There is a massive elephant in the real estate room that many in the industry dare not admit and most in government and local authorities have not really woken up to, let alone addressed. It is the biggest industry disruptor most of us will ever see.

The growth in online shopping is accelerating and retail and industrial property have swapped roles as the darling and ugly duckling for investors.

Online retail sales grew to £133bn in 2016 and are increasing at some 15% per annum. They are about to accelerate even further. Having leased more than 20% of the large sheds let in the UK last year, Amazon is a clear precursor.

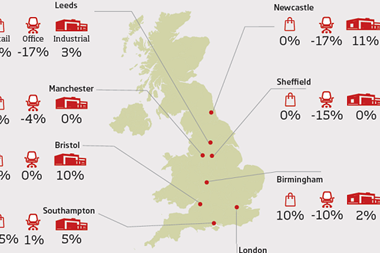

While I am in favour of competition, it has to be from a fairly level playing field. Industrial rents are soaring and retail rents are slipping. Yet the recent ratings revaluation still hugely penalises retail in favour of industrial.

Large new sheds are getting bigger and taller - they are virtually becoming shopping centres without the customers. These mega-sheds need a whole new use class of their own, which is rated differently.

More and more of the countryside will be gobbled up by these mega-sheds, while the beating heart of most communities, the high street, is on life support.

There is a simple answer to help rebalance the situation: we need an online delivery tax on all internet shopping. This can be used to offset and rebalance the rates bill to retailers.

Total business rates this year will be approximately £28bn; retail pays about 20% of this, of which London pays some 30%.

An online delivery tax of 3% would generate some £4bn per annum, which could offset almost 100% of all retail rates outside London. One could mix and match this potential saving with investment into high street infrastructure and facilities.

Responsible tax

Customers would be paying for their convenience - but so they should for the extra wear and tear on the national road infrastructure. If they pick up from stores, collection points or use the Royal Mail, they would be exempt from the tax.

This would encourage a change in people’s behaviour, which would reduce the growth in delivery vans. Simultaneously, it would transform the economics of high street retailers.

Politicians from the left would howl that struggling families would be worse off, but I suspect internet shopping is more the preserve of the middle class and the better-off than the lowest paid. Furthermore, one could avoid the extra cost.

While I’m on the subject, surely rates should also be adjusted to reflect the growing height of these sheds given the vast difference between a 6m-high eaves unit and a 12m eaves unit, which is not very significantly reflected in rents.

Finally, why do we have this hugely time-consuming, expensive process of district valuers assessing rates every decade or so, then everyone crying foul and appealing? It keeps plenty of professionals in work, but it is pretty soul-destroying and unproductive.

Again, there is a simple solution. The rateable value should be adjusted automatically every time a new lease is signed, using a simple formula based on the use and the rental level agreed per square foot. The level would be determined jointly between the lawyers for the tenant and landlord and notified electronically to the council’s records. It would be cheaper to maintain, enable more accurate rate collection and substantially reduce the process of notifying when space is occupied.

Just look at all of these opportunities to resolve problems and save money, despite Brexit… sorry, I couldn’t resist it!

No comments yet