The ground has shifted beneath our feet since we published our last annual Industrial and Logistics Census.

Little more than a year ago, Bank of England base rates were 0.1%, and had been below 1% for almost 13 years. But starting with a 0.15% hike on 15 December 2021, rates have since risen in 10 unsettling steps to today’s 4.0%.

Base rates rose in response to inflation, and many in property have felt the impact of spiralling energy, material and labour costs, as well as the rising price of debt, over the past year.

Attitudes have naturally responded, as measured in our sixth industrial & logistics (I&L) census, conducted by Property Week, Savills and Tritax Symmetry, in association with Analytiqa. Held in the fourth quarter of 2022, the survey questioned advisers, agents, asset managers, consultants, developers, investors, landowners and occupiers in the I&L sector around the UK.

Subdued sentiment

Our survey found that respondents in all roles were more pessimistic than a year ago, when asked to compare business conditions against the prior six months. The biggest swing was seen among developers. More than two thirds (68%) had given a positive assessment going into 2022, but more than eight out of 10 (83%) had a negative view by the end of it.

Perhaps surprisingly, the smallest swing in sentiment was seen among occupiers, where 53% gave a positive response going into 2022, and 22% were still upbeat a year later.

Across all parts of the sector, two thirds (66%) gave a negative assessment of current conditions – seen as either somewhat or much more difficult than before. Almost a quarter (24%) chose the most negative option.

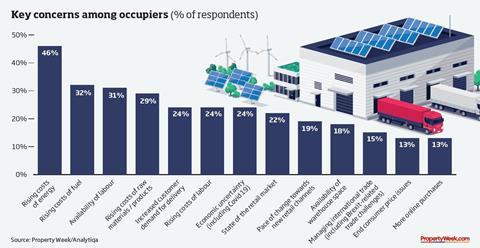

Our survey found a wide spread of factors behind that shift in sentiment. In a multiple-choice selection, almost half of I&L occupiers (46%) cited rising energy costs as a key concern, while about a third (32%) cited fuel price hikes. These issues were closely followed by worries about labour shortages (31%) and the cost of raw materials (29%). General economic uncertainty was chosen by almost a quarter (24%) of occupiers.

The list of occupiers’ concerns has reshuffled dramatically over the past three years. In our last census, the top concern was labour availability, and a year before that it was the rise of online purchasing – now seen as a minor concern.

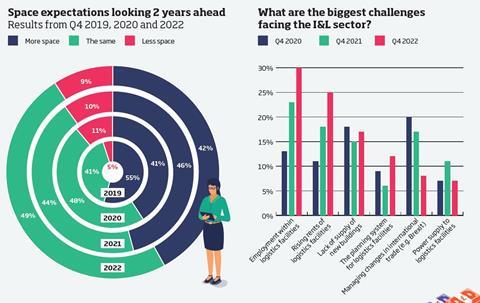

Looking ahead, the occupier view was positive, with around two in five (42%) expecting to need more space in the next two years. Only about one in 10 (9%) foresaw reduced needs, while half (49%) expected their requirements to hold steady over the next two years. The corresponding numbers from Q4 2020 are virtually identical, but the mood was much more aggressive pre-Covid. In Q4 2019, 54% of occupiers expected to need more space – before anyone suspected a global pandemic lay ahead.

On another positive note, core business expansion was the most commonly cited reason for new warehouse requirements, taking 24% of answers given. Network consolidation (18%) and expansion into new sectors or services (17%) also lay behind the need for new space. Fewer occupiers mentioned legislation or similar factors (9%), while just 3% cited external factors such as Brexit.

The rise of ESG

Just as economic concerns climbed the agenda in 2022, so too did environmental, social and governance (ESG) issues.

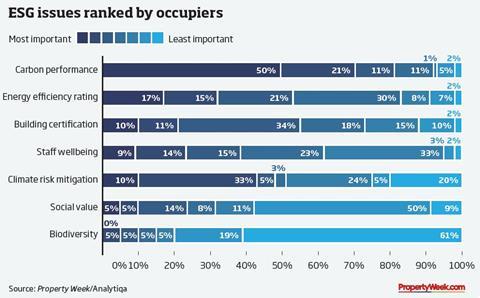

Occupiers showed a strong bias towards practical factors in our survey. Carbon performance was the most popular ESG measure, ranked first among seven options by 50% of our sample. In a relatively distant second place (17%) was a good energy efficiency rating – perhaps reflecting flaws in the current EPC system.

