challenge as we have major cities that could work better and be more competitive. The UK could have more than one city with successful mixed-use environments. We should try to find a better solution than say it is politically too difficult.

PC: It isn’t that long since the last piece of planning legislation. In some respects it has made it easier from a residential perspective. Our experience nationally has been encouraging since the changes. I would be inclined to let it settle down.

Northern lights

LH: Will the northern powerhouse take off?

Paul Firth, Irwin Mitchell: It will. UK plc needs to rebuild its manufacturing base. If you link Leeds, Sheffield, Manchester you get an area the size of Greater London. I do think there is a big disparity in wealth that must be addressed. Crossrail is fantastic, but the amount of infrastructure in the north is unbalanced.

LH: With the northern powerhouse you have many different cities. Will they band together?

BH: One North came before northern powerhouse. What started that going was some cities realised HS2 might happen and they had an interest in making a collective case for it. Manchester took the lead, others followed and it happened with all sorts of decision-makers, corporate and local politicians and a whole variety of people.

PC: The idea of effective regional democracy is exciting; it has the prospect of addressing some issues. But it will need consistency and patience. Hopefully it will be thought about long enough so that it does something that could be very good for the whole country by ensuring it is applied consistently across the regions.

RB: Birmingham is already worried about the government singling out the northern powerhouse. To be meaningful the approach has to be balanced across the regions.

BH: Similar in Bristol.

PC: That is why we need consistency and to take time over it. You need a technocratic approach to it, looking logically at all the regions, at the tiers of government needed and the powers each tier should have.

LH: I’m not convinced cities up there are happy about Manchester being seen as the heart of it. You might have some unwilling partners.

PF: I wouldn’t say unwilling. There is a respect for the chief executive of Manchester City Council, Sir Howard Bernstein. Bernstein has been a fantastic ambassador and leader for Manchester and other cities need to recreate that model.

BH: Bernstein is misunderstood. Everyone thinks that is the blueprint to success but not every city is like Manchester. I went to an event a year ago and he didn’t mention Manchester once - he talked about most other northern cities. He understands that northern cities together are more powerful.

LH: But do other cities get that?

BH: They do.

PF: It is getting over years of squabbling and that takes a change in mindset, but with the right incentive - and the prize is so big - it is going happen.

LH: What are the incentives?

PF: Infrastructure, investment, spending - things the north hasn’t had for a long time.

BH: I get worried about the losers from this process. We’re right to be positive but there will be losers. It will cannibalise growth that might otherwise happen in other parts of the region. If I were running one of those cities up there I’d absolutely want to be in that cosy club.

LH: But how many cities can be in that club? Excluded cities will look in jealously.

BH: That is the risk.

RTh: London creates a halo effect. I don’t see why that shouldn’t occur around Manchester and Leeds. But if you are in a fringe city outside that halo it could be awkward.

RW: Potentially there is a push factor. London is expensive and it is difficult to buy a house there, so there has to be an attraction for young people to stay in towns like Manchester where they went to university.

LH: University towns are doing well. Will north-shoring become a phenomenon?

PF: Lots of businesses with huge presences in London are thinking they don’t need a production unit sat in expensive space in the capital. They are moving to where rents are a third of the price and salaries are cheaper.

BH: Why have Deutsche Bank and HSBC moved to Birmingham - is it HS2 or cost?

PF: Cost.

BH: HS2 is nowhere near enough to make a commercial plan. So London becoming expensive

is good for everywhere else. There’s a decentralisation phenomenon happening.

LH: Do you see outright decentralisation happening - with companies exiting and moving from London, rather than just having satellites?

PF: Not currently. Mainly it is support services. Northern cities are targeting this in terms of attracting companies.

LH: What impacts will the northern powerhouse have on the development and occupier markets?

PF: Wherever there is major investment it creates opportunity. Particularly if we start making things again, which is a government-stated aim. I am working with University of Sheffield, which is making small-scale modular nuclear reactors and putting that forward as a genuine alternative to the old-fashioned massive reactors. They have the technology, just waiting for the order. That would kickstart investment in the north of England.

RB: But I don’t get the view that industry, which now accounts for 12% of GDP, is going to be put into reverse in the UK.

PF: That trend isn’t set in stone. We can make things again. It is about doing things smarter.

RB: Of course we want to make things again. But in terms of the northern powerhouse - where will the funding come from for that? It has got to come from a guarantee - from government or councils - to allow institutional money to flow into this. The trouble is with infrastructure there is lack of certainty. We can talk about HS2 or HS3 but no one knows when it is going to start. The devil is in the detail, which may become clearer in the budget on 8 July and even more defined in the Autumn Spending Review.

How to brand a city

LH: What about the role of international investment in regional regeneration? Investors are priced out of London and looking further afield.

PF: China is looking hard at the north of England. There will be a lot of inward investment from there in the next few years.

