The retail sector is undergoing seismic changes affecting the entire property chain from retailer to landlord, developer and investor.

Too much attention up until now has been on the retail sector’s problems. Property Week brought together two panels of retail experts to discuss uniting the sector to bring about positive solutions.

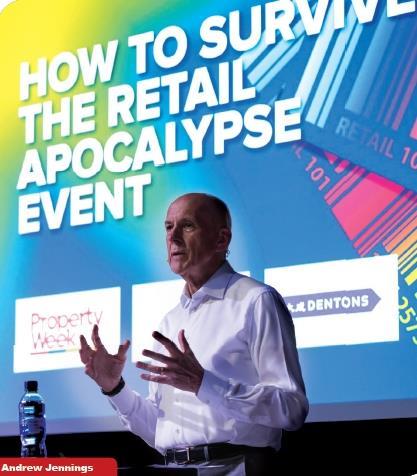

The event, in association with Quintain and Dentons was held at Boxpark Wembley earlier this month, hosted by Property Week editor Liz Hamson and was kicked off by global retail adviser Andrew Jennings, who gave the first keynote speech setting the scene:

“In 45-plus years in this business I have seen a lot of changes. However, I haven’t seen anything like what is happening in our industry today. High streets and city centres around the world are under huge pressure as bricks-and-mortar stores start to crumble under the pressure of hybrids and excessive rents.

“Since 2015, we have seen the escalation of one of the most severe crises in the global retail industry. In the UK, there have been many struggles on the high street and we have seen the department stores and major businesses going through insolvency.

“If I look at the US, more than 8,000 major brand stores went under last year. In 2008, only 6,000 stores closed their doors. All around the world there are signs of a retail crisis. Number one, bricks-and-mortar retailing is a high-fix business: heavy investment, long leases, significant inventory investment and a fixed cost base. It only takes a few seasons of sliding scale before the whole thing tips up on end like the Titanic filling with water.

“Some of this has been caused by online where 16% of all UK retail sales happened last year. That will no doubt grow to 20% to 24% in the next three years. Customers are no longer just kings; they have become the all-knowing super-beings. They want and demand transparency, convenience and value for money at every step of their retail journey.

“The retail graveyard is full of once-relevant businesses that have allowed themselves to become irrelevant because these businesses lost their focus on the customer”

“They know as much about the product as we retailers know and they are ruthless in the way they use that knowledge. Any retailer who wants to stay in the game has to think in an entirely different way. Get it wrong or move too slowly and the customer will be lost forever.

“There are two words I’d like you to remember: be relevant. Relevance is a simple but powerful word. It encompasses everything we need to do to survive. We can’t do retail half-heartedly. We must make sure the customer experience is perfect.

“The retail graveyard is full of once-relevant businesses that have allowed themselves to become irrelevant, simply because these businesses lost their focus on the customer. There will always be winners and always be losers. I believe bricks-and-mortar retail has a great future and I’m not alone in thinking that. Amazon is busy eyeing up the high street.”

Future of the retail sector

Jennings’ speech was followed by the first panel session focused on what could be done to improve the landlord/retailer relationship and was chaired by Liz Hamson.

Panel of experts

- Mike Anderson, Milligan Retail

- Liz Hamson, Property Week (chair)

- Steve James-Royle, The Yard Creative

- Matt Slade, Quintain

- Mark Williams, The Hark Group

How bad is the landlord/retailer relationship today?

MS: To be successful for the future, the two have to work very much closer together than they have been historically. What the recent spate of CVAs has shown is that there is significant change and rebalancing of what retail looks like on the high street.

It’s not what we are seeing on the ground, though. Do you think the relationship has got worse in the last year?

MS: The number of CVAs has been huge. We have lost 7,000 stores over the last four or five years, which is equivalent to five Westfield centres. I’m sure there are more coming down the line.

Given the challenges, are we seeing the relationship improve?

MA: We are at a low point in the relationship between landlord and retailer. The relationship is predominantly governed by historic instruments and I think the legislation behind that, such as the Landlord and Tenant Act 1954, needs to be updated and become more relevant to the trading conditions we find ourselves in today.

So operate outside the 54 Act to build better relationships?

