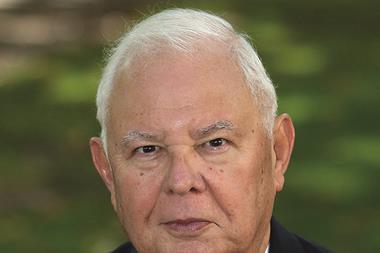

Property Week editor Liz Hamson recalls her interview with legendary property tycoon Gerald Ronson back in February 2015. Flanked by his brother, Laurence, and daughter, Lisa, he discusses what drives him.

Boasting a rags-to-riches… to rags-to-riches tale (courtesy of a property crash that saw him lose £1bn of his own personal wealth and the Guinness affair), Gerald Ronson has lived a life that, in the words of one of his closest friends, is “biblical” in its proportions.

He is right. You literally could not make it up. Having left school at 14 and a half, Ronson worked in the family furniture manufacturing business, invented self-service petrol stations, oh and built a sprawling business and property empire, straddling Heron International, Ronson Capital Partners, Rontec Investments, his Snax 24 petrol retail interests and GMR Capital, along the way.

And despite the departures of right-hand men Peter Ferrari and Jonathan Goldstein, he is still going strong – thanks in no small part to the involvement in the business of younger brother Laurence (dad to Uptown Funk’s Mark) and daughter Lisa.

In an exclusive interview with Property Week in his cigar-perfumed Bentinck Street office ahead of the topping out of prime residential scheme Riverwalk on 5 March, Ronson is as passionate as ever about his business interests. However, he is in a more subdued, reflective mood than on the previous occasion we met.

While he boasts that he still works six days a week and feels like two 35-year-olds (my quip of “plus a five-year-old?” is met with a narrowing of the eyes and a half smile), he acknowledges he is part of the old guard making way for a new – and in his view – not particularly improved younger generation. He also admits his motivation is as much to do these days with ensuring his family are provided for “before I depart” as his enduring love of property.

Work ethic

Not that he is about to hang up his gloves any time soon. Ronson reckons he has another 10 to 15 years in him. He will retire, he declares, “when they carry me out in a box… and I’m not planning that for a long time”.

Alluding to his family’s many charitable exploits, he adds wryly: “I’ve got to work very hard to make money that they can give away. It’s a work ethic. I inherited it from my late father. If you have that work ethic it’s in your genes and you do what you have to do.”

In Ronson’s case, this seems to be twice what most men half his age could manage. “A tough guy who knows what he is doing and has a sense of honour and fairness”, in the words of a peer, he has been in property for about 50 years and the petrol retail business for 49. I say I like the way he describes the latter. He chuckles. “The fuck-you business.”

So called because of its apparent incongruity with the rest of his interests, the business takes up two-and-a-half days of his time a week – he famously spends Saturday visiting his sites. There is a good reason for his seeming obsession. “I’ve had my ups and downs in the property business, but I must say that my petrol retail business is a business that’s never let me down,” says Ronson. “It’s a business that turns over £1bn and we own all our sites predominantly or very long leases – it’s a very successful business.”

Retail is detail

He is not fazed by the aggressive pricing strategies of the supermarkets in the forecourt arena. “People aren’t going to go out of the way to save 1p a litre,” he says dismissively, adding that fewer people are going to supermarkets and more want convenience.

“Retail is detail,” he adds. “We’re selective price marketers; we price to the market we’re in. We position ourselves to be part of the local community, so it’s 24/7, off-licence, free banking, promotions. We’re not in the supermarket business. We’re not competing. My shops aren’t big enough; the average size is 1,000 sq ft – some are 600 sq ft.”

He even does business with the supermarkets. When Rontec Investments bought the retail business of fuel group Total in 2011, it took more than 800 sites, 300 of which were wholesale and 500 freehold. It then sold 250 sites to Shell, as well as the wholesale business – “which is not the business we’re in”, says Ronson – and developed around 30 sites for supermarkets.

He upped the ante again last year, when he bought out the Esso network in the South West of England, integrating that into the Rontec group, and he reveals that other negotiations are ongoing with the major oil companies.

However, he concedes: “It’s difficult to buy the right sites at the right price, because just like the property business, people have got inflated ideas of their assets in the current market, so it’s a very competitive business. It’s not a business where you want to have a lot of debt because there are times when the profit margins are very low and there are other times when they’re not.”

People have got inflated ideas of their assets in the current market

While Derwent London’s John Burns stresses the importance of knowing your market, for Ronson it is about “understanding the business”, and that takes experience (his senior team in the petrol business has been with him for an average of 20 years each and his MD for 40) coupled with hard work.

