I can’t help pigeonholing people into Dad’s Army characters.

Since Brexit many property pundits have been issuing Private Frazer’s war cry: “We’re all doomed!”

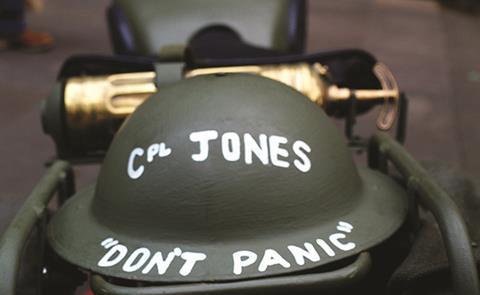

At the recent launch of the RICS Commercial Property Market Survey, however, the message was more aligned to Lance Corporal Jones’ refrain of: “Don’t panic, Captain Mainwaring!”

The survey of surveyors’ sentiment for the second quarter suggested there is, indeed, plenty to worry about: most of the 392 respondents believed they were in the “early downturn” phase of the cycle.

This seemed to be borne out by the flurry of ‘open-ended’ investment funds suspending trading or cutting their net asset values drastically since 23 June.

However, the view among the launch seminar’s panel, which comprised senior figures from JLL, Aberdeen Asset Management, Kames Capital and Legal & General Investment Management, was more sanguine. Values in the commercial property market “had already peaked” before Brexit.

But this was relatively controlled and ‘forced’ sales by funds does not reflect a collapse in underlying assets - rather a reflection of the seeming absurdity of their open-ended structure. There has been no shortage of buyers.

Three of the four panellists were from investment funds and the other, JLL, was at the coalface, orchestrating transactions. The prospect of bargains to be had from forced sellers on top of the weakening of sterling attracted a surge in interest from Asia, the Middle East, the US and other regions.

During Q&A, I asked what the going rate was for discounts, expecting to be palmed off with a “commercially sensitive” riposte. Not so. “Five per cent” was the instant response from JLL. Not bad, considering these were supposedly distressed sellers. Something close to or into double digits might have been expected.

Indeed, it was, according to JLL. “Some US private equity houses had been expecting a car crash and were disappointed when they didn’t get it… I think they’ve gone back to looking [for higher yields] in Europe.”

Very little hestancy amongst property investors

Several of the deals have been chronicled in Property Week. For instance, Aberdeen Asset Management sold 355-361 Oxford Street, the largest property in its £3.2bn fund, to Norges Bank Real Estate Management for £124m. This was admittedly 14% below the initial asking price but, hey, which seller (other than liquidators) ‘starts low’?

A resultant 3.5% yield still looks a result. And the deal was concluded in under a fortnight. Meanwhile, L&G cut its ‘Brexit discount’ from 15% to 10%, and PW has reported that retail investors had started to put their money back into property.

That’s the investor market, but an even more relaxed view of the occupier market was portrayed. There has been very little deterioration in occupier demand, with any hesitancy among potential takers of space restricted largely to the London office side.

This represented more of a ‘wait and see’ approach than a fundamental diminution of the Square Mile’s international status. I - as a confirmed ‘Brexiteer’ - take with a kilo of salt my own industry’s threats to ship out thousands of employees to Paris, Dublin or Frankfurt.

In wider industry, GlaxoSmithKline was one of many prophesying gloom if the vote went the wrong way. Mystifyingly, it has since announced it is to invest £275m expanding its UK manufacturing sites.

Ah, but gloomsters can always turn to the International Monetary Fund for sustenance. It has cut its growth forecast, not just for Blighty, but for the whole planet. Who do you think you are kidding, Ms Lagarde?

Alastair Stewart is an equities analyst and columnist

No comments yet