Similarly, a green energy supply was the most popular sustainability measure among occupiers, ranked first among eight eco options by 43%, followed by on-site renewables (28%). Increased biodiversity was the least appealing measure, ranked bottom by 56% of occupiers.

Challenges ahead

The top concerns among occupiers naturally differed from those of developers, but worries have also shifted over the past two years. In Q4 2020, the impact of Brexit was the main worry, but a year later the top concern was a shortage of new buildings. Since then, labour availability and rising rents have shot up the roster of challenges.

Labour shortages accounted for more than a quarter (30%) of issues chosen by occupiers in our latest survey, followed by rising rents (25%); a shortage of new buildings (17%); and the barriers created by the planning system (13%). Only one in 12 (8%) mentioned the developers’ top worry of securing power, which tends to fall on the developer during delivery.

Asked to compare rent to other costs, just over half of occupiers (56%) said they were moderately sensitive to rising rents. About one in five (21%) said they were very sensitive, while another quarter (23%) said they were only slightly sensitive relative to other costs. Nobody said rent rises were not an issue.

Looking ahead to how supply chains might evolve over the next three years, the most popular option among occupiers (18% of answers) was investment in building-level automation, which is likely to be a direct response to labour shortages. The next most popular measure (15%) was lower-carbon transport, followed by technology to improve supply chain visibility (12%), and only one in 12 answers (8%) indicated consolidation into fewer buildings. Only 4% mentioned making more use of third-party logistics providers.

Investor expectations

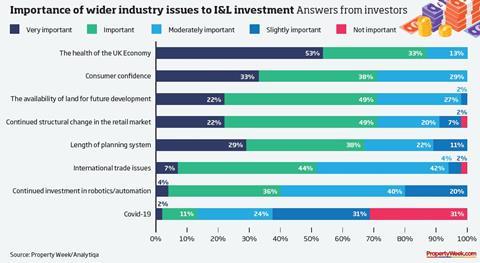

While almost nine out of 10 investors (87%) agreed the broad health of the UK economy was set to have an important or very important bearing on their investments this year, it was by no means their only concern. Almost three quarters (72%) gave similar gravity to consumer confidence, structural changes in retail and the availability of land, and almost as many (68%) cited planning delays.

The primacy of these factors has not changed dramatically since 2019. Headwinds might grow or wane, but they keep blowing from the same directions.

What has shrunk is the speculative development pipeline. In Q4 2019, just over 30% of developers expected to speculatively create more space in the year ahead. In our latest survey, the proportion predicting expansion had dropped to 25%, while 31% expected to develop less speculative space, with the remaining 44% planning to hold level.

If carried through to real developments, the weighting suggests a decrease in supply and no doubt further upward pressure on rents. However, the data is also likely to reflect an increasing shift towards build-to-suit (BTS) rather than spec schemes, as developers seek to balance risk in a period of uncertain demand.

The top concern among developers in Q4 2022 was getting power to new sites, rated as important or very important by 91% of our sample. Coming a close second was the lack of suitable development sites, seen as important or very important by 83%, while 80% cited the length of the planning process. Perhaps surprisingly, less than half (47%) of developers and landowners expected to face significant problems securing finance.

Conclusions

According to Tom Leeming, development director at I&L developer Tritax Symmetry, the most significant insights from the census are the enhanced focus on ESG among occupiers, reductions in supply and development pipelines and occupier labour challenges. “At Tritax Symmetry, we have seen an unprecedented take-up of our speculative development programme in 2022: of the 2.4m sq ft speculatively built, 95% was let prior to practical completion, demonstrating the demand for new, sustainable buildings in the right location.”

He adds: “Looking ahead, the continued pressure on land supply, delays and uncertainty in the planning system coupled with funding market dynamics will all bear down on reduced spec development, encouraging a refocus on BTS, which will, in turn, continue the upward pressure on rents.”

Kevin Mofid, head of I&L research at Savills, also draws out both highs and lows from the latest data. “The results of our census have become a leading indicator for the health of the logistics sector in the UK,” he says.

“Clearly, sentiment across all stakeholder groups has shifted in the past 12 months, which in turn will impact the market, but it is pleasing to note over 90% of our occupier audience expect to take more or the same amount of warehouse space over the next three years. This should give investors and developers more confidence about the medium-term health of the sector.”

How the rest of 2023 will play out remains to be seen – but even with all of the pressures occupiers are facing, it seems that good-quality, energy-efficient warehouse space is likely to remain in strong demand.

No comments yet