The key priority for this government seems to be widening home ownership and the property world now has a new tenure to grapple with following the introduction of First Homes.

Pushed out ahead of the now stalled planning reforms, First Homes is a new discount market sale tenure that may become compulsory across all sites, with discounts starting at 30% and potentially rising to 50%.

The Conservatives’ focus shouldn’t be a surprise. They have enjoyed the most electoral success within the so-called ‘Red Wall’ seats. It is these places where house-price-to-earnings ratios offer a fighting chance to buy a home and where Help to Buy has had a meaningful impact.

However, First Homes should not be considered a replacement for Help to Buy and will create new complexities and challenges.

A central mistake of this policy is the mandatory requirement to provide First Homes on every site. Pocket’s long experience of delivering discount market sale is that it works best in central, more urban locations.

A better approach would have been to ask councils to plan strategically and think about which areas might offer the best match for local First Homes.

A central mistake of this policy is the requirement to provide First Homes on every site

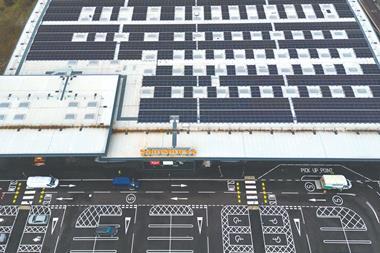

For example, I see a big opportunity for First Homes in town centres that might be transitioning away from retail to more mixed use. But on fringe sites, perhaps in more suburban locations, discount market sale may be less attractive and other forms of affordable housing might be more appropriate.

First Homes can command up to a 50% discount off the market rate. Pocket’s experience, however, is that a 20% discount works well. It means buyers who acquire a Pocket home are not too far out of step with the open market. Too great a discount risks trapping people in this tenure; a first home could become their last home.

There are also mortgage companies to consider; they are more inclined to lend where a buyer has decent skin in the game. The greater the discount, the greater the perceived moral hazard – and mortgage products on offer start to dry up fast.

Pocket has shown there is a place for discount market sale in the development world, but it tends to work best on smaller central sites and with smaller homes. The data shows 70% of first-time buyers are singles and couples wanting one- and two-bedroom homes. The larger the home, the greater the cross subsidy, which means less money for other affordable housing.

A more imaginative approach would be to give councils powers to plan positively and developers routes to innovate through a range of tenures. From open-market sale through to rent and everything in between, different sites need different solutions.

Pocket thrives in some places and there is very much local choice at play with some local authorities recognising the need for first-time buyer accommodation and others choosing to focus elsewhere.

This is healthy. It is not healthy to compulsorily mandate where a tenure may not be wanted or needed. We will wait and see how new secretary of state Michael Gove grapples with the challenges ahead.

Nick Cuff is chief commercial officer at Pocket Living

No comments yet