“Working six days a week – well that’s a little bit old fashioned,” he says. “Today, people don’t want to work six days a week, and at the same time their hands are out all the time, you know, gimme, gimme, gimme.”

Asked whether he thinks the younger generation lack the same work ethic and entrepreneurialism of his generation, he answers: “The simple answer to that is yes, but that’s unfair because there are a lot of young people who do work very hard.

“The interesting thing about the business we’re talking about is that it’s a boring, old-fashioned business, but you need that passion, commitment and dedication to want to work six days a week and that corporate pride in being the best in the industry, which we are. It’s not a get-rich-quick business and it’s not one where everybody’s earning telephone numbers, which is what people want to earn in the property business, without necessarily having the experience or the knowledge, but that is life.”

Ronson is not a fan of what he regards as a slightly cavalier approach among those coming through the ranks. “When I see these bright, young people – they’re young compared with me, but that doesn’t mean they’re that young – and I see the game they’re playing, well, would I want to be doing that? No, I’ve always been a principal in this business. I’m not, shall we say, a minority player.”

There are, however, plenty of people he does admire. “A guy like Nick Leslau is very able. If I take somebody a bit older, I look at a guy like John Burns, I regard John as one of the most able people in the business running a big investment development company and he’s got a first-class team of people,” he says, adding: “Chris Grigg does a very good job at British Land. Chris is really a banker, but he’s smart; he’s got a good nose for a deal.”

On the road

Ronson, who describes himself as “a retailer in the property business”, spends half a day a week at a management meeting for the retail business and the other two on the road. The rest of his time is spent on Heron International. Having once been in nine countries, the firm is now a pure investment company, owned by US investors, including Bill Gates, although Ronson will not confirm their identities.

“We’ve got three major centres in Spain and own 35% of Heron Tower. Heron was a major investor in the residential Heron tower with myself and others. We have a major land bank of something like 10,000 residential and commercial plots. Basically, Heron consists of three Heron Cities in Spain, UK prime assets and cash.”

As to whether it would look again to other international markets, that is up to the board, says Ronson, adding that everything is well funded in the group and that “it enjoyed a very good year last year”.

Where he is still very much in the driving seat is with the development business, Ronson Capital Partners, which he is a substantial shareholder in and also the managing partner of. At the moment, it is overseeing £700m of prime residential development in central London in the form of Riverwalk and Chiltern Place.

If you factor in The Heron residential tower, which is 51% owned by Heron International and 49% by Ronson himself, that increases to about £1bn of “prime prime”.

Ronson is proud of all three schemes. “If you looked at the 10 best schemes in London, they’d be positioned as three of them,” he boasts, adding that although it is only just in the ground in Chiltern Place, it has already sold more than a third of the units at “very, very good figures” and has presold £160m of Riverwalk. The reason they have done so well is simple, he says: “We acquired them at the right time, five or six years ago… and we build quality.”

While he has agreed to acquire two other potential development sites in the wake of Chiltern Place and Riverwalk, do not expect him to embark on an acquisition spree any time soon, however.

“The problem with the development business is the economic cycle risk. You can build the greatest building in the world but if the market is in the toilet, you don’t make the profits,” he says bluntly. “The whole issue of development risk vis-à-vis the building costs in central London, which have gone up over the past two years by 15% to 20%… I don’t believe developers are taking that into consideration.”

Weight of foreign money

He is keenly aware of the challenge posed to the big private developers by the institutions. “Really profitable development opportunities are fewer and farther between, particularly now there are so many institutions investing in the sector. There are very few significant entrepreneurs in property today and even fewer newcomers. This reflects the nature of the returns on investment that are available.”

He is also concerned about the weight of foreign money coming in. “They’re not looking to make 15% or 20% IRR; they’re happy to make 8% IRR, but I’m not in the business to make 8% or 10% IRR and taking a development risk. If we can’t make between 15% and 20%, why would we want to put our money into it?”

Once again, it is the younger generation that he sees as distorting the market fundamentals. “It’s a business that today is all OPM – other people’s money. You set up a fund, bright people, well educated, speak nicely, go around and schmooze people with the product. They’re taking the management fee of 1%, 1.5% and may even be taking a fee on acquisitions. Great, but that’s not the business we’re in.

