With major changes to property taxes combining with the fallout from the Covid-19 pandemic, Property Week – in association with Smith & Williamson – brought together a panel of experts to discuss the main challenges.

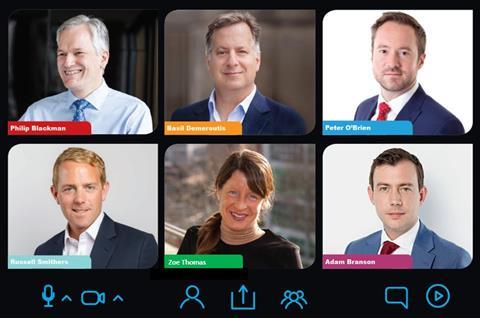

Panel of experts

- Philip Blackman, finance director, Native Land

- Basil Demeroutis, managing partner, FORE Partnership

- Peter O’Brien, principal, valuation advisory service, Avison Young

- Russell Smithers, managing director, London, REDD

- Zoe Thomas, partner and head of real estate tax, Smith & Williamson LLP

- Adam Branson, freelance journalist specialising in the built environment and former associate editor at Property Week (chair)

AB: Quite clearly, the last 16 months have been extraordinary. How do you think attitudes towards UK property have changed since the onset of the pandemic?

POB: What I’ve seen and what we’ve generally seen during times of uncertainty is that there is a flight to quality in property decisions. When I say quality, I mean quality of income, building location, tenant income and so on.

So, pre-pandemic, there was a lot of interest in industrial and logistics. That continued and almost exploded in 2020. There was also more interest in alternative sectors. These both provide de-risked and high-quality assets and potential to the investor, and that’s why we saw these switches. We saw exactly the same switches during the global financial crisis (GFC) and the fallout from the GFC.

AB: Obviously, the funds closed pretty much immediately at the start of the summer and we saw two of them deciding to shut up shop entirely. To what extent is the fallout from the pandemic comparable to that from the GFC?

POB: Certainly it’s comparable, but if you look at things like the stats and the data that come out of the real estate market that we track, the impact is nowhere near as severe in that respect. So, the impact on yields and rents and so on have nowhere near had the same impact that we saw during the GFC. And that’s because people see Covid-19 as a relatively temporary issue.

What I’ve seen during times of uncertainty is that there is a flight to quality in property decisions

Peter O’Brien

There is a wall of equity targeting the UK and that equity needs to find a home. With the GFC, we really didn’t know how long things were going to go on. We were in this holding pattern – it was a pretty dark period – where we didn’t actually know how long the severity of the situation was going to last; whereas with the pandemic, initially it felt like it was going to be quite a long period, but certainly with the vaccine roll-out it feels like it’s going to be a much shorter period of pain.

PB: I would totally agree with what’s been said. You always get this emphasis on quality, but also I think that people have adjusted to the new normal relatively quickly. It is more of a blip – people have recalibrated and now we’re moving forward again.

Perhaps there is a tweak in the sort of products and the offerings and it’s obviously sort of affected both the residential and the office markets, but we now know what we need to do going forward and we can now move in that direction.

Basil Demeroutis soundbite

Managing Partner at FORE Partnership

Perhaps change is a good thing – it sorts one or two things out. It’s the way you then respond to that change.

AB: What do you mean by “sorts one or two things out”?

PB: Technology is changing how we live, work and socialise, and I guess in my mind Covid-19 has accelerated some of those changes. Then it’s about how we [as an industry] respond to those changes. I’ll be frank: I think customers and consumers are getting increasingly demanding. We all want better places to work and live, so then again it’s about how we respond to that. And I guess the challenges for each of the companies we work for are going to be different.

AB: Given that a lot of people are still working from home, how do you all feel about investing in offices right now?

BD: It’s a seminal question and it’s one that’s been asked so many times over the last 18 months. I don’t think that there’s a right or wrong answer. I think that there’s absolutely a role for the office to play and I think we’ve been asking, over the last decade we’ve been in business actually, why people go to the office.

