Overseas investment into the UK will continue throughout 2016 and this is no bad thing for the UK property industry; this was the overarching finding of a Property Week survey carried out this autumn on behalf of RSM

Overseas investment

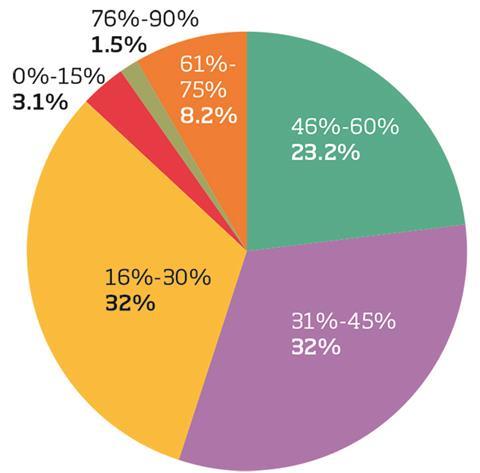

The UK property industry is expecting more overseas investment to arrive in the next 12 months (see graph one, ‘Percentage of investment from overseas in next 12 months’). A significant 23% of respondents believe 46%-60% of total UK commercial property investment will come from overseas, giving a clear indication of how many investors are believed to be circling the UK at the moment.

In general, this is viewed as a new norm in the current market; 72% of respondents indicate that the growth in overseas investment is inevitable as the UK continues to be one of the most attractive markets. A significant 62% believe it is essential to the growth of the UK’s commercial property sector, while 40% believe it is essential to the growth of the UK residential sector. In terms of impact, 45% believe overseas capital will continue to push prices up.

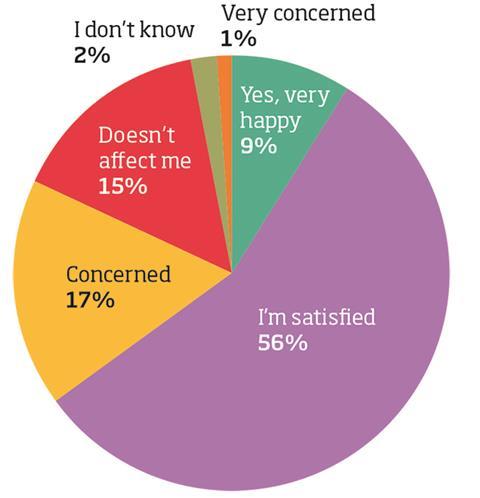

However, despite high satisfaction levels regarding the level of international investment (see graph two, ‘Are you happy or concerned with the level of international investment’), the influx of foreign capital is causing values to rise and yields to fall in a way that could be construed as reminiscent of the pre-recession environment.

“There is a concern the weight of capital coming into the UK is causing pressure on values, with the possible risk of a ‘bubble’ developing,” says Howard Freedman, head of real estate and construction at RSM.

It’s worth noting concerns from some respondents about the negative impact of international investment. Around 20% believe that overseas investors are taking valuable opportunities away from UK investors and 21% indicate that interest is likely to slow down as prices in the UK continue to rise and more buyers are priced out.

Regional growth

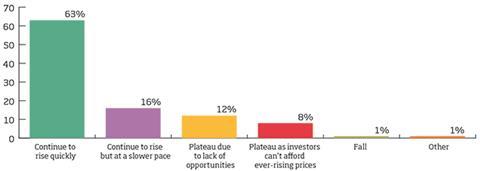

Given the high levels of activity in the first three quarters of 2015, it is unsurprising that 63% of respondents believe that the price of London property is going to rise quickly in the next 12 months (see graph three, ‘The price of London property will…’). However, 20% believe that prices will plateau either due to lack of investors or unaffordable prices.

This could be good news for the rest of the UK. “It is clear there is a scarcity of investment and development opportunities in London and the South East, now forcing investors to look further afield in the UK than they may have previously,” Freedman says.

Respondents were split in terms of what an overseas investor might do if priced out of London. A third indicate they might look to establish a joint venture outside London with a UK investor, a third believe they might go it alone in the regions and a third believe they would look outside the UK instead.

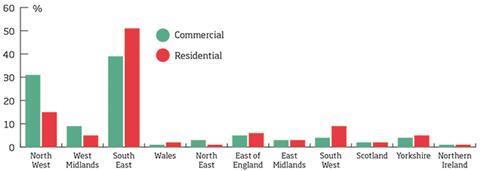

Interestingly, respondents vary in their opinions of whether residential or commercial property will attract most investment in each region (see graph four, ‘Outside London, which region will attract most investment?’). In the North West, for example, double the number of respondents believe commercial property will attract investment compared with residential. In the South West, however, residential property is predicted to attract more investment.

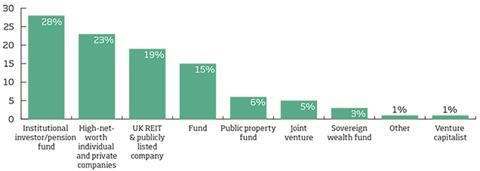

The market believes the weight of money that institutional investors and pension funds have to spend means they will be the most prolific investors in the regions (see graph five, ‘Which type of investor will spend most in the regions’). However, other types of investor weren’t far behind, which is a clear indication of the amount of money from all sources that could be pushed outside London.

Sources of funding

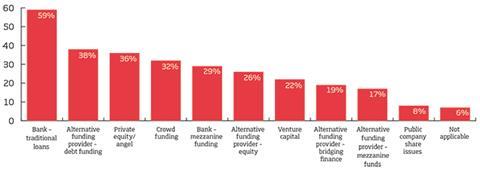

Today, banks are lending far more readily than in the last few years as confidence has returned. Debt is widely available and the cost of financing has reduced significantly. Banks are not the only source of funding for investors, however. Though they have been the most prolific investors in the last year (see graph six, ‘Which sources of funding appear most readily available?’), alternative funding, private equity funding and crowdfunding are all on the radar.

“The survey confirms our thoughts that there is a wider range of funding available than there has been traditionally,” says Freedman. “Over the last 18 months, there has been a significant increase in the amount of capital available and the number of sources providing it.

“The traditional banks are looking much more positively towards the sector making significant amounts available for lending,” he adds. “In addition, there have been a number of significant debt funds established providing both senior debt and mezzanine capital. Overall, there is now no shortage of funds available for viable development projects.”

If this level of access to funding remains and the UK maintains its stable position among global economies, indications suggest that the UK property industry could be looking to a busy 2016 indeed.

1. What percentage of investment in UK commercial property do you think will come from overseas investors in the next 12 months?

2. Are you happy or concerned with the level of international investment in the UK?

3. Over the next 12 months, the price of London property will…

4. Outside London, which region do you think will attract most investment in real estate?

5. Which type of investor do you anticipate will spend most in the regions (outside of London) during the next 12 months?

6. Over the last 12 months, what sources of funding appear to be more readily available?

METHODOLOGY

The ‘Where will growth come from?’ survey was carried out in September 2015 on behalf of RSM. Respondents were from our Property Week audience, who span a range of real estate disciplines including consultancy, property development, property investment and agency. Almost a third of respondents were directors (31%), while 25% were either senior managers or managers. Just over half the respondents were based in the South East, while 14% were from the North West, 10% from London and the remaining 25% from around the country.

No comments yet