The amount of information available on properties and local areas has never been greater, and buyers of residential property and land should use this to their advantage when evaluating a potential purchase.

Skimping on due diligence is a false economy – every hour invested in careful evaluation at this stage of a purchase process reduces the chance of an expensive mistake.

Here are ten important things a buyer of residential property or land for residential development might look out for.

Boundaries & ownership

Start with the basics – verify the location of boundaries and ownership of the official title. If applicable, look at the financial structure and recent accounts of any corporations in the ownership structure. As an extra step, consider doing the same research for neighbouring land titles in case there are any red flags.

Valuation & comparables

You need to model the GDV for the completed property/development after all proposed works. Up-to-date market data will help you identify relevant comparables, with transactional £/sqft data being the most important. If you have a good automated GDV model you can experiment with different unit configurations to work out the optimal allocation of units on the site, given market conditions.

Rental yield

For build-to-rent developments in particular, rental yield is obviously crucial. Plenty of data is available to help you determine rental valuations and therefore expected yield. By taking account of rental market activity for similar properties in the local area, you can model an accurate rental yield.

Finance strategy & issues

Do you need specialist development or bridging finance? With interest rates and terms changing all the time in this complex and unusual economic environment, good up-to-date information on specialist property lenders is invaluable. Identify any issues the might compromise the asset you plan to use as security, such as land conditions or legal issues.

Transaction costs

Have you budgeted correctly for the transaction costs involved? Stamp duty rules are now different in England, Scotland and Wales, and can be complex, particularly for multiple linked transactions or properties with existing dwellings. Professional fees (buyers agents, legal, surveyors etc) need to be accounted for too.

Planning policy & constraints

Verify current local planning policies and applicable constraints. Is the property in a National Park, Area of Outstanding Natural Beauty or within the greenbelt? Scour the title’s planning history carefully, and that of nearby properties, and consider getting an opinion from a planning consultant.

Building costs

How realistic is your construction cost model? Consider using unbiased data to estimate costs of a building project on a £/sqft basis, based on the region of the UK and quality of finish.

Legal restrictions

This one is boring but important – check online whether the any of the land titles in your proposed purchase have any legal restrictions, such as easements, covenants, wayleaves, uplift clauses or similar.

Flood risk

Is the land in question subject to flood risk, and can the be insured for?

Internet speeds & mobile coverage

Data suggests super-fast fibre internet is now an absolute must-have for many tenants. It’s easy to find out if the local area has this available. Likewise, solid mobile coverage from at least one and preferably two or more providers is something that many eventual buyers will look for.

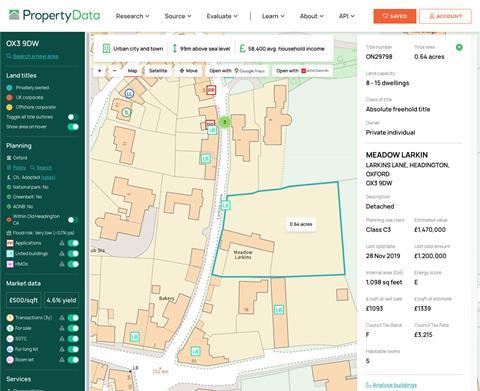

The power of having everything in one place

We launched PropertyData in 2017 so that UK residential property investors and developers would have as much relevant data as possible in a single easy-to-use tool. Our software covers all of the due dilligence issues I’ve described in this article, as well as many other types of information.

Unlimited data access costs just £600/year – why not give it a try in your business today.

Find out more about Property Data

No comments yet