I do think there is a reason for the office to exist and I think people do need to come back for lots of reasons

Basil Demeroutis

It used to be that it was for convenience or for enhancing productivity. These are quite old notions and I think they’re already well along the way of being upended. If there was ever any doubt, they are now fully being re-examined by every industry, every sector and every company, big or small.

But I do think that there is a reason for the office to exist and I think people do need to come back for lots of reasons. It’s for creativity, for bringing new people into the business, for activities that can best happen collectively. I think these are all self-evident.

But I think also it’s a reflection of a company’s brand and their values and I think this really gets at the core of why we are cautiously still bullish on offices. It’s because it’s the most visible outward expression of what a corporation stands for and that’s important. Those values are important to infuse in your staff, your customers, your stakeholders and your clients, as well as your shareholders. That drives home Peter’s point about a flight to quality.

AB: Peter, does that chime with what you’re seeing in the numbers?

POB: Absolutely. There is still a lot of interest in offices. We did think that maybe regional offices would suffer during Covid-19, but actually the opposite has happened. Certainly, London and South East regional offices have been doing really quite well and that’s happened in pockets around the UK in key cities.

A lot of the heat has gone out into the home counties because of people looking to relocate

Russell Smithers

Equity is still targeting offices in a very big way. People are making all these noises about the end of the office but that’s not what we’re seeing being played out on the investment side, with huge amounts of equity piling into the sector.

That equity is very clever – it’s not as if they’re just stupidly throwing money around in a hope that it’s going to give them a good return. It’s very closely analysing what’s going to happen in the future.

BD: What we’ve seen is that actually the rents haven’t moved that much at the top of the market.

You’re seeing deals at mid- to high-£80s/sq ft. If that had been two or three years ago, so before the pandemic, those would be eye-opening rental levels.

POB: What we generally see is the headline rental staying really strong. What we’ve been seeing is that there has been a little movement in incentives – not massive but a little – in the prime grade-A space. And I think that’s all we’ll see going forward.

AB: Switching sectors, what has REDD’s experience of the prime London residential market been? Has the lack of international travel been an issue?

RS: Certainly, central London has been fairly dormant, particularly in terms of secondhand stock. Generally, new-build stock, and apartment buildings particularly, has still done OK because of the ability to do remote viewings and off-plan sales and so on. It’s less easy with secondhand stock where the product required is less well defined.

A lot of the heat has gone out into the home counties because of people looking to relocate and it doesn’t rely heavily on international footfall, which we haven’t seen.

The tax changes have certainly had a massive impact on how we invest in property

Zoe Thomas

However, it hasn’t stopped deals being done: there is still an international wall of equity, which is very much putting the pressure on me at the moment to find those opportunities for those equity houses and private individuals to invest.

I still very much see London in the medium to long term as a place for them to invest their money. With residential, it is somewhere to put your money, but it’s also something that you can enjoy and that your family can enjoy while spending time in a great city.

AB: How have the funds responded more generally? Have they changed their business models or has it been about battening down the hatches and just waiting for normality to resume?

POB: I think some of them have had to batten down the hatches. But in general, what funds have been doing is really taking it as an opportunity to dispose of those assets that perhaps are at the end of their business plans anyway. And during that whole period, you had international buyers in the market ready to buy those assets. So, there was a good chance to dispose of those types of assets, but then also dispose of those assets that could have hurt their income returns going forward.

Philip Blackman soundbite:

Finance Director at Native Land

So, we did see prior to the pandemic retail being disposed of in huge amounts and during the pandemic we’ve seen a lot of funds disposing of those retail assets that are potentially going to hurt their returns going forward.

And then there has been a refocus of the funds, which is a general thing that we see in the market to both offices and industrial but heavily weighted towards industrial and logistics, which of course have been the darlings of the market over the last five to 10 years.

AB: Clearly, there have been quite significant changes to property tax in recent years. Zoe, how have those changes affected funds’ thinking? And has there been any interplay between those changes and the pandemic?

