Earlier this year, Investec published research showing that 91% of investors think ‘blended living’ schemes that incorporate a combination of BTR, student accommodation, co-living, retirement living and/or serviced apartments will be commonplace in the UK within the next five years.

Last month, Yardi brought together a panel of residential experts to explore what makes a successful blended living scheme, the importance of good design and how tech can improve customer experience.

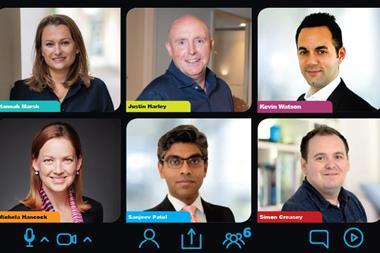

Panel of experts

- Christian Armstrong, director of brand, product and technology, Get Living

- Mark Bladon, director, Investec

- Georgie Drewery, account executive, Yardi Systems

- Félicie Krikler, architect and director, Assael Architecture

- Beth West, head of development management, Landsec

- Simon Creasey (chair), consulting editor/features, Property Week

Blended living schemes are already commonplace in the US – why do you think they haven’t yet really gained traction in the UK?

Bladon: For a number of reasons. If you look at the most developed of those sectors in the UK, it would probably be purpose-built student accommodation and that’s only been going in one form or another in a meaningful way for about 10 years. In the US, the investor market for this type of product is much more mature. Also, the BTR market in the UK had a lot of false starts between 2000 and, say, 2010 where people were just not able to get developments off the ground, but that’s all changed now. People have taken a bit of a leap of faith and there is now trading product, so you can benchmark yields and you can look at it on a cashflow basis. So what we’ve seen is people that have been in a very specific ‘beds for rent’ sector have realised that they can leverage off their existing operational platform, off their infrastructure, off the location – there’s so many things they can now do to broaden their horizon.

What are the key ingredients that you need to make a blended living scheme work for all residents, particularly in terms of things like amenities provision?

Armstrong: Amenities are really important but you have to think ahead, do some research and speak to your existing residents and prospective residents about what amenities they would actually use. I’ve seen some stunning stuff on schemes like barbecue terraces and outdoor terraces and then it hits me that we live in the UK – this is not the US. So I’m going to be sitting there with my cappuccino on the outdoor terrace with the froth blowing off!

Bladon: That’s where the skill comes in. These schemes still have to make a profit, so you can’t just keep pouring money in. Somebody described it as an ‘amenities arms race’. They’re almost turning student accommodation into hotels and then they’re charging students £350 a week. As a result, you might end up with a half-empty property. The most successful operators are going to be the ones that can find the right balance.

West: That’s why I think we haven’t reached that maturity point yet – this amenities arms race is a very immature reaction to what people think is a single market and a single customer for this product, but there are loads of people who want this product. If we’re going to build housing that attracts a broad range of different people staying for a long time then we have to think about offering a variety of different affordability points.

Bladon: I think there’s another issue that lends itself to a blended portfolio and that’s the power of building a brand that can be used across the whole lifecycle of your tenant. So you start with your student, then co-living, then they get into their mid-20s and they want to move into BTR. That [BTR] can take them from being single, to married with children and living in a three-bed, all the way up to potentially the age of 60, when they might move into retirement living and then on to the full care home before finally off to better places. I really can see some smarter, more visionary developer/ operators saying: “I’ve got my tenant when they’re 18 – why am I letting them move to other operators or other projects when I should be keeping them for life?”

Drewery: You have to ask: who is tomorrow’s customer? And I actually think that it’s yesterday’s student, like you mentioned. You’re only going to retain that customer with excellent customer service, well-located buildings, a great amenity offering and events space etc. If customers are going to be spending more money [on a blended living product] than they would on a normal residential letting property, they want to feel like they’re getting value for money.

How big a role does design play in the creation of blended living schemes?

Armstrong: A big role. I sometimes think design is underestimated. We have a team who works tirelessly years in advance before the scheme opens its doors to try and think about how that space will be used.

Krikler: The really important thing is to design the framework of a scheme. The infrastructure has to be there and then it’s about the management of the operation, and that has to be able to evolve over time. A scheme we designed for Essential Living in Greenwich has got one building with smaller units and then another building with two and three-bedroom apartments for families. Is it possible for developers to build flexibility into their schemes so that they change the balance between student accommodation, BTR and co-living in response to market demands?

West: I don’t think the planning policies have really caught up to the market yet. When the GLA talks about the private rental sector it’s all about rogue landlords and none of us are rogue landlords. We’re long-term investors and we’re offering a very different product than somebody who is buying a flat and then renting it out to someone. Policies need to adapt to deal with this growing product.

Krikler: Planning is the big hurdle. For example, the later-living sector is C2 class, but the criteria is applied differently from local authority to local authority.

How can technology help to manage the customer experience and the ongoing relationship between the operator of the blended living scheme and its residents?

Armstrong: Over the last year or two technology has emerged as a real way to engage with customers. We use the platforms we’ve got [like Yardi] to push out messages about events via our app and a lot of people engage with that. We also use the hotspot data from our wifi platform to find out where people congregate the most and then we use this information to determine where to host events within our buildings. As long as you’re really upfront and transparent with your customers, you can use technology to see how people are using and experiencing buildings.

Drewery: Something we’re working on at the moment is self-guided tours. So we’re looking at integration with Alexa to allow a potential customer to get access to a building when it’s convenient for them and then essentially you interact with Alexa and she will maybe explain the finishes of the apartment to you, tell you what’s in the neighbourhood and what amenity provision there is within that building. Everything can be from one platform and you can allow them to be self-sufficient to apply online. Allow them to choose whether they are a student or a traditional build-torent tenant. You might be offering corporate and short time lets as well. To be able to change the workflow in the background, dependent on who the resident is, is really important.

What’s going to accelerate the growth of blended living schemes in the UK?

Bladon: As we see BTR achieve the potential and scale that we all think it will, I think that it will inevitably overtake student accommodation and at that point you’ve got two very major sectors. I also think co-living is really becoming more of a meaningful bridge between those two. So straight away you’ve got three sectors right there. The other thing we put in our blended living report earlier this year is that investors are getting more savvy to the benefit of having a blended portfolio at slightly different yields and at slightly different risks. So at the moment you’ve probably got BTR at 3.5% to 4% and then at the other end of the scale retirement living/care homes at maybe 6%-plus. They’re probably being backed by two different types of investors at the moment and I think the more successful funds will be those that are able to demonstrate the defensive attributes of having a blended portfolio as we go through different economic cycles.

Armstrong: I think you could add coworking to the list of potential components of a blended living scheme. In the States, a lot of the multifamily and BTR equivalents have already added co-working to their offer because of its stickiness – why would a customer leave [a scheme] when they have everything they need in the building? When I entered the industry three years ago you didn’t have the technology platform that could track outputs, but now we can demonstrate returns and say to investors that, based on the data, coworking works and co-living will give you a return.

West: Data is going to be really important. So the longer you operate East Village [Get Living’s BTR scheme at Olympic Park in east London], the more data you’re going to have, which means you’re going to be able to see things like how full you are and how long your voids are. I think that will provide clarity to investors about where the yields should be. Some planning certainty around how this [blended living developments] is going to be looked at by local authorities would also help accelerate growth.

No comments yet