International buyers accounted for more than half of total investment volume last year.

But with the EU referendum looming and concern growing that the market may have peaked, Property Week gathered industry experts to discuss whether the UK is still an attractive market for international capital and whether buyer attitudes are changing.

Guy Montague-Jones: The market has undoubtedly slowed since the start of the year after the turmoil in financial markets in January and with the threat of Brexit. Are international investors spooked and are they still looking for opportunities?

Fergus Keane: There was a moment of paralysis in March after the decision to call the referendum on the UK’s membership of the EU. Global economic risks have definitely risen up the agenda for international investors and sentiment has changed. From last summer onwards, there has been a move away from risk to more secure income. That said, when compared with other asset classes, real estate remains the least worst option for a lot of investors. We expect to see very meaningful levels of stock changing hands this year.

Will Lowndes: You have to remember that we are coming out of what was an exceptionally busy year last year. This year, a lot of the nervousness has actually come from UK institutions. International investors are not so worried about Brexit - they have money that is looking for a home and want to invest for the long term.

Paul Simmons: International investors are conscious of the potential effect on FX markets should the UK vote to exit the EU. However, paradoxically, Brexit doesn’t register high on

their league of criteria when considering investing in the UK.

FK: Foreign exchange is something every international investor is thinking about. What we haven’t seen is Brexit clauses being written into contracts.

GMJ: What about demand for different types of asset class? Has appetite for development waned, for example?

Andrew Boulton: We haven’t seen that. If anything so far this year, we’ve been doing more development work.

PS: We’re cross-sector but we have a penchant for offices. With limited speculative development since 2009, specifically in the regions, the market is facing a pinch point in terms of the supply and demand dynamic. There is also an occupational push from corporates into the regions. Together with the reduction in supply due to permitted development rights, the demand from some of the overseas investors into these key areas remains strong.

FK: Recently, we have seen a move back to core investment and reduced appetite for risk. That’s down to a few things, but mainly there’s just been a pause for breath amid all the macroeconomic and political uncertainties.

GMJ: Has the fall in the oil price had a dampening effect on the market?

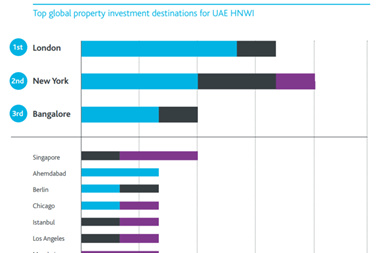

WL: It has affected a lot of economies in the Middle East but that does also encourage diversification and investment into real estate. We are seeing a distinction emerging in the attitude to new investment, in some geographies, between institutional and private investors. Regardless, there is a lot of overseas capital looking to diversify and invest in UK real estate.

Irene Morrison: When you look at Aberdeen, there used to be 250 flights a day going out to the oil rigs. Now the number of flights appears to have been reduced, so no doubt there has been change. But the clients we deal with, who are mainly in the residential sector, are not having any particular problems. The North East generally appears to be as buoyant as it ever was.

GMJ: What about the stamp duty changes for commercial property introduced in the Budget? Was that more of an issue for international investors?

FK: It took 1% off everyone’s portfolio but just as importantly it was a surprise. There was no heads-up. People don’t like that, particularly in Asia. It starts to affect the perception of the UK as a place where things don’t change overnight.

Craig Brown: The case for investment in the UK is all about stability and certainty. If things like that start to change overnight, it can be very damaging. Let’s have it flagged more clearly in future.

GMJ: What about the Panama Papers - could they have a damaging impact on international investment?

IM: International investors like the stability of the UK, but they also like the stability and flexibility of offshore structures. It’s easy for them, especially if they have family members scattered around the globe. If we want international investment in the UK, we have to be able to be flexible. Things are remarkably transparent as they stand. The firms we deal with certainly aren’t doing anything under the table.

GMJ: Finally, any predictions for the future of international investment?

FK: You are seeing an increasing range of international investors coming to the UK. Whenever you have one group backing away from the market, you have two or three others stepping in. We don’t see that changing.

PS: We’d share that optimism. When it comes to the referendum, in or out, there will be opportunities for everyone. My feeling is the country will vote to stay in. Don’t be surprised if around 24-36 hours before polling day, the ‘remain’ camp produces a press release to compel the apathetic majority to vote. Similar to the Scottish referendum last year.

OUR PANEL OF EXPERTS

Andrew Boulton, partner, DAC Beachcroft

Nick Marshall, partner, DAC Beachcroft

Paul Simmons, director, Greenridge Investment Management

Irene Morrison, client services director, First Names Group

Craig Brown, managing director, First Names Group

Fergus Keane, senior director - London capital markets, Cushman & Wakefield

Will Lowndes, vice-president - real estate, Gatehouse Bank

Guy Montague-Jones, news and finance editor, Property Week - chair

In association with:

No comments yet