Wow, no one saw that coming, did they?

George Osborne’s shock move to increase stamp duty on buy-to-let and second homes from 1 April 2016 will no doubt be welcomed by Joe (and Jo) Public, who will see it as a clampdown on opportunistic small landlords and people owning more property than they need. But will it have the desired effect of shoving aside such owners in favour of first-time buyers? I’m not sure.

Yes, the announcement of the biggest housebuilding programme since the 1970s has to be applauded; yes, it is good to see the government recognise the burgeoning build-to-rent sector by making institutionally backed investors exempt from the additional stamp duty; and yes, there’s a chance some buyers will be dissuaded from buying to let or buying to let… gather dust for half the year.

But in the short term, we could see a rush of activity as people try to get in before the deadline, pushing up prices, and in the medium term, there is a danger landlords will put up their rents to cover any additional costs, which will make housing even less affordable - especially in London, where let’s face it, even a 20% discount on prices up to £450,000 doesn’t exactly open the door to all on the home-ownership front.

The key to solving the housing crisis is boosting supply of new homes. Surely making rental properties less affordable - and potentially reducing the number available - threatens to lock many people out.

Talking of housing, the last time I sold a house, I did what everyone does. I got three high-street estate agents to value the property, each of which sent around a suited-and-booted wide boy to give me the spiel on why I should place my property in their hands.

The valuations varied wildly. The national chain significantly inflated the going market price, the London chain played it safer and the local independent pitched the price about right. Even though their fees weren’t the cheapest, I ended up going with the local independent as I felt their market knowledge put them head and shoulders above the others, and so it proved as the house sold within days.

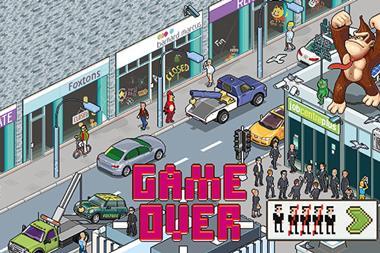

Should I decide to sell my current home, I already know the sales process will be radically different. As our special feature on online estate agents reveals, although they currently only account for a fraction of the homes sold nationally, their share is expected to grow exponentially in the next few years, which begs the question: is the current high-street estate agent model sustainable? The online agents don’t think so. They claim their most expensive fee packages are less than the average amount of VAT a homeowner will pay a high-street agent.

Traditional agents are waking up to the threat. Some are reportedly slashing fees to as low as 0.5% to stay competitive, but they’re still more expensive than the average online operator. I certainly know that next time I sell I’ll be exploring my options online before walking into my local high-street agent.

No comments yet