The coronavirus has led to a swathe of short-term lettings in the industrial market.

Occupiers have been looking for space to stash excess stock incoming from overseas, to distribute personal protective equipment and deal with a sudden surge of online sales. Last month, Property Week chief investigative reporter Mitchell Labiak chaired an online discussion with key figures in the UK’s industrial sector on how this sudden move to short-term leases has affected the market.

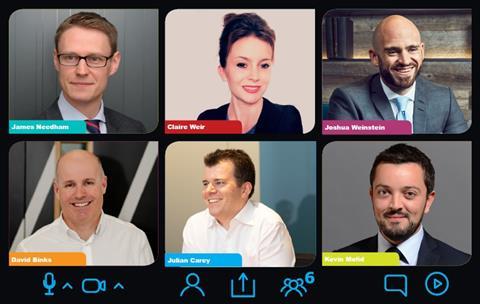

Panel of experts

- James Needham, partner, Shoosmiths

- Claire Weir, director, industrial and logistics project management, CBRE Building Consultancy

- Joshua Weinstein, structured property finance originator, Investec

- David Binks, senior director, leasing & markets, St Modwen Industrial & Logistics

- Julian Carey, managing director, Stenprop

- Kevin Mofid, head of industrial research, Savills

- Mitchell Labiak (chair), chief investigative reporter, Property Week

What will the move to shorter leases mean going forward?

Julian Carey: Most of our tenants are SME businesses and our average unit size is only 3,000 sq ft. So, we were already quite kind of indoctrinated into the world of short-term leases. In terms of changes during coronavirus, we probably feel, like most landlords, that you just need to be a little bit more open to short-term leases now than maybe you did before.

David Binks: Disruption like we’ve seen in the market over the past four months was always going to create different approaches to lease length. Only time will tell whether what we see in terms of the increase in short-term leases will actually stick or whether or not we’ll revert to the old ways of doing things. I think perhaps the jury’s out a little bit on whether in the short term these shorter leases will continue. We’ve been making sure our existing customers are staying with us, because they’ve got existing, viable businesses.

“During coronavirus…you just need to be a little bit more open to short-term leases”

Julian Carey

Kevin Mofid: There are two key parts to this. There’s the smaller, multi-let, urban logistics part of the market and there’s the big-box logistics part of the market as well. The idea of flexibility at the smaller end is not necessarily a new concept, so I think the biggest change potentially will be at the bigger end. Only 11% of the deals in the first half of 2020 have been short term. It isn’t a huge part of the market, but it is it is notable. Covid-19 has amplified trends that were already bubbling under. And that’s happening across the board in every sector.

Claire Weir: I think what Kevin said is really relevant: coronavirus is amplifying trends that were already out there. On demand for flexible space, we’ve been looking at that for some years now and seeing how that’s starting to really work for some occupiers. Landlords are adapting to be able to offer it. But I think it will probably be next year before we start to see what the real, long-term response will be in terms of how you provide flexible space occupiers can drop into quickly. It’s about the speed of getting a building ready for occupation and the cost of fitting it out. If you’ve got block stacking of fast-moving goods, it’s relatively cheap to move in. But if you need an expensive racking system, you are not likely to invest in that on a short lease arrangement.

Joshua Weinstein: The short-term nature of these leases does create a conundrum for the banks and their ability to find comfort with the underlying assets. Typically, we would base funding on looking at the covenant strength of the asset – whether there are five years remaining or 10 years remaining. You look at the covenants, you look at the operators, the track record and how much cash is in the deal. Short-term leases then create an issue for us: how do we underwrite the ability for the landlord to actually pay their interest?

Flipping the question on its head, how do you think occupiers’ attitudes towards lease length have changed as a result of coronavirus?

James Needham: During the past 20 years there’s been a pretty continual slide toward being more tenant friendly and tenant-focused about leases. I remember in the early 2000s arguing about things at great length that are now boilerplate. They’ve become so accepted in the market that they are now just standard.

“Understanding what customers need is what drives a landlord to providing flexibility or not providing flexibility”

David Binks

DB: Whatever landlords do going forward needs to be driven by what their customers are asking them to consider. Whether that’s a long lease for a million square foot building or a 12-month lease in a multi-let industrial estate, it’s all driven by what customers want and understanding what customers need. This is what drives a landlord to providing flexibility or not providing flexibility.

JW: I don’t think this is unique to logistics. It’s the same with office space and retail as well. Occupiers are looking to share a bit of the risk with landlords that view things very much as a partnership. I think it’s far more acute in the retail space than anywhere else at the moment.

CW: If you’ve got a requirement for a short-term lease, landlords are trying to respond to it, but the usual challenges come back to face you again and again: What’s the cost of getting in? What’s the speed of getting in? Is the space tenant-ready? Can an occupier operate out of a generic fit-out, if there is such a thing?

Do you think we’re seeing a long-term shift in the balance of power in the market away from landlords and towards occupiers?

CW: Occupiers certainly have a voice. From a building consultancy perspective, flexibility in building design is key. Covid-19 has tested the landlord-tenant relationship and shown that the output is a convergence of views; effective collaboration drives high-quality flexible space that benefits both.

KM: On shorter leases, the impact will be most relevant for second-hand, first-generation logistics buildings. Buildings developed in the late 1990s to early 2000s are coming to the market and that’s when the landlord has a decision to make. Do you strip out the fit-out? Do you refurbish? Do you knock down and start again? What this situation is potentially creating is a new market, a new demand, for those second-hand buildings. On build-to-suit, short-term leases is not the right way to go. On a speculative development, landlords will take a view on shorter leases depending on how long that building has been void for.

Finally, what will be the potential benefits and problems in a market where short-term leases become more normal?

JW: The biggest hurdle we face is the time it takes to generate the track record that gives the financiers comfort that short-term leases are a sustainable model. In the interim, there are ways to get the banks more comfortable. Whether that’s cross collateralisation, guarantees or loan leverage, there are mechanisms to do it.

DB: We absolutely see the benefits of looking at shorter leases. We want to put the right sort of structures around that activity to make sure it can be done quickly and achieve the right sort of rental premiums. It will accelerate the speed at which we lease space and shorten the time it takes to complete individual transactions. There are problems to doing all that, but we take the view that there are more benefits to be gained.

”Landlords and tenants working together will find a settled solution to [any changes due to coronavirus] because they have to”

James Needham

JN: The fact is, landlords need occupiers and vice versa. They have to work together in the same market to achieve something that suits both of them. So, if there is a drive in certain sectors towards more flexible space, I think landlords will respond to that. There are inevitably trade-offs associated with it. Landlords may expect something in return to move to more flexible leases. But if that’s where the market is driving people, that’s where they’ll go. Landlords and tenants working together will find a settled solution to it because they have to.

No comments yet