Why do we do the things we do? In a world that is changing rapidly, with technological inventions constantly challenging our assumptions, why does the property industry remain in its own silo? Most importantly, why do we think our industry is not going to have its own ‘Uber’ moment?

This mindset needs to change. Rather than cower behind traditional practices until technology turns the sector on its head, we must use emerging tools to improve our services and add value for clients.

We’re at an uncertain time in the property cycle and, as always, we are relying on our knowledge of previous cycles to work out how to act. Whenever we get to the bottom of a cycle, people start talking about adding value to make assets work. In reality, they wait for the market to change and for yields to compress sufficiently.

This time, it’s different. Yields are already compressed - there’s nowhere for them to go. It’s becoming evident that those holding assets are less inclined to sell and those with cash to deploy are lowering their own hurdles.

In a world where interest rates are around 0% and there is limited growth, the property you own and what you do with it has never been more critical. The questions have become how to sweat assets to really add value for clients and how to deploy capital where it is most likely to create growth.

So where do we turn? The word ‘proptech’ has been bandied around for years and we’re yet to see any real innovations hit the commercial property market. I would argue that the single largest tool at our fingertips is big data.

A new initiative

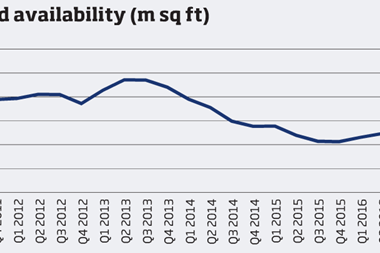

Property people already use data. We all gather huge amounts of information around location, supply, historic demand and market values and chart potential take-up. We need to ask whether these are the right measures. There is so much information in the world: what else can we use to our advantage?

Lambert Smith Hampton has launched its Knowledge Network, a partnership with predictive analytics firm Black Swan, to find out. Black Swan uses any data available to identify socio-economic trends and patterns in consumer behaviour that could have an impact.

We can overlay conventional property data with these metrics to create a more laudable strategy for clients’ assets. For example, a university could launch a new course that attracts students who stay in the city after they finish their degrees, creating a new workforce. How could this affect the office, residential and retail markets?

The most obvious sectors this strategy can benefit are retail and the public sector. In retail, it is increasingly difficult to label a pitch ‘prime’, but there is much wider consumer information that could help. In the public sector, data use could help local government understand where it has a low-value use of a property on a high-value site, for example.

The market is a difficult beast to understand right now, with hotspots and areas of concern across the country

The network is in its early stages but we’re fascinated to see what answers we could generate for clients. The market is a difficult beast to understand right now, with hotspots and areas of concern across the country.

Parts of the UK are benefiting from infrastructure changes and the government is trying to invest more fairly in the regions. By understanding these changes, the property sector can really tell clients what they mean for assets in these locations.

So how can an industry that never changes change? Simply by realising what we don’t know and starting to look for answers.

Now is the time for the property industry to adopt a more intelligent use of big data and accept the reality that clients today expect more than just property advice. We need to surf the data wave that’s hitting every sector before it engulfs us.

No comments yet