After two years of unprecedented challenges faced by real estate, experts share their predictions for 2022.

Steve Coulson

Co-founder and chief executive, Kitt

With 2021 being the year of the remote-versus-office debate for company leaders, in the commercial real estate world we have seen a power shift, with the office purchase now placed in the hands of tenants.

The role of the office has now been thrust into the limelight. The argument for even having an office is now included in more strategic conversations for its functional purposes and as an enabler of ‘human experience’, instead of existing simply for the sake of it. Teams can now work from anywhere and employees will come to expect this from employers, too.

In 2022, this flexibility will surely accelerate, with the office being a platform that fosters culture and collaboration – workspace providers will need to consider a bespoke service closer to the consumer’s needs to remain competitive.

I am excited to see more businesses thinking creatively and critically about the role of space and how the office is further developed as a facilitator of the critical human experiences that help those businesses to thrive.

Rhonda Curliss

Co-founder, Grey Lemon

I hope more businesses embrace positive change in 2022, learning from the uncertainties and experiences of 2021.

While many companies have adapted through the pandemic, those that will thrive in 2022 will have confidence, a clear vision, a trusted and engaged team with defined roles and systems and processes that empower people to perform at their best.

To see real growth and innovation in our industry, we need leaders who are open to new ways of thinking, who will lead their companies to be truly authentic with clarity of purpose; only then will they win the best work, attract and retain the top talent and create a positive, sustainable culture for their people.

Grey Lemon is looking forward to guiding and supporting these leaders to make a positive impact to their organisations and our industry as a whole. Everything is possible.

Philip Gadsden

Managing partner, Orchard Street IM

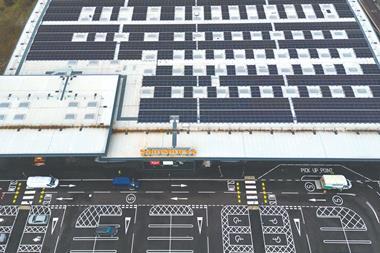

The industrial sector performed strongly in 2021 and is likely to remain hot this year, with rapidly increasing rents and yields compressing to historically low levels, in the expectation of further rental growth to come.

But as we reach yields of 2% to 3% and lower, I expect it to become much harder to underwrite these properties in some parts of the UK, as the drive to net zero is increasing the cost of refurbishment around the country.

There will be value to be found in the retail warehouse sector, and perhaps even the high street. And despite the short-term setback of the latest working-from-home guidance, I expect good appetite for the right type of offices to continue – particularly those with strong ESG and wellness credentials and, crucially, those in strategic locations where employers can access the best pools of talent.

Stefan Wundrak

Head of European research, Nuveen Real Estate

Structural changes in demographics, technology and sustainability could be the big performance differentiators in the decade ahead. The wave of investors and real estate managers formally committed to net zero carbon targets will take significant steps to achieve their goal in 2022.

This creates the potential for carbon data to tip the scales in investment decisions and markets. Investment underwriting will increasingly include what it takes to transition buildings to net zero, leading to an emergence of green premiums and brown discounts. Well-prepared building owners with net zero carbon business plans in place or under way will benefit from greater certainty and higher returns, not least by saving on carbon taxes in some European countries.

Continue to part 29 here

Predictions for 2022: Brace yourself…

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

Currently reading

Currently readingPredictions for 2022: Brace yourself (part twenty-eight)

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

No comments yet