After all the brouhaha that followed the Brexit vote and faux ‘will she or won’t she?’ drama ahead of this week’s triggering of Article 50 (I say faux because only momentarily was there a suggestion it wouldn’t be this week), the actual event was a bit of an anticlimax, wasn’t it?

You only had to start ploughing through the barrage of boring emails saying pretty much the same things as people were saying last week, last month, even last year to realise as much. What else could they say?

After all, nothing has really changed since Tuesday. It still feels as though we’re as far off as ever from heading through the door with the flickering neon Brexit sign.

Only we’re not. Theresa May has now started the stopwatch - and what was merely hypothetical on Tuesday is now a looming reality for the UK, whether the two-year deadline is achievable or not.

Wednesday 29 March 2017 will go down in history as a momentous day for the UK. The question is: what comes next?

The hope is that the PM is not being extraordinarily optimistic in thinking she can strike a comprehensive Brexit deal in as little as 18 months, which is counter to what most believe is likely, and that when we do leave Europe, we are in a better position economically, politically and culturally than we are now.

International inflows

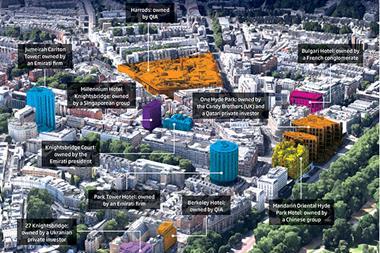

In terms of the property industry, there is no reason to think we shouldn’t be. But here’s the rub for those who voted for Brexit on immigration grounds: the rude health of the sector could well be attributable primarily to foreign money.

The plummeting value of sterling has already prompted a huge inflow of international investment into the UK. Just take a look at this week’s news section. Middle Eastern investors have clearly not been put off by the prospect of Brexit. We lead with the story of Saudi family office Sidra Capital embarking on a £1bn spending spree on London offices.

Neither has Bahraini firm, Tadhamon Capital, which has backed Mayfair-based developer Southern Grove’s 10,000-bed push into student accommodation. Meanwhile, JLL predicts sustained interest in UK real estate from Asia-Pacific as investors capitalise on the continued volatility of the pound.

Indeed, Chinese and Hong Kong firms have dominated London office transactions so far this year. If CC Land’s £1.15bn acquisition of the Cheesegrater goes through, as it is expected to, the £2.9bn that Knight Frank reported was spent by Chinese and Hong Kong investors on central London offices in 2016 could well be smashed in the first half of the year, especially when you factor in the other deals that have already gone through.

According to Savills, Chinese investors accounted for 96% of commercial property investment in the West End in January.

And who knows how much Middle Eastern investors will spend?

The Yanks aren’t coming yet - capital inflow fell sharply last year, according to JLL - but that might change if the pound continues to fall in value.

If Trump puts them off their domestic market, the US institutions and private equity houses could even trump the private investors that have dominated the UK market so far.

No comments yet