The biggest shopping day of the year is almost here and no one on the high street is particularly looking forward to it.

Black Friday will take place on 25 November, with consumers poised to spend £2.9bn over the weekend, up 38% on last year according to PwC.

But more than a third of adults say they have no interest in Black Friday while two-thirds of retailers feel it puts a strain on their operations and is unprofitable. The event is a microcosm of the trends within the retail industry and this year will demonstrate that online retailers – led by Amazon – have made worrying strides away from the high street.

Black Friday, if you don’t know already, originates from the US, where retailers cut the prices of their products on the day after Thanksgiving in an attempt to get consumers back into their shops. The event was brought over to the UK by Amazon in 2010.

Two years ago, Black Friday demonstrated the continuing appeal of physical stores and the high streets as shoppers rushed – and at times fought – to get their hands on the best deals in supermarkets, shopping centres and the high street. But last year shoppers, wary of the chaos of previous years, chose to make their purchases on their tablet from the comfort of their sofa or on their smartphones on the way into work.

Shops that opened early anticipating a rush of bargain hunters were greeted with short queues. Online is expected to dominate again in 2016, with PwC’s research finding that 77% of shoppers plan to make their purchases through the internet.

Two-tier festive season

Despite the glut of adverts promoting Black Friday, most retail bosses are dreading the day and the period surrounding it. Previous years show that Black Friday does not generate extra sales in the run-up to Christmas, it simply brings sales forward and encourages people to buy their presents at a discount rather than full price.

It has led to a two-tier festive season, with a spending rush around Black Friday and then another in the week before Christmas. This concentration of spending and dash for a discount not only puts pressure on websites and distribution centres, but also destroys profit margins. British retailers are putting themselves through this torture because they know that if they don’t offer Black Friday deals, others – notably Amazon – still will.

Slightly under the radar, Amazon has dramatically developed its customer offer over the last year. While high street retailers have been celebrating click-and-collect as a way to compete with online-only rivals – and collecting orders from your local shop is still attractive at times – Amazon has invested heavily in customer services.

Key initiatives that it has introduced are one-hour delivery, grocery shopping, a music streaming service and the voice-controlled Echo speaker. All this is aimed at making Amazon a one-stop shop for customers and improving loyalty, with the Prime membership scheme the backbone of this.

Jeff Bezos doesn’t just want you to buy something from Amazon, he wants you to buy everything. The Echo allows households to control the lighting in their homes, play music and order your shopping – from Amazon of course – all just by talking.

Amazon is expecting its biggest-ever day of trading on 25 November. According to IMRG, online retail sales in the UK are running nearly 40% ahead of forecasts at the start of the year.

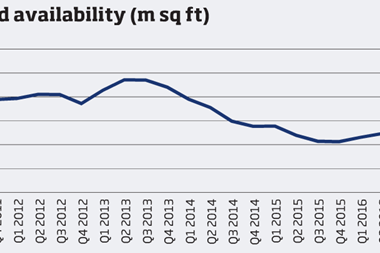

The growth in online sales has slowed in the last two years, but 2016 is on course for another acceleration. The online revolution has gone up another gear and bricks and mortar shops are inevitably losing sales because of it.

Shops would be wise to stick to what they are strong at and reconsider how much they want to be involved in Black Friday.

No comments yet