MW: The language of landlord and tenant is very historic. Retailers and investors in real estate share a common problem, and that’s the dramatic change in bricks-and-mortar retail. There is now a much greater senior engagement between the two sectors in trying to find a solution to a common problem and to try and drive businesses forward. The debate about rent is quite frankly archaic. Retailers want flexibility to move space, flexibility of occupation costs. Landlords are actually very willing to respond to that. For 95% of the real estate industry, giving flexibility is not an issue. The issue is the legal obstacle to that, which is the archaic 54 Act. If we can do away with the issue of the 54 Act, landlords can give flexibility.

How open are retailers to that?

MW: At senior levels it’s not an issue. No disrespect to property managers; it’s an old-fashioned approach. At senior level, they are much more interested in having the ability to have flexibility and the ability to take a store that they can afford. They are really not fussed that the retailer next door is taking it at a different rent. What they don’t want to do is take a rent because someone somewhere else has taken a rent and that has set a new rental tone.

Steve, how do you see the relationship evolving?

SJR: We get to sit on both sides. We are seeing a much more collaborative way of working now. Landlords are much more openminded. They are having to understand how they can contribute and support the retailer and bring it into their wider marketing world. Retailers themselves are looking at new ways of doing things. Digital native brands are coming on to the high street and their KPIs are completely different. The way they are looking at physical space is completely different.

The data piece is key. We seem to have moved away from analysing what’s going on in the physical world. Do you think there is more retailers and landlords can do with collecting and interpreting data?

MA: Where you have difficult trading environments on the high street and shopping centres, you have landlords gathering information on the consumer and the retailers gathering their own data on consumers and to not share that information and try to work together seems somewhat counter-intuitive.

What are some of the early wins if you start gathering data about how people shop in the physical space?

SJR: If we use Fortnum & Mason as an example, we helped them undertake their first-ever piece of consumer insight in 308 years and in just eight weeks helped them understand that their consumer they thought was over here was actually down here. And credit to their senior management, they culled their marketing calendar for that year and started over and Christmas sales that following year were through the roof. But, as they would say themselves, it’s great to know your customer but do you know who you are as a brand? Because there is no point in looking at your customers if you don’t know who you are as a brand. The property is a brand; cities, places and spaces are brands.

Not many people are looking at it that way. Other examples are outlet models, which lead to stronger relationships between landlord and retailer. Is that transferable to other parts of the retailer market?

MS: Absolutely. The outlet model has proven to be very successful and has gained strength through each of the cycles of recession. Within the outlets you have shorter and more flexible leases, which mean the brands can change and evolve. Because there are relatively low-base entry rents and landlords and tenants share that risk, they are as focused on the operators as the operators themselves. That is transferable and we are fortunate enough to be starting a high street from scratch at Wembley Park and we can introduce some of those concepts into a new modern place.

No matter how strong the relationship becomes, other issues like business rates still exist. What can industry bodies be doing to lobby for change?

MW: The relationship between investors, local authorities and retailers has never been greater on this point.Collectively we are lobbying government at different levels. Ministers are recognising the need for change. Everything is low on their priority list at the moment due to Brexit and there’s nothing we can do to solve that. When the government comes out of this, it has to be tackled and there is recognition of that.

What is the killer solution?

MW: In my opinion, it’s easy to introduce an online sales tax. It is simply administered. Do you want to pay online? Yes, you pay a tax. Collect in store? Yes, you don’t pay a tax. It starts to drive changes in consumer habits. You are not going to come up with a solution that suits everybody. At the moment, the current solution is killing the high street.

WATCH HIGHLIGHTS FROM THE EVENT

Shopping for solutions

The panel was followed by a second keynote speech, made by Matthew Hopkinson, co-founder of Didobi and co-author of the Grimsey Review. He set out a four-part story of the retail sector: situation, complication, questions and answers.

“Situation: where we are now? About 11% of shops are vacant. That’s about 50,000 shops. It’s not just about the vacancy rate; it’s the persistency of vacancy. About 15% of the 50,000 shops have been vacant for more than three years. Then you have to look around the country to see the differences. You can have 0% to 1% vacancy in some places and 30% in others.

“Since 2008-9, we have added another 5% of stock and continue to add just under 1m sq ft a year to the stock. Why on Earth do we need more shops? We have too much space. You could argue we have 30% too much space. I think there are about 620,000 shops across the UK and therefore we need to remove more than 100,000 from that stock – significant numbers.

