Location is a critical factor for the success of a property development, and understanding the existing market dynamics of an investment area is an essential part of the research process when looking at potential development sites.

Of course, property is a human business and nothing can quite replace the intuitions gathered from walking the streets and having a chat with the pub landlord.

But they say data is the new oil, and surely the process of researching local property markets now starts with a rigourous analysis of a wide range of objective statistics and data points.

The right tools to turn data into insight

Luckily, a raft of tools have evolved in the last few years which make it easier than ever to analyse local residential property markets from the comfort of your ofice.

At PropertyData we source, clean up and regularly refresh data from more than 24 diferent organisations. Just like oil, raw data isn’t always much use in and of itself, and the real value in what we provide is the easy-to-use interface we’ve built to help you break down data, spot trends, and draw important insights.

Define custom local markets to analyse

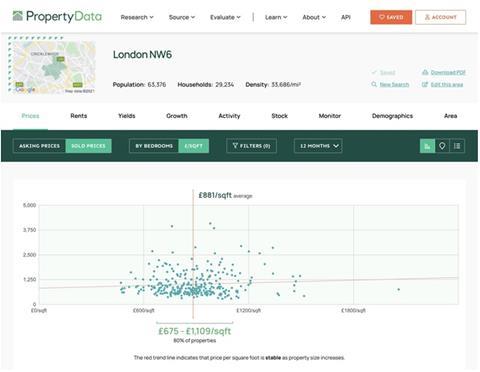

At the heart of the research tools we ofer is our Local Data tool, where you can create bespoke local areas and explore a comprehensive dashboard of data customised specifcally for that area, including:

- Extensive pricing data for the sales and rental market, including asking prices, sold prices, and the UK’s most comprehensive £/sqft data

- A breakdown of rental yields by unit size

- Accurate local capital growth data for the last fve years

- Activity levels in the market, with buyer and tenant demand

- Analysis of the existing property stock in the area

- Demographic data including deprivation, health, education & travel modes

- Up-to-date planning permission data covering all councils in the UK

- Data on state and independent schools

With our Local Data tool, you can save areas to keep track of market movements, and compare diferent investment markets side-by-side.

Do ask how the sausage gets made

Insights from data are only as reliable as the underlying data itself, so it pays to beware of data providers who are all “secret squirrel” about where their data comes from.

A data ‘chain of custody’ is essential. At PropertyData we believe passionately in data transparency, so on every tab in our Local Data tool you’ll fnd an explanation of where the data has been sourced from, how it has been processed, and how it’s updated.

Make data your competitive advantage

Fifteen years ago using property market data like this was complex and expensive and the preserve of the very biggest property investors in the UK.

Now, with tools like PropertyData, data software is afordable for property investment teams of every size. Why not join the thousands of residential developers and investors around the UK already using PropertyData to make beter informed decisions.

Michael Dent is the founder of PropertyData, the UK’s leading analytics tool for residential property investors and developers. Unlimited data access costs £506/year – try it free in your business for 14 days.

No comments yet