Think back to 2009, when London first raised its head above the global real estate parapet.

The immediate reaction was negative. We had activity, we had re-correction, we had the preliminary signs of the safest of real estate havens in 2009-10, and how did the industry respond?

Mainly by moaning that the country was being sold to wealthy foreigners who would keep their piece of London forever. The news spread beyond the real estate world, even reaching the pages of the Daily Mail.

Well, guess what, international investors do sell as well as acquire - they are doing so at the moment and we expect them to continue.

Whether SWFs, pension funds, family offices or private investors, international investors are beholden to market conditions and strategy shifts, just like the rest of us.

In each of the past six years, 65%-70% of investment turnover in London has been from international investors.

The overused phrase ‘trophy asset’ is a business commodity. A London office bought over the past few years is still viewed by some as ‘gold with a dividend’, but it is not sacrosanct. This year will see ongoing divestment by international owners as they transact with other global investors.

This trend will only gather momentum as the cycle continues to evolve. We are meeting new investors every week from Turkey, Italy, Qatar, Singapore, Hong Kong and North America. This is likely to see the continuation of more joint ventures.

As the market cycle evolves, so the presence of international investors in our regional markets is growing. News this month that CPPIB has acquired a landmark joint venture in the Paradise development in Birmingham, in an extension of its regional JV at Wellington Place in Leeds, is a testament to the success of the ‘northern powerhouse’.

Demand for regional diversification from investors from all over the globe has momentum. The newly announced daily flight from Qatar to Birmingham is yet another step in the globalisation of UK plc.

Having spent time in 14 countries in the course of work meetings during February and March, and having met 110 investors, it’s clear to me that the demand for UK real estate is as high as it has been in this cycle.

Mipim tried to physically dampen this enthusiasm, but from an international perspective, sentiment was strong and very focused on the UK market. Brexit may define 2016 as the year of ‘two halves’ in terms of the UK property market, but confidence and demand are currently very visible.

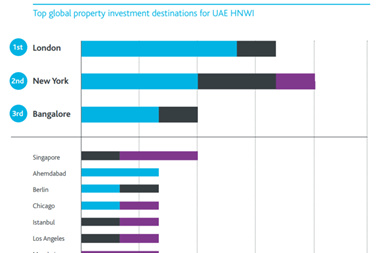

Our recent investor intentions survey showed that London remains the number one global real estate market - 82% of investors will commit the same capital if not more than they did in 2015. This shows great confidence in real estate, and displays the ongoing drive towards growth in real assets. Notable changes include the 21% increase in global investor demand for retail and the change in risk appetite for less risky assets.

Low-risk assets are currently the most popular. To put figures in context, $874bn (£607bn) was invested in 2015.

Our survey respondents (of which there were more than 1,250) implied increased allocations of 6%, thus a predictive out-turn of $929bn. Spend is 47%, considerably lower than the peak of 2007 when debt levels exceeded 75% on annual capital commitment.

What a fascinating and electric marketplace this tiny island produces within the global real estate market.

Chris Brett is head of international capital markets UK at CBRE

No comments yet