The industrial property sector was one of the big winners in 2016. It comfortably outperformed retail and offices, underlining its resilience during what was a period of wider market uncertainty.

With high levels of demand for good-quality, well-located assets and a constrained supply pipeline, the fundamentals underpinning attractive returns in this sector remain positive moving into 2017.

A big part of this story is the growth of online retail. Data from Eurostat indicates that 87% of UK internet users made an online purchase in 2016, as consumers increasingly enjoy the benefits of greater choice, convenience and certainty of delivery that online shopping brings.

Operators are moving quickly to make sure they have the right space to accommodate this transition and, according to data from JLL, retailer take-up in 2016 surged to nearly 14m sq ft, or 58% of total transactions.

Mature market participants are not standing still; Amazon, for example, remains the most active player in the market, taking around 9m sq ft last year.

But online is not the only driver of the market - while investors have been primarily focused on distribution warehouses, the smaller multi-let assets offer a very good proposition as well. A side effect of the internet boom has been that competition for multi-let industrial units has become even more pronounced, with pure-play industrial, trade and business-to-business logistics operators having less of a choice about where to locate.

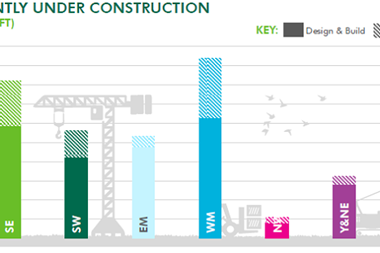

This trend is exacerbated by current low levels of speculative development - especially in the South East - as developers face strong competition from alternative uses, most notably residential. This has, in turn, created opportunities in the market for those willing to undertake asset management on slightly older multi-let industrial assets.

A side effect of the internet boom has been that competition for multi-let industrial units has become even more pronounced

In 2016, UBS Asset Management’s Real Estate UK business undertook several initiatives across the portfolio of our flagship core property fund, UBS Triton Property Fund.

On the back of these initiatives, new lettings were completed across the portfolio. However, none of the incoming tenants were retail or third-party logistics occupiers and the deals delivered an average uplift of 40% on passing rents.

There is currently just one vacant unit across the entire portfolio and units have generally been re-geared or re-let within a very short timeframe with minimal incentives.

Upbeat for 2017

Moving into 2017, UBS Triton has placed industrial at the heart of its strategy, focusing on multi-let industrial estates with good infrastructure connections and locations near major conurbations. The fund is now overweight industrial, which constitutes around 30% of holdings, of which 75% are located in London and the South East.

We remain upbeat about the prospects for industrial, but with the sector becoming increasingly sought after, assets coming to market are generally selling considerably above asking price. Record levels of pricing - especially in the South East - may limit further acquisitions.

So what does 2017 have in store for multi-let industrial? Our view is that, despite a sharp increase in pricing, the cycle has further to run yet. While we’re expecting the strong inward yield shift of recent years to abate slightly, the balance of supply and demand is very much in the landlord’s favour, which should prove supportive of the strong rental growth the sector has been able to capture.

We are confident that strong, broad-based tenant demand combined with a relatively muted supply response should ensure 2017 is another good year for UK industrial.

No comments yet