In my article for Property Week on 10 January, I concluded that given the outperformance by global equities and real estate in 2013, it was unlikely that the level of returns could be sustained into 2014.

This has been the case for the capital markets, with the FTSE 100 and the FTSE 350 generating total returns of just 0.12% and 0.13% respectively. In contrast, the UK-quoted real estate sector is set to outperform the wider UK equity markets for the second year in a row, albeit at a lower rate than 2013. So far, the FTSE 350 Real Estate Index has returned 7.82%.

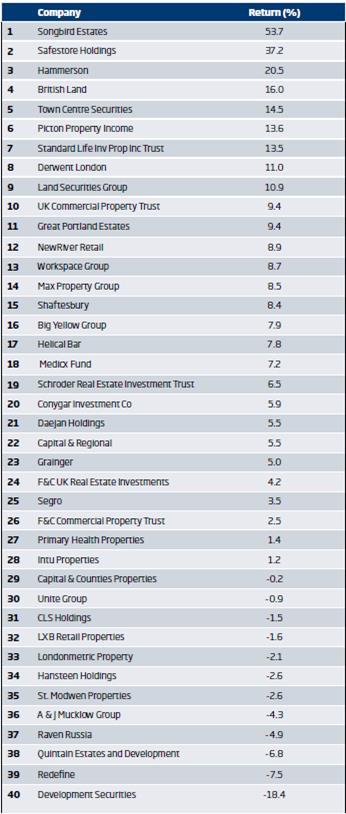

From the analysis of the 40 largest quoted property companies that represent most of the UK-quoted real estate sector (see table), it is clear that the large cap companies have marched back into the lead in the first six months of 2014. Six out of the top 10 performing companies are large cap. In 2013, not one large cap company even reached the top 10.

Unlike 2013, when only one company delivered a negative return, so far this year just over 25% are in negative territory.Nearly half those companies that have recorded a negative return so far this year were in the top 10 performers of 2013, while seven of the top 10 over the same time period were in the bottom quartile in 2013.

Congratulations to Hammerson, closely followed by British Land, for delivering the most improved performances in the first six months of 2014. So far, my firm NewRiver Retail and SEGRO are the most stable in the performance league table — perhaps a reflection of the sector specialisation of both companies and their focus on income.

Forward thinking

I believe the UK quoted real estate sector will continue to outperform the wider equity markets and this will continue into 2015. The capital markets are debating the future direction of interest rates, but UK commercial real estate is almost in a win-win situation, irrespective of any change in interest rates.

One suggestion is that interest rates will remain low for the next five years. PIMCO, a NewRiver Retail shareholder and joint venture partner, describes this as the “new normal”. It argues that there is still a huge amount of debt in the global system that could not sustain a meaningful increase in interest rates and that the global economy is not growing fast enough to allow a natural deleveraging to take place. In that scenario, PIMCO’s view is that cash will return 0%, bonds 3% and equities circa 5%.

There are two positive outcomes flowing from the PIMCO scenario for those real estate companies with sizeable portfolios. First, in a low-return environment, the income characteristics of commercial real estate will be in higher demand and, secondly, global investors will need to get used to lower returns. Both these dynamics suggest upward movements on portfolio valuations.

The other school of thought is that interest rates will rise. In that event, the UK-quoted real estate companies should benefit and especially those that are conservatively geared, such as the large caps and NewRiver Retail. Rising interest rates suggest increased economic activity, which should feed rental and capital growth.

Research from Morgan Stanley suggests that UK real estate stocks’ performance relative to UK equity markets is positively correlated to movement in interest rates.

From 2014 onwards there will be divergence in performance between quoted real estate companies. As in 2013, when the divergence was from -9% to +83%, the first six months of this year already show significant divergence of -18.4% to +53.7%.

Those real estate companies that are sector specialists and income-focussed with prudent borrowings will provide consistent outperformance. NewRiver Retail is determined to be one of those companies.

Allan Lockhart is property director of NewRiver Retail

No comments yet