Another retailer enters administration. Jobs to be lost.” It’s a familiar headline, but while it is easy to blame the pandemic, there were plenty of failures pre-Covid, with changing customer habits, online, digital integration and poor proposition and management some of the factors to blame.

One of the questions posed by the media and consumers alike when an administration happens is whether the brand name will disappear from the high street.

Mike Ashley’s Frasers Group has acquired several brands, including Jack Wills, Game and Evans Cycles. Brand aggregation isn’t a recent trend at Frasers – they’d been recognising the value in brands that still held customer recognition but had become tired for some time. So what’s the opportunity for retailers brave enough to buy a distressed business?

Firstly, you have to select a brand that aligns to your customer base. Retailers have the opportunity to build a detailed understanding of customers’ shopping habits and can use these insights to gently transfer a customer from brand to brand. The Karen Millen, Coast and Oasis acquisitions by Boohoo have given the business the opportunity to transfer customers from brand to brand and capture more of their spend.

However, there are also opportunities where brand association and heritage are strong but the physical store network has been a contributor to its downfall. Jaeger is a good example – slow to engage with digital but a strong brand. M&S acquired it without the store estate in January.

To maintain relevance, retailers need to ensure their store locations remain valuable to the customer. Recently, we’ve seen several retailers partner to provide an improved customer offer, including Homebase’s garden-centre partnership with Next, which allows Next to capitalise on one of the pandemic’s fastest-growing categories and is a great fit alongside its own ‘Home’ proposition.

A huge contributor, though, is the opportunity to gain operational savings by reducing the supplier pool and driving improved terms through production and logistics.

There are also other logistics opportunities, including leveraging store estates for returns logistics and parcel operations. The volume of ecommerce parcels that flows through a retailer’s logistics networks would surprise most consumers. This is a potential additional revenue source and provides extra value to the customer, supporting the role of the physical store.

This consolidation of product into a single fulfilment centre also allows for improved efficiency of labour and reduces costs, as pick, pack and dispatch processes can be shared across the business with elements like mechanical handling equipment (MHE), automation and fit-out aggregated over the businesses.

This move to assemble a ‘house of brands’ can offer operational savings but perhaps most importantly offers retailers a chance to build longer and deeper relationships with customers.

Tim Crighton is partner, retail, logistics and supply chain EMEA, at Cushman & Wakefield

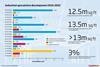

Industrial & logistics sector continues to boom

- 1

- 2

Currently reading

Currently readingBuilding a ‘house of brands’

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

No comments yet