“We’re developers. Keep it simple. We put a lot of our own equity into deals – anything between 30% and 50% equity – we don’t wish to overgear. RCP most probably has got in 60% equity in the deals, because I’d rather use our own money. Same thing applies in all the businesses we’ve got. That may be because I’m not a young man anymore, although the energy in me is that of two 35-year-olds. That’s irrelevant.”

It is not, actually. The great paradox of Ronson is that although you will not see a computer on his desk and he does not own an iPad, he is as plugged in as any 35-year-old… or two, precisely because he eschews technology.

“The more you use your brain and the more you’re active, it keeps you young. That was most probably my best subject, mental arithmetic. Maybe after that I developed into a mental case,” he chortles.

Is there really an appetite for the £10m to £15m penthouse flats in The Heron residential tower or the £25m penthouse in Riverwalk, which is being developed on the north bank of the Thames? Ronson is convinced there is. He points out that one of the Chiltern Place penthouses has sold in excess of £5,000/sq ft, and to a domestic buyer to boot. Indeed, the majority of the scheme has sold to English buyers, he claims.

Penthouses

The smaller of the two penthouses at The Heron is also close to being sold, although not to his nephew Mark, the hit DJ and producer behind recent number-one hit Uptown Funk. It does not strike me as Ronson’s type of music. “I’m not a fan, but he’s very talented,” he concedes, adding: “I get on with him extremely well; he’s a very nice young man.”

He walks over to his desk to retrieve a lighter Mark gave him when he received his CBE.

Ronson also clearly gets on well with Mark’s father, Laurence, who used to run the housebuilding division at Heron before managing a music publishing company and is now sales director at RCP, and Lisa, who has just launched Lisa Ronson Home – an interior design and lifestyle service for its global clients – and is commercial director of Heron and RCP.

Ronson has four daughters and nine grandchildren and has been married to Gail for 47 years – “the Dame, as we call her” – and he makes no bones of the fact that everything he does now is with his family in mind.

It is only a few weeks after the Charlie Hebdo attacks and there is a lot of anxiety about the heightened terror threat. Ronson is relatively bullish about the market’s prospects “as long as the politicians and terrorists don’t screw up”. The looming general election is not something that overly worries him either. “If you let the wrong government get in – and I’m non-political, by the way – if you get mansion tax, that could well turn off a lot of people who want to buy a home here. On the other hand, with more problems in the Middle East, this is still possibly the safest place in the world to live in so we must wait and see.”

The Singaporeans clearly agree. Last September, UOL bought Heron Plaza, the site next to the Heron Tower, for £97m, with a view to spending a further £300m-plus developing the site into a luxury retail and hotel complex operated by subsidiary Pan Pacific.

In 2009, when his autobiography Leading from the Front came out, the office tower was expected to be a resounding success, but like so many developments it was caught out by the recession, and it almost fell into administration in 2013. Some commentators have questioned whether the owners will push for the tower to be sold.

Ronson is adamant. “There are no plans to dispose of the assets. We went through a very painful period of the recession to get it let,” he says, maintaining: “The timing was good. You’ve got to remember we had to fight. It cost a fortune to get planning consent. It was Prescott, who was anti-City, who called it in. The public inquiry cost £13m and then, of course, you had the recession. We put in over £100m of additional equity. Fortunately, it’s one of the best office buildings in London, in my honest opinion.” (Even if there are no longer any sharks in the aquarium – they were removed because they were being nibbled by the other fish in their sleep.)

As for the whole renaming saga, Ronson says it is “done and dusted”. “They spent an awful lot of money and they wanted it to be called Salesforce,” he shrugs. “I haven’t got an ego about Heron Tower – it’s actually known as 110 Bishopsgate. A tenant got himself very busy, jumping up and down winding up everybody. However, the deal is done. Salesforce are entrenched and very happy to be in the building. Most taxi drivers still think its Heron Tower. Those that don’t think it’s 110 Bishopsgate and Salesforce thinks it is Salesforce.”

The Heron Tower was the last office scheme developed by Ronson and its completion heralded the departure of right-hand man Peter Ferrari, who had been with the business for 19 years. Ronson insists there were no hard feelings.

“There wasn’t a job. Peter is a first-class office developer. Well I haven’t been in the business of doing offices since I finished the tower, so I said to Peter: ‘Look this is what the situation is. If you can find yourself a good position, do.’ That is what he’s done and he’s representing a very wealthy Saudi family and he’s doing a first-class job for them.”

It was a similar situation with Jonathan Goldstein, he says. “There wasn’t a job for him in Heron. He’s an ambitious guy and very able so he’s off doing his own property lending scheme and, I understand, doing very well. I speak to him every day.”

