Despite Brexit referendum jitters, the property sector in the UK - and, to a lesser extent, continental Europe - has mainly recovered from the dark days of the immediate aftermath of the financial crash.

So it might be thought that few opportunities remain to profit from distressed property assets across Europe. But this is not the case.

In the UK, it was reported last year that UK Asset Resolution (UKAR), which at the end of 2014 had assets of £70.5bn, according to Cushman & Wakefield, would take more than a decade to wind down. And while Lloyds and RBS, which set up internal bad banks, have sold most of their property assets, many of the large global funds that rushed in to buy them are now looking to exit. In continental Europe, there are still substantial assets yet to come to the market.

In Italy, for example, a deal with the EU was reached only at the end of January this year to speed up banks’ sales of large portfolios of non-performing loans - totalling an estimated €360bn (£275bn) - to private investors by offering a government guarantee.

Significant opportunities remain in Italy as it begins to turn itself around; the challenge is getting the pricing right, as the values provided often fail to reflect a realistic investment duration and the risk associated with the economic uncertainty of this location. In Spain, the government created SAREB to ring-fence poorly performing assets, while in the Netherlands, Propertize was created to perform a similar function.

Substantial assets

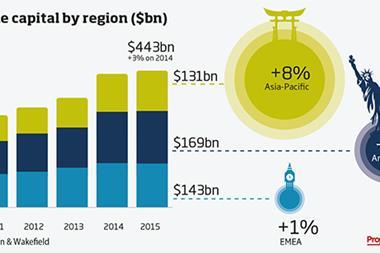

Across Europe, such asset management bodies have substantial assets remaining with commercial and residential mortgage debt set against property standing at €233bn, according to a report by Cushman & Wakefield published last year. This figure included the remaining assets of the Irish National Asset Management Agency (NAMA), which has been quicker out of the blocks in asset disposal than its continental European counterparts.

Even when larger portfolios with more obvious investor value have been picked up, there are always opportunities for those prepared to take a granular approach to investment. The opportunity might arise with an owner that does not have the vision, expertise or financial resources to bring a project to fruition. It might also be a case of reworking the capital structure of a project crippled by historical debt.

To realise the potential of distressed property assets requires hard work and an almost forensic level of analysis. At Patron, we look at the detail and have a vision - for example, to re-examine the marketing strategy; reposition a property through a refurbishment programme; or transform an asset by changing its use.

We have demonstrated this on numerous occasions, for instance by acquiring underperforming

office buildings to transform into hostels for our Generator business or buying good underlying businesses such as CALA Homes and providing them with renewed firepower for growth.

To deliver investor returns from distressed assets, you need to have the right skills, and if you don’t, you need to partner with other bodies that do. This can transform a project from what might appear on the surface an unlikely prospect. Having local knowledge and the right network of contacts is an essential ingredient for success, and our in-house development team helps us to analyse quickly the possibilities that could be unlocked through refurbishment and how viable such a route would be.

Testing times

Certainly the macro market is challenging: quantitative easing is no longer having the effect it once did and economic growth is not strong. The uncertainty around Brexit is causing stalling among the huge piles of capital looking for a home, which are likely either to buy into cheap currency if we vote to leave, or continue to invest in property if our stable position as part of the EU is confirmed.

Whatever happens, the European Central Bank is likely to have to increase or at least continue monetary support for growth in the next two quarters, with rates staying low to deal with the fragility of the system. The greatest risk is political, with the continued growth of the historical fringe parties and their impact on government policy such as immigration affecting the economy at the macro level and revised taxation having an impact at the property level.

For those who look beyond the obvious and have the right armoury of expertise and contacts, there are still great opportunities to be found from distressed property assets in the UK as well as continental Europe - as market dynamics change, they are simply getting that little bit harder to find.

Keith Breslauer is managing director of Patron Capital

No comments yet