SMEs are the lifeblood of the economy, employing 60% of all private sector workers and turning over £1.8trn a year – and they are on the up.

In 2000, there were 3.5 million SMEs in the UK; by 2016 there were 5.5 million – growth that was driven by enhanced communication technologies that allow a large number of small companies to do the job of what was once the preserve of the large corporate.

Multi-let industrial (MLI) is the home of SMEs. Unlike other sectors, MLI is generic and adaptable in nature, so while the units still look like they always did on the outside, inside things are very different.

The days of estates being dominated by manufacturing and mechanical processes are gone. Today it’s all about businesses that are internet driven and looking for flexible accommodation close to their markets. We have already experienced 159% growth in our potential tenant base in the past 15 years, and that’s before you take into account all the new occupiers that have entered the sector, unshackled from their previous premises by the internet and now seeking affordable and flexible ‘back of house’ space to operate from and support their online ‘shop front’.

Examples of these types of occupier are Deliveroo, which is looking for a portfolio of 3,000 sq ft units for ‘dark kitchens’ to bolster its supplier capacity, and our tenant Prodoto, which uses its 25,000 sq ft unit as a photography studio where it produces industrial quantities of images for ecommerce sites.

These companies are drawn to MLI by the flexible space, ample parking, connectivity and proximity to town centres and customers.

“Companies are drawn to MLI by the flexible space, ample parking, connectivity and proximity to town centres”

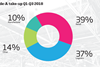

Gerald Eve’s Multi-Let report, which was published in July and is the most detailed study of the sector in years, highlights a number of fascinating trends, but I was most drawn to the statistics about the logistics sector in relation to the MLI market.

Find out more - Industrial portfolio sales soar but total volumes set to slide

The perceived wisdom is that logistics tenants are the holy grail for landlords due to the underlying growth in demand from such tenants, their long leases and strong covenants. This is completely the wrong way to look at the market.

The report shows that, while logistics companies are the least likely tenant type to default on their leases, they actually take the shortest leases, take buildings at the most competitive rents (despite their short leases) and get the biggest incentives and they are the most likely to leave at lease expiry or break.

This last point is interesting. In part, the retention rate of logistics tenants appears to be particularly low when their lease expires because the contracts that they are servicing come to an end. But there is also a strong correlation between retention rates and the cost of the fit-out of units. Logistics operators in the MLI space actually have relatively cheap fit-outs, while high-tech engineers or food manufacturers, which have higher-cost fit-outs, are the most likely to be retained by the landlord.

Trade counters and wholesalers are also more likely to stay put when their leases expire.

It seems clear that landlords are doing soft deals with logistics companies – usually with well-known, international brands – for yield reasons, when the underlying income is actually inferior to that provided by other tenant types.

So while logistics is a great addition to the plethora of new entrants into the arena, last mile is certainly not the last word in multi-let industrial.

Julian Carey is executive property director at Stenprop

Industrial and logistics: investors and occupiers continue to pile in

- 1

- 2

- 3

- 4

- 5

- 6

- 7

Currently reading

Currently readingLast mile is not the last word in multi-let

- 8

- 9

- 10

- 11

- 12

- 13

- 14

No comments yet