Family fortunes

These days, Ronson is happy enough to use the expertise to hand and play closer to home. “I’ve developed in nine countries around the world and I don’t want to do anything today that’s more than two miles’ radius from this office, for a lot of reasons, and the main reason is I know what I’m doing and I’m not having to rely on other people’s politics etc etc with Ronson family money.”

A friend of his says he has become risk averse – something he does not deny. “The more experience you get in life and the more you see the world for what it is… it’s about using your knowledge, experience and focus in not taking unnecessary risks. A lot of people are very gung ho because they’re going in with other people’s money. We’re old-fashioned people. You have to remember I lost £1bn of my money – and I could be very bitter and twisted. I could be bitter and twisted about the Guinness affair. Things get thrown at you in life. You have to pick yourself up, dust yourself down and get back in the ring.”

He is in impressive shape for a septuagenarian and one of his friends cheekily instructs me to ask him whether he is on a diet, to which he responds: “Yes… I eat agents for breakfast.”

In terms of his inspiration, he cites Armand Hammer, the late chairman of Occidental Petroleum, who he once sat with at a dinner at Number 10 with Margaret Thatcher. “He told me he’d only become successful in his early 70s. I told Gail there’s hope for me yet.”

He also has good genes to thank. His father was an ABA light heavyweight champion and Ronson himself used to box. His pugilistic stance stood him in good stead during the two low points in his life: the loss of £1bn in 1991, mostly as a result of the failure of Pima Savings & Loan in the US, and, of course, the Guinness affair.

“People only think about the good times. When I went to America back in the 80s, it was when tax in this country was 103%, so there was no purpose in even doing anything here and I wasn’t going to emigrate or run away any more than I was going to run away after the Guinness affair,” he shrugs. “You know, it was a question of seeing it through, rebuilding the business, rebuilding our reputation.”

If you’re a lion in the jungle, you can manage being in a local zoo down in Sussex.

He has brought up the subject, so I press him on the impact of his conviction for share-trading fraud, which saw him spend six months in jail. “It’s history. Why am I going to waste time thinking about it? I didn’t do anything wrong. I was in the wrong place at the wrong time, standing next to the wrong people.”

That does not mean he looks back on the period in a benign light. “I was able to manage. It was, it was…” he says, struggling to find the right words. “If you’re a lion in the jungle, you can manage being in a local zoo down in Sussex.

“But having said that, it’s not an experience I’d wish on anybody. The humiliation of it all for my family and also for myself… It took 10 years afterwards for the European Court of Human Rights to declare it was an unfair trial and when it did it got hardly a mention in the papers. I don’t know; water under the bridge. It’s over 25 years ago and I’m where I am today and that’s it.”

Staying in the game

Where he is today is disinvested of all his interests, which are now all in the family trusts and The Gerald Ronson Foundation. Looking ahead, he says he is interested in residential in central London, as well as buying land in the south of England as and when sites with potential for planning permission become available.

He sticks by his theory that every property cycle consists of seven years of feast and seven of famine. “I was right, wasn’t I? If you think of the shit hitting the fan in 2008, and here we are today in 2015, that’s seven years, isn’t it? I think the government has done a good job. Not everything they’ve done is right and a lot of things they say they’ve done they haven’t quite done. That’s politics, isn’t it? But I think they’ve done a good job.”

He does not, however, believe there will be a boom over the next few years because of the level of debt the country is in. “What we will see is a steady, steady market as long as we don’t get any stupid things come in to screw it all up. I don’t see interest rates rushing up and it’ll be very difficult to find deals you can make money out of.”

Why stay in the game then at 75? “I love doing what I do. I am blessed by the Lord that I can get up every morning and look forward to the day whether I’m going on the road or going to Bentinck Street or going to Watford and doing what I do. And I’m not doing it for money; I’m doing it because I enjoy it.”

Ronson claims he would take the same approach if he were 45. “I wouldn’t do anything differently than what I’m doing because that’s what I understand.”

Ultimately, he adds: “The measure of a man is to be able to rebuild, most important of all, reputation, because you can spend 50 years building up a reputation and lose it just like that. I didn’t lose my reputation but I had a black eye, maybe even two.

“But I’ve been blessed with a great family, very good friends and a very good community, which I take a leadership role in, and I’m a positive person so I look forward – because there’s no purpose in looking back and saying ‘well, I should have done this, should have done that’. I look forward every day to getting on with what I do. I think I’m the best at that game that there is.”

Not many people would argue with that.

1 Readers' comment