Overseas expansion by US ‘accessible’ luxury brands helped Europe take a larger share of letting activity in the global luxury retail market in 2017.

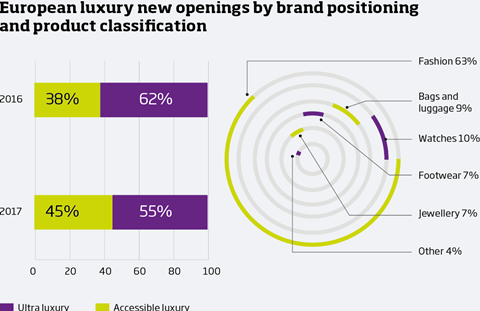

The region’s share of take-up rose from 36% in 2006 to 38%, according to research from Savills.Ultra-luxury brands continued to dominate new store openings in Europe, although their share declined from 62% in 2016 to 55% last year.

Accessible luxury brands were much more acquisitive, growing their share from 38% to 45%. Hickey says that this is a trend Savills has continued to see during the early part of 2018 and that “this shift should prove beneficial in terms of occupational demand as these types of brands can support multiple stores in a given city, particularly in the larger European cities of London and Paris”.

The increased level of activity from accessible luxury brands was driven by the aggressive expansion of US operators, which according to Savills tend to enter the European market via London before expanding into other cities. Despite the rapid expansion of North American accessible luxury operators, Italian and French brands continue to dominate acquisition activity, together accounting for 54% of all new openings.

Paris topped the European and indeed global rankings in 2017, accounting for 5.9% of all letting activity. In Europe, London and Milan were tied second in Europe – accounting for 5% of activity each. There were new store openings for the likes of Stella McCartney, Panerai and Chloé in London and Louis Vuitton, Balenciaga and Rimowa in Paris.

“Growth tourist markets, particularly those with relatively affluent domestic populations, moved up the agenda for luxury brands in 2017 and it was apparent in the new additions to the European top 10 with Oslo ranking fifth,” says Savills’ commercial research director Marie Hickey. “Likewise Munich, while typically often featuring in the top 10 historically, moved up the ranking to fourth in 2017.”

Bain Consulting reported global luxury spend grew by 5% last year, which boosted occupier demand. “This bodes well for occupational confidence across the region throughout 2018 and beyond,” says Hickey. “In the key destination cities, particularly for the larger luxury houses, there is an emerging shift towards larger stores in the key luxury pitches, ultimately to allow for showcasing of the brand.”

No comments yet