The industrial and logistics sector has been at the top of investment return tables for more than two years, its performance underpinned by the seismic shift in consumer spending behaviour sparked by online retail.

Logistics Spotlight panelists:

- Matthew Byrom, managing director, First Panattoni

- Ian Henderson, group property director, Wincanton

- Christian Matthews, director, db symmetry

- Kevin Sey, vice-president of commercial real estate, DHL

- Richard Sullivan, head of industrial and logistics, Savills

- Charlie Withers, development director, Tritax

Chaired by: Liz Hamson, editor, Property Week

Rents have risen and yields have shrunk as investors flood into the market to claim a piece of the pie. It has now reached something of a crossroads, however. There are huge challenges facing the sector, not least a dearth of supply and the ever-changing needs of occupiers.

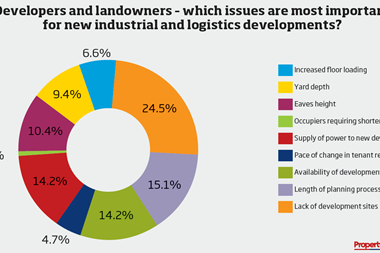

With this in mind, Property Week, in partnership with Savills and db symmetry, conducted the first-ever census of the industrial and logistics sector.

Off the back of the census and exclusive occupier research by Analytiqa, we brought together some of the biggest names in the sector last month for the Logistics Spotlight debate, sponsored by host Savills and db symmetry. It presented a fascinating insight into where the industry is now and where it is heading.

The research identified flexibility as a top priority for occupiers. Kevin Sey, vice-president of commercial real estate at DHL, kicked off the debate by stating that third-party logistics operators (3PLs) had been hit by a “perfect storm” of rising rents and occupiers cutting costs.

“What’s going on with the retailers is a major, major factor,” he said. “They are under cost pressure, needing to get creative with how they deliver their goods to compete with the likes of Amazon. It is critical for the retailers to drive down costs. That causes a perfect storm for the 3PL – costs going down and property rents going up.

“On top of that, the procurement guys are still in control and they want three- or five-year commitments – that is a real issue for us. In the automotive sector, for example, they don’t want to give us two- or three-year contracts so all the risk is there for the 3PLs and we’ve got to live with that.”

Find out more - Watch highlights and extra insights from the event

Wincanton group property director Ian Henderson agreed. “The onus is on the landlord or investor to look behind the lease term to see what’s actually going on in the background,” he said.

“A customer may give a 3PL a five-year contract but will they move out of the building at the end of those five years? No. They spend a fortune on fit-out but the landlord only sees a five-year lease with a 3PL. The story behind it is very different.”

Flexibility

Savills’ head of industrial and logistics Richard Sullivan argued that flexibility was a reflection of landlords’ confidence in the market. However, while most would be happy to talk about flexibility, it would come with a premium rent.

The survey also found that more than half of occupiers were looking to take additional warehouse space over the next two years, a good chunk of which would be higher spec.

Db symmetry director Christian Matthews said that the single most important consideration for a new-build industrial and logistics facility was the power supply.

“It’s one of the most asked questions by occupiers at the moment and one of the biggest challenges we and the industry are facing,” he said. “If you talk to some of the biggest occupiers in the country, they will tell you that they are losing production for one day a month due to power to their warehouses going down.”

”The UK is at virtual crisis point in terms of its electricity supply” - Matthew Byrom, First Panattoni

Matthew Byrom, managing director at First Panattoni, said a modern 300,000 sq ft building needed the equivalent amount of power to a whole logistics park 15 years ago.

“The UK is at virtual crisis point in terms of its electricity supply,” he added. “It is more and more reliant on intermittent renewable energy such as solar and wind. So what you’ve got now is a very systemic and volatile grid where there is no guarantee of when the power is going to come online. This makes it very difficult for occupiers to guarantee supply moving forward. The volatility in the grid is a huge issue.”

The panel agreed that investors and occupiers would have to work together to find solutions, which could include on-site solar panels and gas-supplied back-up generators.

It was not until almost the end of the session that the B-word – Brexit – was mentioned. Charlie Withers, development director at Tritax, said he was optimistic despite the uncertainty that had been caused by the process.

“The fundamentals are still there, the market is driven by occupational demand and the transition from retail to ecommerce is going to continue,” he said. “Brexit will cause issues.

It will probably be a bit of a bumpy ride until March 2019, but fundamentally the transformation from retail to ecommerce is what’s going to drive things forward. Once we get to the end of Brexit, hopefully people will be able to take a more balanced view of how they are going to take things forward.”

The findings from the census and upbeat mood of the panellists were reflected by the audience. When asked for a show of hands on whether we had reached the top of the market, most felt that we hadn’t and that there was further room for growth despite the challenges ahead – and for the sector’s innovators and disrupters there undoubtedly is.

No comments yet