Urbanisation: big word, even bigger concept. The social, physical and economic changes it encompasses are relevant to anyone interested in real assets, but the regeneration of our urban areas to foster sustainable communities and stimulate long-term economic growth is applicable to us all.

In academic terms, urbanisation is the movement of people back into areas of high population and building density. Kickstarted during the industrial revolution, it has been steadily speeding up ever since, to the extent that the World Bank estimates that nearly all global population growth from 2016 to 2030 will be absorbed by cities.

This means it is one of the biggest macro-trends facing real estate owners, investors and policymakers today. Urban areas now generate more jobs and income than rural areas, so investment in and regeneration of towns and cities is key to driving sustainable local economic growth.

Urbanisation has also changed the role of town centres beyond just being places to work, shop or eat; they are now for living. This so-called ‘five-minute living’ is being driven by non-traditional working practices, unrelenting technological innovation and sharing economy models.

It is blurring the way in which people perceive and use commercial and residential space, resulting in a transformation of high streets.

From an owner’s perspective, long-term investment returns are underpinned by stable income streams derived from occupier/user demand. So we need to ensure our location and asset allocation strategy evolves in line with that of our dynamic occupier/user base, which means focusing on fit-for-purpose urban environments.

Capturing catchment

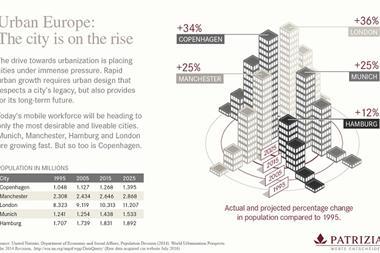

We have educated ourselves as to what ‘good’ looks like, analysing city-level factors such as population growth, employment and expenditure.

But the quantifiable can only take you so far. Critical within our thinking is what will ‘capture the catchment’; characteristics that ensure people are attracted to and stay within an area, such as connectivity, cultural provision and overall quality of life. These are often nebulous and subjective but are what encourage people to live, work and shop within an area, providing that all-important underpinning for economic growth.

Having taken a 360-degree view of the drivers of a local economy, infrastructure, property market and the facilitators of social change, we have had to evolve our own investment rationale. We believe responsible investors should account (and be accountable) for the social and environmental impact of a scheme.

This is impact investing; moving beyond a one-dimensional view of the green credentials of a building towards assigning a monetary value to the long-term impact on the economy and community.

Legal & General is currently involved in 10 major UK urban regeneration projects and we want to do more. From Cardiff to Canning Town, Liverpool to Leeds, we are transforming and reshaping urban communities, bringing housing, jobs, commercial property and economic and social infrastructure to the fore.

It is about sustainable regeneration, not opportunistic gentrification. It’s about developing outward-facing schemes where bottom-up community involvement is as important as top-down investment strategy. It’s about leveraging localism to create a feedback loop with the local economy to ensure the future of the development. Only by doing this can shareholder requirements be aligned with social need.

Economic growth is for the long term and so is our commitment to driving it forward. Never before has patient private capital played such an important role.

No comments yet