December’s general election appears to have restored a certain level of confidence to the UK property market at the start of 2020.

However, looking ahead at the market’s prospects for the year, Brexit is far from done and dusted, with uncertainty remaining about the terms of the UK’s exit, while retail continues to struggle as pressures from online and business rates mount. On the upside, the decline of retail may open up a gap for the expansion of alternative sectors, such as retirement living and student accommodation, while combining uses in mixed-use schemes looks like a development model with a healthy future.

Meanwhile, in the office sector, the rise of proptech and tribulations of WeWork are likely to have a big impact. On the eve of Britain’s official exit from the EU, Freeths and Property Week gathered a group of property experts to discuss what impact these issues and others will have on the industry this year.

Panel of experts

- Anna Strongman, managing partner, Argent

- Ayesha Ofori, founding director, Axion Property Partners

- Vanessa Hale, research director, BNP Paribas RE and president, ULI

- Melanie Leech, chief executive, BPF

- Cressida Curtis, head of corporate affairs & sustainability, British Land

- Michael Webb, co-founder, Distrkt

- Savannah de Savary, founder & CEO, Built-ID

- Darren Williamson, national head of real estate, Freeths

- Robin Martin, director, strategy & ESG, real assets, LGIM

- Adam Blaskey, founder, Produktiv Partners

- Andy Gulliford, chief operating officer, SEGRO

- Liz Hamson, editor, Property Week (chair)

Have we reached the end of political uncertainty and what impact will the new political landscape have on the property sector?

Robin Martin: I think we’re going to see some pretty headline grabbing domestic policy initiatives from the government in the near term. From a property perspective, I think we’re going to see some action on planning – I think they’re going to be in a hurry to do something there.

Daren Williamson: My view is that the freight train that is Brexit will continue [to roll]. I think the majority of the civil service’s time will be dedicated to that, but there will be legislation brought in on fire safety, following Grenfell, as well as reform of business rates for retail and the high street. I think the government will try and go for a couple of quick wins straightaway.

Melanie Leech: I think the prime minister has seen the lessons of history and knows that if you want to make big decisions, you have to do it very early in your tenure. I’m expecting to see very significant infrastructure commitments, and commitments to the digital agenda and R&D.

Savannah de Savary: This year I don’t think anything significant is going to change in terms of Brexit. I think uncertainty and instability will only continue and I think it’s now sort of the new normal.

Michael Webb: People want to have confidence in something and I think they wanted to exaggerate the positive, because there needed to be some form of good will in the market. Business rates are the killer from the occupational side. I think we’ll see a lot more partnerships occupational wise – that’s the feedback we’re getting because of business rates.

Adam Blaskey: In terms of fiscal policy, business rates reform and digital tax need to be discussed. Both need to catch up with how the world works, it’s outdated that just doesn’t work.

The public have really latched onto climate change and sustainability. What do you think will happen in the short and medium term in this area?

Vanessa Hale: The younger population is 100% [focused] on climate change and sustainability – on understanding where we’re going and how we’re going to get to carbon neutral and zero carbon. I think the budget will have to make sure younger voters are on board to get an immediate win.

SS: Developers as well will have to step up. When they say they’re committed to sustainable development you have to ask what that means – it sounds like the bare minimum. You have to ask what are they doing to go above and beyond?

Anna Strongman: I think developers have the responsibility to lead by talking about environmental issues, but also about the whole ESG agenda – for example social equality. We have to lead not follow in this sector; we have to be promoting a whole breadth of issues.

VH: I think the government will be looking at it in order to say they have delivered on something they made a promise on.

Cresida Curtis: I expect to see regulation tighten really quickly. There’s no way we can hit carbon reduction targets if it doesn’t. We need to get better quickly. If businesses can’t talk fluently on this subject, then I would worry about their strategy.

MW: It’s not just a tick box culture anymore – It means so much more. The younger generation will decide on a restaurant on the basis that they have two to choose from. It used to be a tick box to get a government grant – now it’s at the heart of a decision.

RM: It goes from how people behave in their private lives to the goods and services they buy and also how they invest their money. Climate change is the existential risk of our age and it motivates people who have a stake in the future.

AB: People’s consciousness has elevated to a point where we are making these decisions ourselves and we are not being told what to do by the government.

Turning to retail, what are the prospects for the sector over the course of the year and how is the high street going to look?

VH: It’s going to be really dependent on whether or not we get revised planning or a totally new planning system. There will be questions about how to change some of the big retail boxes into alternative uses and mainly how to turn them into mixed-use residential.

AS: Retail is the best asset class, because you can transform the ground floor of the space through the choice of retail. Despite what you can do online, there will still be demand for creativity in retail and there is a shake-up in the market to be seen.

SS: I think we are going to see a trend inside and outside London of grass-roots retail. I also think we can’t underestimate that people slightly missed a trick with the experience that a lot of it is just about community and connecting.

Andy Gulliford: We are not anti-shops, but we have just got too many units and too much physical space. If you cut it down I can see those other uses coming into play, which is fantastic.

