Assurances about the pace of future interest rate hikes from a senior figure at the Bank of England helped drive a spike in property shares on Wednesday.

The FTSE UK REIT Index rose 1.65% and the FTSE Real Estate Investment & Services Index rose 1%, well ahead of the FTSE All-Share which was up a modest 0.24%.

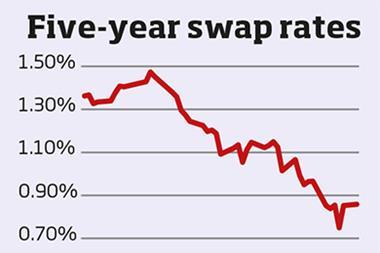

The market reacted positively to news stories indicating that interest rates are unlikely to rise anytime soon here or in the US. In a press interview, the Bank of England’s chief economist Andy Haldane said there was “no rush to raise rates”. He said the bank may increase rates by no more than 0.5% a year and the base rate could go no higher than 2.5% by the end of the decade.

Meanwhile, in the US, the Federal Reserve left rates unchanged after a two-day policy meeting and said it would remain “patient” regarding a rate rise.

Unsurprisingly, the biggest mover of the day was Songbird, whose shares leapt 7.78% to 347p on news that its major shareholders had come out in favour of the 350p a share bid from the Qatar Investment Authority and Brookfield Partners. Few had been expecting all the three major investors – the Glick family, China Investment Corporation and Morgan Stanley – to support the bid.

Analysts at Oriel Securities said: “This is a surprise announcement to us because in our view the response circular gave a thorough and detailed rationale as to why the Offer did not reflect the full value of the company.”

However, not all shares were up. Schroder REIT’s shares dipped 1p to 59.5p after it announced a modest rise of 1.8% in its net asset value £290.7 million or 56.1 pence per share over the three months to 31 December 2014.

No comments yet