Earlier this year, Legal & General (L&G) started construction on the 185-home Bonnington Walk residential scheme in Lockleaze, Bristol.

The site, which sits around three miles north of the city centre, is being transformed in partnership with Bristol City Council and Bristol Housing Festival and will deliver a mix of two- and three-bedroom houses and one- and two-bedroom apartments, with a focus on bolstering the provision of affordable housing in the city.

Despite the scale of the development, local residents might not have been aware construction had got under way. That’s because the homes are being built at L&G’s 550,000 sq ft modular housing factory in Sherburn-in-Elmet, near Leeds, around 200 miles away.

The developer was one of the first to significantly invest in creating a large-scale modular construction facility, and although it took a while for the division to gain traction, it is now ramping up its delivery pipeline.

The UK’s modular housing sector is still in its relative infancy, but over the next few years, it is anticipated that the development of houses built using modern methods of construction (MMC), such as modular, will rapidly accelerate. This is being partly driven by private companies like L&G and partly by central government.

In September, the government announced an £11.5bn affordable homes programme that runs from 2021 to 2026, which will require organisations to deliver 25% of their homes through MMC.

New industrial subsector

But will this desire to deliver more new homes using MMC translate into more factories dotted across the UK that are capable of building them? And if it does, then just how big could this new industrial subsector get?

Last year, Savills published a report looking at this very question. It found that 150 sq ft of additional factory space is required per additional unit – or home – developed using MMC and calculates the average size of factory needed to build these homes is around 150,000 sq ft.

Each house is created in the factory then tansported floor by floor to the site before craning it into place

Chris Shaw, House by Urban Splash

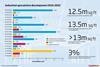

The report mapped out a number of different scenarios over the next 10 years for the sector. Should demand for modular homes increase by 15%, it estimated that this would require an additional 1.5m sq ft of industrial space. Should it increase by 20%, 6m sq ft would be required – equivalent to 40 new factories.

In the spring of 2020, Savills reported that there were around 100 schemes across the UK in the development pipeline using one of the seven different MMC techniques. These schemes are due to deliver around 17,000 new homes, the majority of which will be built in London and the South East where the demand is greatest.

In addition to L&G, one of the UK companies leading the modular charge is Urban Splash, which launched a joint venture to deliver thousands of new modular homes with Homes England and Japan’s biggest housebuilder Sekisui House in 2019.

In March this year, Urban Splash delivered a milestone for the joint venture: the first of 406 modular homes at a scheme in Northstowe, Cambridge, called Inholm. These new homes are part of a study by Homes England into MMC, which will see the performance of the homes tested over the long term, to provide data that will help further drive innovation in the sector.

The homes were manufactured in the House by Urban Splash factory in Alfreton, in the East Midlands.

“Each house is created in our factory and then transported floor by floor, which is known as a ‘module’, to the site before craning it into place,” explains Chris Shaw, delivery director for House by Urban Splash. “We’ve been pioneering this concept for a few years, delivering homes this way in Manchester, Birmingham, North Shields and Salford.”

Countryside goes modular

Another housebuilder quick to jump on the modular bandwagon was Countryside. It recently opened a third purpose-built modular homes manufacturing facility in Bardon, Leicestershire, spanning 359,305 sq ft – the other two sites are in the north of England and the Midlands.

The new factory will be used to make Countryside’s advanced modular panel system and the company has a target to build 6,000 homes per year by 2025 using MMC.

And just last month, Liverpool-based modular homes manufacturer IDMH announced plans to move to a new 208,663 sq ft warehouse in Sheffield, South Yorkshire.

On announcing the news, Sonny Burrows, chief operating officer at IDMH, said: “The decision to expand has been driven by modern methods of construction complementing the existing housing supply chain to add more capacity into the system and increase the quality and availability of much-needed housing.

Assembly line: L&G builds modular housing at its factory in Sherburn-in-Elmet near Leeds

“Our existing factory in Liverpool has a team of 70 people in 50,000 sq ft, whereas the new site is over 200,000 sq ft, allowing us to expand and satisfy the demand for new contracts won, to act as a springboard to win more work and to allow multiple production lines to extend our portfolio.”

Despite this flurry of modular factory openings, Kimberly Markiewicz, a senior analyst at JLL, thinks we are unlikely to see a significant number of similar sites popping up any time soon.

“I don’t see this creating a subsector of factories dedicated to modular housing in the next five or even 10 years,” says Markiewicz.

“There are a lot of key players that need to get on board in order for us to see this subsector grow,” she adds. “Mainly it is the traditional housing developers who will need to work with MMC manufacturing partners to get their pipeline in order.”

Kevin Mofid, head of logistics and industrial research at Savills, is also not convinced that we’re going to see a sizeable subsector of MMC factories springing up across the country in the short term.

However, he adds: “Following the government’s affordable housing policies announcement, there could be a case to say the initial scenarios predicted in our report last year are on the conservative side.”

Current warehouse capacity fits most housebuilders’ and developers’ requirements

Richard Valentine-Selsey, Savills

Mofid’s colleague Richard Valentine-Selsey, a research analyst at Savills, agrees that although there has been a lot of hype surrounding modular homes, “we don’t expect to see a huge uptick in the current warehouse capacity [for modular], which fits most housebuilders’ and developers’ requirements”.

That said, Valentine-Selsey is quick to point out: “We have a 2021-26 homes programme requirement [from central government] for 20% to 25% of homes delivered to be [developed] through modern methods of construction, including all seven categories of the sector.”

If housebuilders are to hit these targets, more modular factories may need to be built.

Regardless of pressure from the government to increase delivery of MMC homes, Nick Whitton, a director at JLL, points out that the property sector is always slow to embrace change.

‘Curve of innovation’

“The growth of any new industry sector takes time and the first few per cent of demand is very difficult to get,” says Whitton. “It’s called ‘the curve of innovation’. Once you hit the first 3% to 4% of take-up, the growth following that can be exponential.”

The present situation is some way off that – there is sufficient capacity to handle the current pipeline, and so an immediate boom in factory construction is unlikely. But with the support of government and the increasing backing of developers, that position may well be subject to change.

If the growth of modular homes in the UK – and housing delivered using MMC more widely – does eventually become exponential, it’s inevitable that many more factories capable of building them will be needed.

The landscape could look very different in 10 or 20 years’ time.

Industrial & logistics sector continues to boom

- 1

- 2

- 3

- 4

Currently reading

Currently readingHome truths on the MMC revolution

- 5

- 6

- 7

- 8

- 9

- 10

No comments yet