BH: There is an education process going on. Talk to international capital and all of it knows about London but not about other cities. It is possible to make a case for international capital to invest in a whole range of places.

DO: The northern powerhouse might be a political label but it isn’t a zero-sum game. The more efficient the major conurbations are the better they are. It is better for London, not an either/or situation. If HSBC or Deutsche Bank can employ people more efficiently it will attract more capital to the UK more readily than if it is just about one city. Leeds, Manchester and Sheffield do have remarkable competitor advantages that take time to understand. Manchester has been fantastic but it has major advantages other cities don’t, and will find hard to replicate. You can fly from Manchester to most places in the world in one haul, and it is probably the only airport outside London that offers that. Other brands associated with the city have made it famous. It is not a fluke the Chinese are investing there. But it isn’t to London’s detriment either.A good aspiration for the UK would be for it to have two or three cities, in addition to London, that count in Europe’s top 10.

Patrick Duffy, Irwin Mitchell: Manchester has a population of only half a million. But Bernstein has made the conurbation of Manchester into a brand, with a population of 2.8 million. If you can sell that abroad, it is more compelling. That would complement London well.

AD: Cities have to [attract] growth industries. International investment has to be drawn to something.

JH: I was listening to the northern powerhouse debate and I was surprised the point about skills didn’t come up. Google came into London as it couldn’t get hold of the labour it needed elsewhere. I get asked if fleet of foot occupiers with short leases could go elsewhere. Yes, but they can’t employ people. They’re employing people from overseas. Every time I hear about the northern powerhouse it tends to be about the ‘northern back-office powerhouse’. That’s not solving the problem. Universities need to look at the degrees they are pumping out. We are missing a trick with the tech industry - not with the front-end entrepreneurs but the people that support them.

BH: If you talk to universities in Sheffield, Leeds or Scotland they do want to evolve to produce a skillset that provides competitive advantage. There’s a lot of progress on that front. But how much of that talent pool can they retain? If you offer a quality of life, proper rental property and amenities you’ll keep people. If you don’t, everyone will leave for London. Cambridge is good at this. Most cities are learning how.

LH: The other thing that will keep people in university towns is affordability of housing.

CJ: The more expensive London becomes, the better it will be for the northern powerhouse.

Cold, hard questions of cash

Mark Collins, Patron Capital Partners: We’ve seen a massive weight of capital helping to drive value up and yields down. That will be helped by rental growth in London, the regions and across all asset classes. That helps to underpin investor sentiment. But money today is more global than it has ever been and if we become too expensive - because of exchange rates going the wrong way or property values - then investors will have the choice to find better value elsewhere.

PD: The market needs to keep an eye on the exchange rate, the value of Sterling - particularly outside London in respect of the manufacturing base and cost of exports from the UK.

LH: What about development finance? What about the pent-up desire among those wanting to develop in the regions and being unable to?

MC: The risk return isn’t there for the banks. Deals can be very difficult to stack up. I think there is appetite for lending on investment stock - margins have come down quite a bit.

RW: Funding for speculative development has returned to London, no question. But it has to be for projects in London or very good [areas of the] South East. Once you go beyond there availability is thin.

LH: Do you see that changing?

RW: It is getting increasingly competitive for the banks to find the best deals in London and they’re all under pressure to lend and find margin, so it will filter out but it will take time.

RB: There’ a lot more variety of funding. But in terms of the availability of speculative funding, I absolutely concur.

DO: There isn’t prejudice against lending in the regions, it is an economic decision. People are lending on speculative assets at cheaper levels in London because rental growth is coming through. When that happens in Manchester and other cities, they’ll get the same terms.

PC: We’ve got a good short-term outlook, we have an economy flourishing based on exceptionally low interest rates and an awful lot of quantitative easing, and at some point it will have to function without those things - and that’s the crunch.

DO: There’s lots of rental growth coming through in lots of pockets. But the elephant in the room is no one has come up with an argument to convince me that the cost of money - whether equity or debt - will be anything other than more expensive in three- to five-years’ time. That means yields will be higher, and properties will be worth a lot less unless they’re generating a lot more net income.

CJ: There’s a real shortage of yield and global capital will continue to flow but I agree with Duncan - look further out and you have tothink about income growth and capital growth. How will you sustain yourself when interest rates and cost of capital rises? It is right to focus on rental growth.

This event was chaired by Property Week’s editor Liz Hamson and took place on 21 May at Irwin Mitchell’s London offices, 40 Holborn Viaduct, London EC1N 2PZ. Contact Rob Thompson. Email: rob.thompson@irwinmitchell.com Tel: +44 (0)20 7400 8719

If you are interested in hosting or participating in future events, please contact Niki Kyriacou, client solutions business development manager, Property Week. Tel: +44 (0)20 8253 8692. Email: niki.kyriacou@propertyweek.com

No comments yet