Plans to create eight new freeports in England should benefit businesses that choose to locate themselves in these areas as well as generate jobs, but will they generate much-needed investment?

Occupiers are keen to explore the opportunities and we have already seen requirements in the market that are focused on freeport locations. But while the incentives should help to attract businesses, the benefits for property investors and landlords are less direct.

Freeports fall into two categories: customs and tax sites. To reap the most reward, the focus for investors should be on tax sites, where the Treasury has allowed for up to 600ha at each freeport. Proposed incentives include: stamp duty land tax (SDLT) relief; enhanced structures and building allowance (SBA); enhanced capital allowances (ECAs); employer national insurance contributions (NICs) rate relief; business rates relief; and both simplified and faster planning. There is also the potential to benefit from infrastructure funding to open up sites.

All of these combined provide landlords with a number of key USPs to market their schemes and attract potential occupiers with swifter delivery and shorter voids, while also being better placed to negotiate terms such as shorter rent-free periods. Depending on nearby competition, there could also be a case for pushing up quoting rents, provided this does not negate the benefits already on offer. After all, time is money, and even a slight adjustment

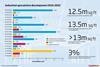

Industrial & logistics sector continues to boom

- 1

- 2

- 3

- 4

- 5

- 6

- 7

Currently reading

Currently readingReaping freeport rewards

- 8

- 9

- 10

No comments yet