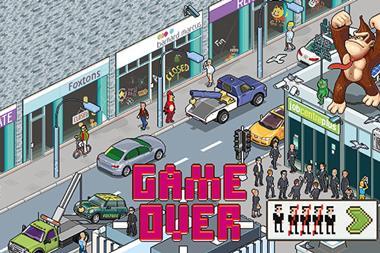

The Veracity Index of public trust in professions puts estate agents third from bottom, behind only politicians and government ministers.

But over the next 10 years, estate agents will undergo a transformation so radical they will end up with an entirely different reputation - that of expert advisers, not dodgy salespeople.

The property industry is embracing the future. Over the past year, the ‘proptech’ sector has exploded. Digital innovations, including apps, gadgets and peer-to-peer technologies, will enhance the business of buying, selling and letting houses. But I believe that, more crucially, they will also help to bring greater transparency to the market, and finally rid the profession of its dishonest reputation.

The way estate agents have operated for decades - effectively being the middleman between buyer and seller, landlord and tenant, broker and borrower - has often left us open to mistrust, and made establishing an open and honest agent/client relationship notoriously challenging. But new advances in technology look set to really shake things up, from the way homes are marketed and sold, and how house hunters are matched with properties, to even how mortgages work - and, crucially, the estate agent’s role in all this.

We recently commissioned a report into future trends in the property market to explore how to adapt to these exciting challenges, and found that by the 2020s estate agents as we know them today could be virtually unrecognisable.

Technology and trust

High-street estate agent branches are likely to become extinct. Instead there will be multi-brand virtual-reality cafés where buyers will be able to remotely walk around properties, and even touch and smell them. Buyers physically visiting dozens of houses in their search for homes will become a thing of the past. So will the ubiquitous ‘for sale’ signs, which will be replaced by invisible digital beacons that transmit a property’s details to suitable house hunters as they pass by.

Meanwhile, new property search software using ‘big data’ - where the entirety of a person’s online activity is used to build up a detailed profile of their lifestyle preferences and choices - will transform the way house hunters are matched with their perfect homes and neighbourhoods.

Clients will be shown houses automatically based on the way they live their lives, even taking into account their hobbies, their likes and dislikes and even the distance from their favourite restaurants and travel links to their places of work. It will mean that, far from feeling that estate agents are only interested in arm-twisting them into closing a deal, homebuyers of the future will come to value their agent’s input as a trusted adviser.

Perhaps most important of all, though, is the way ‘trust’ will be measured in this not-too-distant future. By the mid-2020s, every individual and business will have a ‘conscientiousness rating’ mined from their combined online behaviour and big data that will dictate how others engage with them.

People are beginning to understand that in the future everyone will effectively be a personal online brand and that their data represents their digital reputation, telling a story about their trustworthiness - or lack of it. These online reputations will be as important as our credit rating, deciding whether people are trustworthy enough to do business with. I believe this cannot come quickly enough for estate agents, because it will weed out the bad from the good, and help the majority who do business honestly regain vital trust.

It’s not the only way people’s conscientiousness rating will revolutionise the property industry. In the rental sector, landlords will establish whether prospective tenants have a history of non-payment or problem behaviour, while tenants will also be able to check out their landlords’ track records, introducing a new element of competition to the market in which financial success will be determined by how you service your tenants.

Agents will be able to match buyers to reliable sources of finance based on their digital reputations, lessening the likelihood of frustrating last-minute collapses of sales chains, and making the whole process faster and more transparent.

Work the crowd

Lastly, the ability to measure an individual’s personal trustworthiness will help usher in the era of peer-to-peer or crowdfunding mortgages. With rising house prices and ever more stringent bank lending criteria, conscientiousness ratings will be used by first-time buyers to reach the lower rungs of the property ladder.

In the same way that today’s entrepreneurs reach out to project-funding peer-to-peer sites such as Crowdcube (find out more about property crowdfunding here), a would-be homebuyer in 2025 will ask crowds of micro-investors to loan the money to buy a house, circumventing obstacles such as a lack of deposit or a poor credit rating. This will be useful as it will allow first-time buyers in particular to demonstrate the ability to pay to a mainstream lender and switch more easily to a bank or building society mortgage at the end of the term.

These are very exciting times for the property industry, and for me the future cannot come quickly enough.

Rob Ellice is CEO at easyProperty

No comments yet