CC: The one thing that real estate will always have over the digital realm is that it allows people to have a proper human experience. At the moment, space is still where humans get together and I think we have to maximise that – space is space, so why don’t we get creative with it?

AG: I can see online and physical retail coming together much more. I think it is driven by experience really. I can see some shops being used for small pick-up points, which will become part of the supply chain for logistics.

Does retail space need to be scaled back, and by how much?

ML: It’s not a one-size-fits-all situation. There’s a way to go, its just how you manage your way through it. We’re a nation of shoppers and as a species we’re gregarious, so if you put those two together then you’re defining what a successful high street is.

CC: People are going to look to the real estate sector to be a major mover in this. I think the government is also going to be putting more money towards town centres.

Ayesha Ofori: I think there’s going to be a change on the high street, but not the death of the high street. It will have more residential and other social spaces, so that community area will still exist – it is just going to look very different to what it has historically been.

SS: There is a trend of people wanting to consume less and I don’t think we’re going to go back from that. It really is a conscious move to consume less and better. There’s no way we can regenerate our high street to how it was before because our consumer habits have changed.

AB: I think people just want to go out for that experience. Property is great for trying to find out exactly what people want. Take the idea of flexible offices: things have massively changed and people want to choose where they work and not sit in an office all day.

Where is co-working going in the wake of WeWork’s issues?

AO: I think people and organisations want more flexibility, so even corporates that have buildings, particularly a lot of them in financial services, are adopting set ups where you no longer have your own desk.

CC: It’s made everyone adopt a much more flexible working pattern. It’s up to managers to see if they want more from their team.

DW: The nice thing about co-working is the ability to sync with other businesses. We’re looking at taking flexible space as an overspill, enabling us to work in a different environment.

AS: I feel very strongly that you can never assume people have a space to work at home. The assumption that people can work at home is really crazy.

AB: It [flexible working] does start to raise questions about the inherent value of a building. As people embrace flexible working patterns, with some people choosing to work from home, in some cases you may have less desks than people. It does raise the question of the value of office space to that business and suddenly it becomes one smaller input in the value chain.

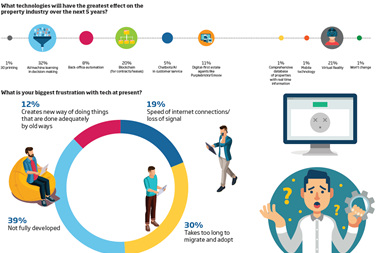

What role will proptech play this year?

AO: I invest in start-ups and the number of proptech start-up pitch books I get on a weekly basis is ridiculous. Now you have so many people trying to bring technology into property in as many creative ways as you could possibly imagine. We have an industry that is resistant to change, but I think it’s inevitable that companies are going to have to start adopting proptech and taking some of these things on board.

RM: In a way, there’s not been many big success stories yet, but that’s at least partly the incumbent’s fault. We’ve had to take on data scientists and it does reflect a different skill set that hasn’t generally wanted to come into real estate before.

ML: I hope this will be the year that we’ll see the traditional property sector get its act together to articulate the challenges that it would like the proptech sector to respond to.

To round off, what are everyone’s predictions and resolutions for the year?

AG: From an investment stance, we will continue to concentrate on urban environments because the twin themes of urbanisation and digitalisation are where we see real activity. We’ve also got to get the industry behind LandAid and addressing the issue of homelessness.

ML: We would be mad as an industry not to take the opportunity that’s been presented to us to forge a meaningful partnership with the government and unlock investment around the country. My resolution is to drive that agenda of demonstrating that it makes a meaningful difference to people’s lives.

CC: I think we’re going to see some really interesting innovation and collaboration between real estate players on the environment – the difference they can make could be huge.

AS: I want to keep flying the flag for the social in ESG and my prediction is that someone has got to make money out of the retail sector.

AO: There will be continued investment in the property sector in terms of capital inflow, as long as there isn’t too much instability in what the government does next. I want to continue focusing on doing things that have social impact, for example affordable housing and care homes.

RM: With climate change, there is a momentum that is not going away. I think it’s going to stick this time. I think that climate change and climate risk will destroy everything else. We have to redouble our efforts.

VH: Unquestionably there is capital looking to come into the UK. I think the levelling up agenda that the government is going to pursue will result in a lot more investment in regions.

SS: People will start chasing social impact opportunities more, such as investing in social impact technology. People care more about this and I don’t think that’s going to go away. So we will try to find sustainability tech for our clients.

MW: I think we are going to see a lot more collaboration and partnerships between landlords and tenants. Sustainability will also be at the heart of the industry. Distrikt is also going to spend more time and money with Magic Breakfast, which sponsors children who can’t afford to have breakfast.

AB: I think we are in a period of consolidation and I am looking forward to a much better pace of working life.

DW: I want to keep trying to raise consciousness – the more we talk about the issues in our sector, it becomes infectious, so I want to promote more of that. My prediction about Brexit is that it will be over by the end of the year.

No comments yet