The UK’s impending exit from the EU has dented investor appetite for UK real estate, suggests a just-released survey by KPMG at RE-Invest Summit at Mipim.

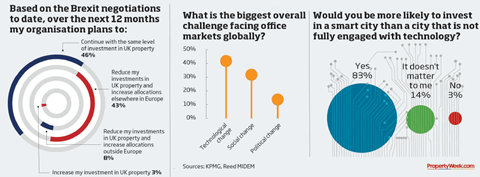

A poll of 75 global real estate investors from 52 institutions across 22 different countries reveals that only 46% of investors intend to continue with the same level of investment in UK property, with 51% expecting to reduce investment. Between them, the survey’s respondents control more than $650bn (£499bn) worth of property, but only 3% say they plan to increase their investment in the UK.

“The data suggests that people are being relatively cautious,” says Andy Pyle, UK head of real estate at KPMG. “I would imagine that the developments of the last weeks won’t have been helpful, but on the other hand, I think that most of the investors tend to take a long-term view and therefore they are more concerned about what is going to have a longer-term impact on the UK.”

Pyle says that investors should continue to consider Brexit uncertainty in a broader context.

“If you look at property generally, long-term investors have on average been increasing their allocations to real estate and infrastructure assets over the past 10 years and many of them have not yet reached their target allocation for the amount they want to have invested,” he explains. “This is positive for real estate investment as a whole, but the question then is whether the UK is becoming more attractive or less attractive as a potential destination for their capital.”

Europe continues to be the main area of focus for more than two thirds of investors, according to the research. The other thing that continues to appeal to real estate investors is technology and particularly smart cities.

“Most want to invest in smart cities, and almost everybody has either changed their investment strategy in response to the potential impact of technological advancement or at least plans to do so,” says Pyle. “I hope that in five to 10 years’ time people won’t be talking about ‘proptech’, as property will simply be technologically enabled – it will just become part of the sector.”

No comments yet