This year may have ushered in unprecedented change, but it is 2017 that is set to be the truly turbulent year for business.

June’s vote to leave the EU has brought with it uncertainty, economic change and a new government and now, the same government that is vying for renewed global confidence is simultaneously planning to hit businesses on its home turf with increased business rates.

London’s economy is vital to Britain’s success. The capital’s businesses work in partnership with suppliers throughout the UK and the prosperous ones also invest in other parts of Britain.

The millions of international tourists attracted to Britain by London visit and spend widely across the UK. Moreover, as a net contributor to the public finances, tax generated in London is spent all over the country by the government for the benefit of the whole UK.

The fact that businesses across much of London are now faced with a significant business rates rise will have a negative impact on both employment and investment opportunities.

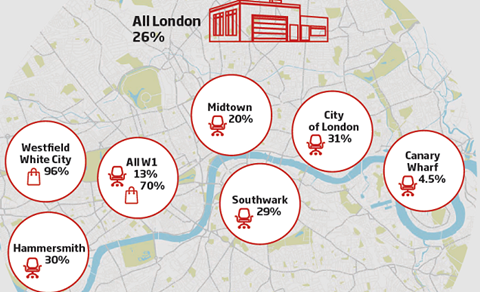

West End businesses in particular will be facing an average increase of 80% a year in their rateable value, affecting small businesses and international brands alike. On Oxford Street, for example, businesses are estimated to be facing a 56% average rise in rates.

Across the West End, retailers will need to generate an additional £2.5bn in annual sales to recover these costs. This 80% increase in rateable value since the last revaluation does not reflect business performance - West End retailers have seen sales increase by only 30% in that period.

Some may argue that the West End will always be hot property, and with the recent sales uplift from the weakening pound, retailers can afford the rises. But the truth is, this sales uplift is marginal, short-term and in single digits. It will not compensate for next April’s huge rates increases.

Changes after Article 50

The government’s preferred option of setting the transitional relief rate at 45% - which will actually be more than 50% when other business rate factors are added in - requires mitigating measures. London’s ability to prosper will be under real threat otherwise.

The government wants to impose an outdated tax on an industry constantly modernising. We urge it instead to implement a system that is more fluid and reacts to changes in the economic climate - which will become even more likely when Article 50 is triggered by the end of March.

It is inevitable that business rates will increase next April. However, I still maintain that the government should consider two key proposals to help ease their impact.

Firstly, we want to see the transitional relief scheme that has been applied in every previous revaluation to help businesses prepare for the increase. The six months’ notice that we have been given to plan for a 50% increase is just not realistic.

Secondly, we want the government to review on a district-by-district basis measures that can help businesses generate additional turnover to pay for these costs.

A West End-specific example would be extending Sunday trading hours in the International Shopping Centres designated in the mayor’s latest London Plan. Additionally, this would include support for the West End Partnership’s request to retain just 2% of its business rates in a TIF scheme to part-fund infrastructure improvements necessary to prepare for the opening of the Elizabeth Line.

But in the longer term, we need the government to admit that this outdated system is no longer fit for purpose. In a world where online retailers threaten to pull ahead of the pack, but do not have the same rate bills as high-street retailers, we need a review of business taxation to make it fair for all. We need a system that enables us to maintain London and the UK’s position on the global stage.

Sir Peter Rogers is chairman of the New West End Company

No comments yet