Not tens, but hundreds, thousands and even millions of miles are embedded in many of the products we touch daily. But it’s the final moments of the race to the finishing line that is the most interesting — the sprint down that last mile.

SPONSORED CONTENT FROM PATRIZIA

It’s just as critical in logistics, as it is in a marathon.

Driving this interest in the last mile are the people who are waiting eagerly at the finishing line, the consumers at the end of the supply chain. Their round-the-clock purchasing habits and door-to-door demands are fuelling the changes in the retail businesses, but also in logistics.

Customers expect more delivery options that are quicker, cheaper and also more convenient. Click & collect and locker collection points are on the rise. It’s also the reason why more flexible and innovative delivery and production systems, for example using drones and 3D printing, could be on the horizon. Consumers want to be able to choose whatever meets their needs — the fastest.

Best locations, tighter infrastructure

Instant gratification is something that Amazon understands best. To satisfy consumer demands, the e-retail giant is working hard on its ambitious same-day delivery expansion plans. This year, the company made the headlines when it announced it would be expanding its own distribution and fulfilment network to include urban centres in major cities.

Increasing numbers of smaller distribution units in the city centres will be needed.

The move also demonstrates just how influential e-commerce has become for logistic properties. As “same-day delivery” becomes more important for all online retailers, and not just Amazon, it’s clear that they won’t need as many distribution centres out in the sticks.

Instead, increasing numbers of smaller distribution units in the city centres will be needed. As well as enormous logistic centres, online retailers want to be close to the city centres so they can guarantee a faster delivery service to their customers.

A dense, urban and state-of-the-art supply chain

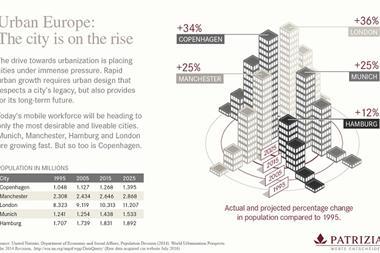

The right kind of logistics infrastructure is vital. Ongoing global urbanisation and continuous growth of our metropolitan regions makes “last mile delivery” facilities to serve consumers, retailers and delivery points crucial. Dense, urban solutions for same-day delivery are in demand. Which means it’s no longer business as usual for traditional warehouses.

In the past, goods just needed to be stored somewhere. Today, they need to be checked, sorted, repackaged, labelled and prepared for the onward transport. Modern facilities are state-of-the-art properties.

Occupiers and users need modern big-box centres, which often have highly specialised features not found in conventional warehouses, so they can be integrated into an ever more sophisticated supply chain. Smaller light industrial infill facilities that complement the big-box centres are a key component in this chain.

They are more and more fully automated in order to guarantee short delivery times.

It’s astonishing how sophisticated these modern facilities need to be. New technology advanced logistics buildings are smaller. They have conveyor belt systems, a high IT component, tend to combine ambient products with non-food products — and they are more and more fully automated in order to guarantee short delivery times.

They have higher office components employing more people due to the converging of several office activities, probably twice as many as in conventional logistics. They have more loading doors for trucks as well as vans. The loading capacity of the floor within the building differs per activity with a lower average in the handling area for picking and packing area, while it is higher for the racking or conveyor belt area. Such properties are also highly sought after.

A good deal for consumers and investors

Investors needn’t be put off by the host of features, characteristics and demands on this type of asset. Quite the opposite in fact. According to CBRE, the global commercial property consultants, real-estate investors have already picked up on this trend.

Their research indicates that in 2015 close to €4bn poured into logistic properties in Germany alone, eight times higher than in 2009. In the first quarter, transaction volume in logistic properties increased to 13% of overall investments in commercial property, ahead even of the hotel sector, which had a healthy 9%.

One reason for this, CBRE research appears to indicate, is that investors can realise higher yields on average with this property type than other commercial assets. Even though prices have risen, yields tend to be more than 5%, which is a good 1 point higher than with offices or retail property investments. Transaction volume is expected to remain stable, which is due in part to property scarcity more than anything else.

Prime logistics space in urban centres is hard to come by as they need to compete with other types of use, such as offices and residential properties, which are currently the preferred option politically.

The digital economy is driving the change

As we transition to a digital economy and purchase ever more items online, we’re also adding more trips and more miles to the overall logistics journey. To stop this from becoming a logistical nightmare — and in order to deliver on the promise of same-day door-to-door delivery — the last mile has to become a smoother and much faster sprint. Crucial to achieving this goal, and to satisfying the customer, is the right kind of property.

Roger Peters, group head PATRIZIA Logistics Management Europe B.V.

About PATRIZIA Immobilien AG

PATRIZIA Immobilien AG has been active as an investment manager on the real estate market in 15 European countries for more than 30 years. PATRIZIA’s range includes the acquisition, management, value increase and sale of residential and commercial real estate over own licensed investment platforms. As one of the leading real estate investment companies in Europe PATRIZIA operates as a respected business partner of large institutional investors and retail investors in all major European countries. Currently, the Company manages real estate assets worth around EUR 17 billion, primarily as a co-investor and portfolio manager for insurance companies, pension fund institutions, sovereign funds, savings and cooperative banks.

No comments yet