Shares in British supermarkets plunged last month when Amazon announced it was buying high-end grocer Whole Foods Market for £10.7bn, sending a shockwave through the grocery sector.

The biggest ‘pure play’ on the planet will be catapulted into hundreds of physical stores, largely in the US, where it will use multi-channels to fulfil its long-held wish to sell more groceries.

No one in the UK warehouse market should underestimate the potential impact of this M&A, or indeed of potential collaborations such as Ocado’s recent hints of software supply to retail clients to speed up and ‘import’ online distribution expertise.

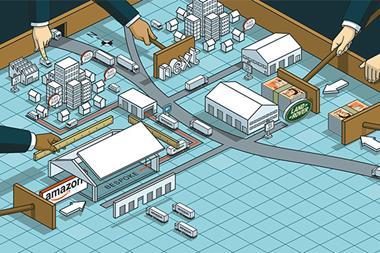

The bigger picture surrounds rapid structural changes in the retail world - and it is these that will continue to drive warehouse demand.

Whether it is Amazon buying Whole Foods, Tesco buying Booker or Sainsbury’s buying Argos and now having a tilt at Nisa Local, retailers want to be visible and accessible to customers on many different levels. And they’ll need a distribution network to support that ambition.

Amazon’s choice of Whole Foods shows that it wants to add ‘experience’ and ‘social shopping’ to the huge volumes of online business it now drives. In time, and particularly in the US, Whole Foods stores are likely to become click & collect points for Amazon.

For Sainsbury’s and Tesco, the attraction of acquiring Nisa Local and Booker respectively is to increase visibility through convenience stores - because consumers, particularly urban-dwelling millennials, want more flexibility and choice, so are buying the food they fancy daily.

At your convenience

A convenience store tie-up also enhances the supermarket giants’ click & collect potential. Nisa, for example, has 2,500 shops through which Sainsbury’s could reach its customer base by buying the whole chain for £130m - a relatively small amount for a retailer with a market capitalisation of £5.37bn.

So what are the implications for warehouses following this new wave of consolidation and collaboration? The most likely outcome is the continued growth of the ‘hub-and-spoke’ model, whereby very large national warehouses (of 1m sq ft or more) get bigger, holding omni-channel inventory to supply a network of much smaller warehouses located on the edges of towns. These satellites are close to customers’ homes and local high-street stores, enabling more frequent deliveries in heavily congested areas.

This trend is expected to accelerate as the likes of Amazon Prime, Amazon Fresh and Tesco offer an ever-faster delivery service, with one-hour delivery time slots now being offered in some areas.

Here’s the rub: Colliers’ recent market barometer showed a drop in availability of smaller warehouses since 2009 of 63% in London and around 70% in the East and West Midlands. Furthermore, speculative completions are expected to fall by 60% on the year in 2017 to just 3.5m sq ft.

Where retailers would once have shuddered to consider sharing warehouse space, supply pressures may force them to consolidate in multi-user facilities as rental growth continues.

While global retailer consolidation has already caught the eye of shareholders, shoppers and the media, the implications for the world of warehousing are profound. You can be sure that logistics, deliveries and digital sales will have been at the heart of the strategic thinking behind each deal.

No comments yet