CoreNet Global’s membership is largely made up of, and indeed exists to serve, corporate occupiers.

A new accounting standard, IFRS 17, is being introduced for December 2018-January 2019, which affects how corporates account for real estate and could fundamentally change how we perceive leases. This article examines what it really means and how occupiers and the property industry might need to react.

Currently, operating leases that represent 99% of all property leases do not appear on the balance sheet. Other than spreading the rent free, which we regularly see, we don’t have to delve too much deeper into the accounting world for operating property.

A company could sign a 25-year lease on CPI uplifts with no balance-sheet impact – from an investor’s perspective there is very little transparency of the liabilities under this lease.

Therefore, it is not difficult to understand why the International Accounting Standards Board (IASB) would want to put operating leases onto the balance sheet. It recognises that operating leases are the most common form of off-balance-sheet financing and provides investors with transparency of a company’s liabilities, enabling them to compare on a like-for-like basis.

The method of adding these liabilities to the balance sheet has been hotly contested, but now, as we near implementation, there is a good degree of certainty about the content of IFRS 17.

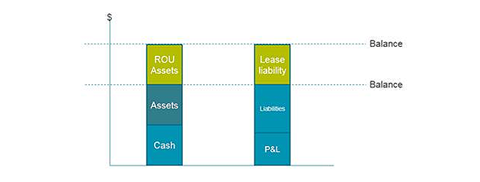

To avoid a considerable profit-and-loss (P&L) hit on day one of a new lease, there will be a right-of-use (ROU) asset added to the balance sheet to match the lease liability. This will be calculated as the net present value (NPV) of the lease payments over the duration of the term of proposed occupation, at the current incremental borrowing rate, which represents the costs of capital, for the company in question. There is a nuance here. Rather than lease expiry or earliest break, there is a drafted requirement to measure liability to the earliest date that a company would reasonably exit, which is likely to be a hotly debated topic with auditors.

The key effect of this is an increase in the size of the balance sheet. For every £1 spent on a 10-year lease, £7 will go on the balance sheet for a typical corporate, compared with £0 as it currently stands.

Those that control US generally accepted accounting principles (GAAP) (Financial Accounting Standards Board, or FASB) and IFRS (IASB) have disagreed on how these assets and liabilities will be structured.

The FASB feels that a distinction between property and non-property leases is required. In its proposed standard, the ROU asset depreciates at the same rate as the relevant liability for property leases. While the lease is ‘on balance sheet’, the structure is more akin to the traditional operating lease in terms of P&L impact.

The IASB recommends one single definition of a lease for all assets, the same structure currently applied to a traditional finance lease. This has a P&L impact, with a front loading of P&L charge on the accounts in the first part of the lease.

Alongside the accounting implications, there are questions about the interpretations by ratings agencies, and the skeletons in the closet in terms of unexpectedly high lease liabilities.

So what does this mean for real estate?

Here are our predictions:

- Shorter lease terms to reduce the liability on the balance sheet. However, the lease is related to the total reasonable-use period, not the lease term.

- For some occupiers, there may now be an incentive to own real estate rather than lease it.

- Under the IFRS, all leases will effectively now become finance leases, so options to buy may now become more common, as will finance lease structures.

- More emphasis on NPV and cash; paradoxically we anticipate complexities around lease accounting might drive more cash-based decisions.

- Exacerbation of the landlord/tenant dichotomy – a landlord education process is needed so they understand occupiers’ new challenges.

- Under the IFRS, more revenue-/profit-based leases to keep liabilities off balance sheet, as these are excluded from the new accounting standard.

- Sale-and-leasebacks will still happen to meet operational objectives and raise cash, but their impact will be more closely scrutinised by the accounts team.

- For banking and insurance companies, the new standard will have an impact on their calculation of regulatory capital, which may result in a move to shorter leases or freehold ownership.

The biggest practical change, though, is that lease administration will become fundamental to company accounts, bringing an additional cost burden of calculation and data maintenance, especially for variable leases. Property teams and their finance colleagues will have to work more closely than ever to submit auditable accounts. Occupiers need to be prepared and the industry needs to be on hand to help.

James Maddock is president of CoreNet Global’s UK Chapter and international director at DTZ

No comments yet