”It’s not going to happen over 12 months. We’ve spent 40 years managing the decline of our town centres and it will take another 40 years to get it back on track.

“You’ve also got a number of complications. One is sales. If you look at Deloitte data, around 44% of retail was on sale in December – anything from 2% to 80% discount. We have all been conditioned to not buy at full price. Retailers have only got themselves to blame for conditioning people. Why did they do this? Because competition has been so fierce.

“You have also got the fickle consumer, this history between landlords and retailers and the speed of change that are complicating factors. Questions that come out of all of this for retailers are how we are going to cut these spiralling costs. These costs are going up and up and the consumer wants it to be more convenient and cheaper and that doesn’t go with the model where the costs as an operator are increasing.

“Around 44% of retail was on sale in December because competition has been so fierce”

“There is also the point about data and what is going on. Do you understand the business model of the retailer if you are a landlord or do you understand how your landlord works if you are a retailer? And invariably they don’t. The answers are in the clarity of your vision. Leadership is driven by visions and people buy into that. Then you need to have a clear plan that is flexible and enable teams within stores to make decisions. The impact of a good store manager on the store’s sales can be plus or minus 40% but what have we done? We’ve paid them as little as possible and then wondered why we don’t get the results. How can we create places that have excellent people that are supported by this digital economy? Then there’s the execution and how you measure that. The most important piece is around leadership.”

The event was rounded off with a second panel focused on solutions to the problems.

Panel of experts

- David Bannister, Nash Bond

- Alex Coulter, Dentons

- Emma Mackenzie, NewRiver

- Anna Strongman, Argent Related

- Justin Taylor, Cushman & Wakefield (chair)

- Roger Wade, Boxpark

- Don Williams, KPMG

Talking about business models, Roger yours is very different…

RW: We don’t believe retail development is an appreciating asset but a depreciating asset. The minute you open a retail asset, you’ve only got a limited amount of time. So the idea that in 20 years you are going to be relevant is crazy. There is an obsession with the quality of tenure and long leases, and then they wonder why the customer isn’t excited because the decision about the retailer is based off the balance sheet and not the customer experience. We’ve put customer experience before anything. If they go bust it doesn’t matter; we’ve got a waiting list of people wanting to come in. We’re not worried about whether it’s a one-, five- or 10-year lease; we’re worried about creating footfall. If we create footfall, we will have tenants knocking on our door.

NewRiver is driving retail regeneration and specialising in convenience-led community focus centres. Can you talk about that, Emma?

EM: We own and run 34 shopping centres around the UK and have a great understanding of towns throughout the UK. Many towns have lots of challenges and we have on occasions bought failing shopping centres in failing towns and turned them around. What’s important right at the start is the price you pay for the asset because you can’t turn anything around without investing in it and if you overpaid for it you are already in a downward spiral. If you have bought sensibly and modelled in re-basing of rents at lease expiry, it results in retailers running sustainable businesses in the stores they are in. The challenge is how the industry addresses capital value and property return declines and that has to be with public sector intervention. Without them being involved and having a vested interest in that town, a lot of towns will not survive. It has to be much more collaborative in terms of all different uses – resi, cultural and retail sitting cheek to jowl. We have repurposed a lot of space to become medical centres, libraries and leisure facilities.

How do you see commercial leases developing in the future, Alex?

AC: We have been working with many clients about having more flexible leases. The market is moving to a more standardised position, more balanced leases. But one size doesn’t fit all. It is possible to balance longer-term investor wishes with shorter occupational demand. The vibrancy of asset, tenant mix, asset manager – you need to look at that and get funders to focus on that and the income in the same way they would with hotels, so it’s not always the old model of having a 15-year lease to a department store. Leasehold reform would help. They are doing it on resi; they need to do it on commercial, too.

What has Argent Related learnt from King’s Cross, Anna?

AS: We have learnt a lot and are still learning. The message from King’s Cross is that people today yearn for a broader experience and wider sense of consumption.

By that I mean they want to learn, want friendship, want to be inspired by culture, want to feel good, healthy, want to feel part of something local and want to hang out in a space and sit in the sun with their family and friends. That broader sense of consumption and meaning is critical to how we should approach places and the content.

LISTEN TO EXPERT INSIGHTS

No comments yet