I never could have imagined, following the great celebration of the opening of the new OMERS office at The Leadenhall Building that I wrote about in April, that my next Property Week column would be written shortly after the vote to leave the EU.

Equally nor could I believe that I would be attending my first meeting as chair of the British Property Federation (BPF) Policy Committee on Tuesday afternoon.

Over the past two weeks we have all been watching with astonishment as the impact of this decision plays out in financial markets, at the EU member country summits and within the political parties of the UK. And if readers’ experiences are anything like mine, this has been the main topic discussed at board meetings, at industry association events, at local pubs and around the dinner table with family.

The two days before the vote, I was actually in Liverpool speaking on a BPF panel at the International Festival of Business, where representatives from more than 30 countries gathered to talk about opportunities to expand business relationships in the ever-increasing global marketplace.

Although I think we had all become increasingly nervous about what the polls were telling us in the week leading up to the vote, there was still a hope there would at least be a narrow ‘stay’ outcome, and this close call would encourage ongoing discussions about how to improve the way in which globalisation was happening and the institutions governing it, whether at home, in the EU or beyond.

What I learned, however, in talking with many people, was that the vote was not actually about the EU (as we all have seen, the most frequently ‘Googled’ phrase the day after the vote was ‘what is the EU?’). Rather it appears to have been more about the increasing divide between countries, regions, cities and demographic groups and the complete lack of trust in most of our elected officials to understand this.

Just to be clear, I am under no illusion about how difficult this is and I have a lot of respect for anyone who is prepared to stand for public office for the right reasons. Regardless of one’s political persuasion, it is hard to not want more Jo Coxs (hopefully in time there will be a positive legacy to her tragic death) and fewer Boris Johnsons or Nigel Farages. I am afraid, however, that this may just be the beginning and we will continue to see disruptive results from elections around the world for some time, until we address the issues leading to these divides.

Implications for real estate

So what does this mean for real estate? We have all seen the immediate impact on share prices of publicly listed REITs. We have also seen deals that had conditional contracts dropped post-vote because people are just too uncertain about how this is going to play out.

When we were facing the Scotland referendum in the UK last year, I wrote about the second Quebec referendum in Canada in the mid-1990s.

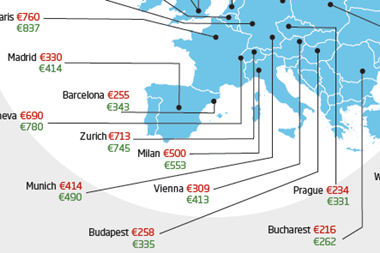

A narrow ‘remain’ vote was unfortunately enough to force many companies to move their offices and people from Montreal to Toronto (a trend that has left Montreal behind ever since) and led to financial market disruption as the Canadian dollar dropped to as low as US$0.63 for a period of time. London and Paris are not Toronto and Montreal, and I am confident (or at least hopeful) there will not be this sort of dramatic shift and consequence, but it is an interesting parallel.

In terms of transaction volume and pricing, I anticipate that we will see a widening bid-ask spread and fewer transactions, at least for a while. Having said this, capital may see real estate in major global markets to be a safer alternative to volatility in the public markets. Global capital must still invest and, although it feels a little early, there are already groups thinking this change may result in lower prices or at least fewer participants and are looking to take advantage of this situation.

Investors where the UK and Europe represents only part of their portfolio are thankful for diversification, but the global economic system has continued to function. Our industry is better capitalised following 2008 and business decisions leading to letting, construction and refinancing are being made even with this uncertain backdrop.

Going forward, I think this is another example of the merits of our industry being very close to government through associations such as the BPF. We must be sure to understand what key policy changes may be under review that could affect us.

The sun has come up every day since the vote - although there have been a lot of clouds and some heavy rain. I am encouraged to see the calm, patient, balanced and thoughtful responses of leaders in our industry and some areas of politics, including the new London mayor, the chancellor and the governor of the Bank of England, who recognise the importance of focusing on the job at hand and of stabilising markets while taking the appropriate amount of time to work through a sensible, well-thought-out plan.

I am hopeful we will see the same in the political arena shortly and that people will start to address what is at the root cause rather than simply pursue their short-term

political ambitions.

Paul Brundage is executive vice-president and senior managing director - Europe for Oxford Properties, and the new vice-president of the BPF

No comments yet