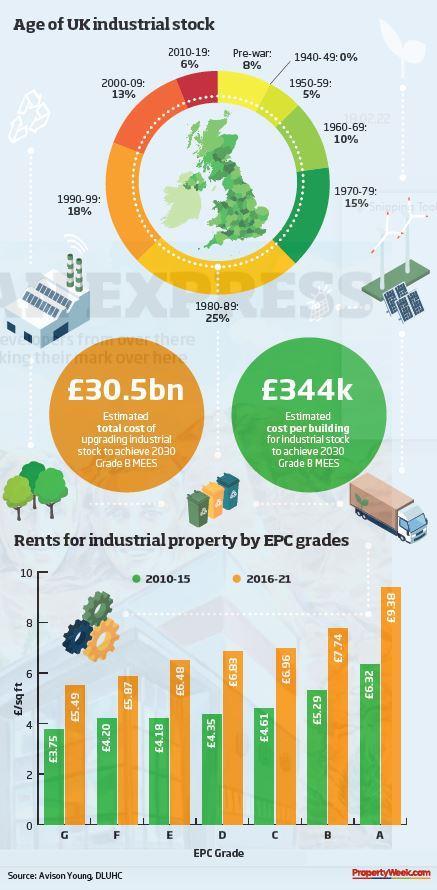

Improving the UK’s industrial, manufacturing, logistics and warehousing stock to achieve a grade B rating under the 2030 Minimum Energy Efficiency Standards (MEES) requirement could cost as much as £30.5bn, according to data shared exclusively with Property Week by Avison Young.

Its upcoming ‘Building Zero: the road to zero carbon logistics’ report, which explores the key pressures affecting the industrial built environment, sets out the changes that need to be made and the cost of doing so to achieve the new standards. The report notes that if a change in regulations was pushed through that required buildings to meet an EPC requirement of ‘A’, the cost would be higher still.

“The cost of improving the UK’s industrial, manufacturing, logistics and warehousing stock – even just in terms of MEES – is immense,” says Daryl Perry, head of UK insight at Avison Young. “Taking into consideration merely recommendations for improvement for existing buildings with EPCs, we estimate that the total cost for achieving the 2030 MEES requirement for industrial stock comes to £30.5bn, at an average cost of just under £344,000 per building.”

Perry says detailed modelling on an array of buildings undertaken by the company suggests that 1980s and 1960s buildings – under the current seven-year payback guidance – would only achieve and EPC grade ‘C’.

“While a number of forward-thinking developers are moving towards net zero carbon development and on-site energy generation, arguably the greater challenge is around how to upgrade existing stock, with 80% of the UK’s industrial stock more than 20 years old,” he says. “The policy shift around MEES, and changing requirements, has the potential to create significant environmental obsolescence.”

Meeting EPC standards is only a small part of the challenge owners of existing industrial and logistics buildings face in terms of delivering on their net zero carbon aspirations. Perry believes that a “holistic approach” to reducing carbon emissions is required across the sector and will enable the sector to make greater use of what it already has.

“Owners and developers of warehousing and logistics space are increasingly setting more stringent carbon and sustainability targets for both new and existing portfolios,” he says. “This is being driven by occupier requirements to minimise supply chain emissions and ensure that their built stock is fit for purpose.

“While capital costs compared with other sectors are less, the scale of the task ahead, in terms of putting sustainability at the heart of the industrial sector, is large.”

Industrial & Logistics sector keeps on booming

- 1

- 2

- 3

- 4

- 5

- 6

Currently reading

Currently readingUpgrading stock to MEES could reach £30.5bn

- 7

No comments yet