Mipim was buzzing: the most upbeat event since 2006, with 22,000 delegates and British numbers up 18% on last year.

But while the networking was in full flight there was also a serious undercurrent to my week, as delegates digested the consequences of a strong property market.

My week started with a London Chamber of Commerce & Industry (LCCI) dinner where we started a four-day series of events designed to highlight crucial issues affecting us all.

This agenda continued on Wednesday lunchtime at LCCI president Tony Pidgley’s MIPIM lunch for 80 guests. Luminaries like Nick Candy, Capital & Counties managing director and chief investment officer Gary Yardley and Dalian Wanda general manager Laurent Fischler were among the guests debating how to solve London’s housing shortage.

We are clear that property needs a cohesive and clear voice to government at this crucial time, with the economic impact of a housing under-supply becoming increasingly profound.

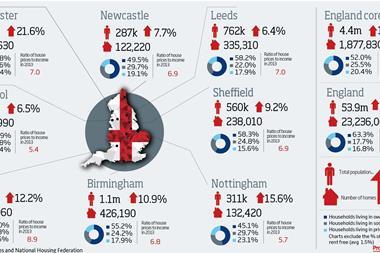

According to LCCI research, average London house prices have increased fourfold since the late 1960s and are now more than twice the national average, growing at a much faster rate than wages.

As the deputy chairman of the LCCI’s property & construction group, I fully endorse its recommendation that the mayor of London should set a trigger mechanism whereby ownership of publicly-owned brownfield land is transferred to private firms for development as housing.

I also subscribe to the view that the mayor should work with local authorities to increase density around transport hubs.

While the likes of Tony Pidgley and his Berkeley Group are crucial to the expansion of London’s housing supply, we should also not forget the crucial role that smaller developers can play.

So other LCCI arguments we were pressing to policy-makers at Mipim were that:

- The Greater London Authority should actively recruit smaller developers to its London Development Panel and should consider deferring payment for land acquired from public ownership until after the homes have gone to market;

- Local authorities should allow developers of sites under 50 units to defer payment of the community infrastructure levy until the homes have gone to market;

- The chancellor and mayor of London should launch a ‘help to build’ risk-sharing loan guarantee scheme for smaller developers.

The other big issue we were pressing at Mipim were the stark consequences of construction skills shortages. With £95.7bn of construction output planned for 2014-2017, 20% more workers will be needed to meet pipeline demand than were needed from 2010 to 2013.

This translates to more than 600,000 workers needed on site next month, with a significant increase needed in roofers, bricklayers, scaffolders and electricians after so many left the industry following the great crash of 2008.

To that end we used Mipim to call for:

- Local authorities to employ a more flexible definition of local labour when setting section 106 requirements to allow apprentices to move across boroughs and complete their training;

- The government to review the impact of proposed changes to the apprenticeship funding system to minimise the financial and administrative burden to small and medium-sized enterprises;

- The Skills Funding Agency to convene industry bodies and representatives to redesign training and apprenticeship frameworks to reflect modern methods of construction.

These measures are needed because interest in London residential property remains incredibly strong.

British buyers returned in force last year and are now being joined by an ever-widening set of overseas investors.

In March alone, CBRE Residential has held an event for Chinese buyers at our Henrietta House base, played host to 45 Russian women to mark International Women’s Day and been on sales missions to Hong Kong, Kuala Lumpur and Turkey.

Settling the election first time round would be a very positive step, particularly with the political agenda I have outlined above.

But my Mipim week wasn’t all about lobbying. Our annual Tuesday-evening dinner has become a residential market fixture and we met dozens of clients in an informal environment with a relaxed atmosphere.

My favourite moment? Walking down the Croisette in a hurry and on the phone and crossing paths with Legal & General’s head of real assets Bill Hughes, who was likewise busy with his phone to his ear. How to respond? A simple high-five did us both very well indeed.

Mark Collins is chairman of CBRE Residential

No comments yet