ZT: I don’t know that there’s been much interplay but the tax changes have certainly had a massive impact on how we invest in property. Certainly, the property funds that

I’ve been working with have been rethinking how we structure things but also how we communicate with investors so they understand that some of the structures they’re used to seeing over the past 10 to 15 years now do not provide the same benefits.

I’ve seen a lot of short term pain, just due to the virus, but we’re considering the long-term changes in behaviour and tax is a part of that, but it’s also things like people are going to be working from home. They’re probably not going to be working from home all the time because they like the interaction and I think that that’s always going to be the case; it’s just going to change the focus and the way that we use the office.

AB: But from your perspective, tax changes have to be thought about in a long-term way alongside any such changes?

ZT: Yes. Since about 2012, there have been a whole handful of tax changes ranging from stamp duty land tax being increased to 15% where a residential property worth more than £2m is acquired by a non-natural person (typically a company or similar structure), which has impacted a number of investors. Also, for individual investors, tax relief on mortgage interest for residential property letting has been reduced annually since April 2017 so that from April 2020 the tax relief is more or less limited to a 20% tax credit on the mortgage interest paid in any one year.

There is more of a reluctance to invest or certainly they’re very keen to know what the post-tax returns are now

Philip Blackman

There were also significant changes in April 2015, which meant non-residents were taxed initially on capital gains arising from the disposal of UK residential property.

Then in April 2019, the government announced that gains on the disposal of UK residential property as well as UK commercial property would be subject to corporation tax.

So now pretty much all UK property disposals will be taxable, whether owned by an individual, through a fund, trust, partnership or company, meaning there are very limited options for owning UK property without suffering tax on any gains arising. There are ways to manage this but the landscape has changed dramatically.

Typically, we used to structure through Jersey and Guernsey, but there is no real benefit from a tax perspective anymore of doing that. It’s really just for privacy and regulatory issues that you would invest via Jersey or Guernsey or some other offshore jurisdiction.

AB: Is there anything else for investors to look forward to?

ZT: A couple months ago, there was also a proposal for a residential property developer tax, which the government has said they’re going to introduce in April 2022. We haven’t yet got a rate but we think it’s probably going to be between 4% and 7% and it’s meant to be for a set period of 10 years to help the government raise £2bn to fund the money they have been putting into blocks of flats where the cladding needs to be changed.

Peter O’Brien soundbite

Managing Director of Valuation Consultancy - Avison Young

It’s quite a wide-ranging group of property developers that are going to be affected by this. Sometimes you think this is a sector that actually has been unfairly targeted because the tax changes have been quite significant over the last few years.

AB: Does the panel think people will be less interested in investing in UK property as a result of all these changes?

PB: I do think it is starting to affect investor appetite. There is more of a reluctance to invest or certainly they’re very keen to know what the post-tax returns are now, whereas 10 years ago you wouldn’t get those sorts of questions.

So, I think there is an awareness that the tax environment is far more complex. It is getting extremely complex, even for a professional tax layman like me. The only good thing is that you’re starting to get a bit more of a level playing field. People know they’re going to be taxed so they start to see it as just a sort of a necessity or a factor of doing business. But it does seem that we are being unfairly affected.

ZT: I think a lot of people that I’ve spoken to in the business do feel that it is unfairly targeting the development of property, including retail where they really think they’ve suffered, especially with business rates coming back. You think ‘my goodness, they really need to have a bit of a break’. You can kind of see their views on this.

RS: I always think that the government sees residential as the golden goose when it comes to tax and also the planning regime. It’s another layer to the fact that as developers we have to deal with things like CIL [Community Infrastructure Levy] and section 106 commitments. That’s when the local authorities get to have their bite at the bottom line, as well as the viability.

For me, the tax is huge. I think there does need to be a bit of a view on this from central government. They are expecting essentially private development houses to bring forward, modernise or optimise a building or site. But there has to be a view on viability today and not just this continual taxation.

The problem that we face in the development world is that actually there is a big lag between the investment going in and actual delivery, which we see in terms of the tower cranes going in and property going on the market.

No comments yet