Investment in our later living market has risen markedly in recent years, but what does the future hold?

The last few months has placed a spotlight on people in later life. People generally wish to live independent lives as long as possible and it is vital that we provide age appropriate housing options to seniors. The need to address this issue is pressing, with demand only increasing as people live longer. Well-designed extra care retirement communities provide people with a housing option that delivers a good standard of independent living while also ensuring that high quality care and support is available when required.

Despite recent weeks of temporary muted activity enforced by the lockdown, we have seen positive sentiment continue especially amongst institutional investors. Clearly the full impact of Covid-19 on the sector has yet to become evident, however the strong fundamentals underpinning investment have not changed.

The Covid-19 pandemic will result in a reordering of decision-making priorities for tenants and residents. Topics like infection prevention and control will drive demand, but require us to look at how new schemes are designed as well as staffed and managed. This in turn will lead to a greater desire from investors for professionally managed buildings with an operational focus. In short, the investment case remains compelling, supported by a number of key fundamentals.

Firstly, the underlying demographic trends underpinning the sector will continue. The UK’s population is ageing and by 2037, it is forecast that 13% of the population will be 75 or older – an increase of more than 60% from today.

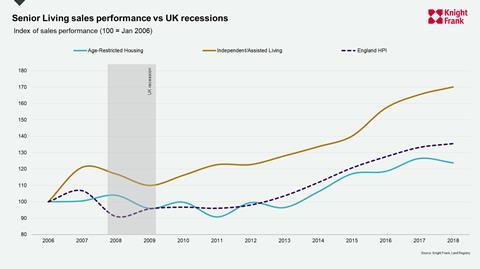

The second fundamental which supports the investment case for UK senior housing is price growth of independent living and assisted living, which outstrips other residential sectors. Price growth within the sector stands at 55% since 2009 compared to average house price inflation across England of 42%.

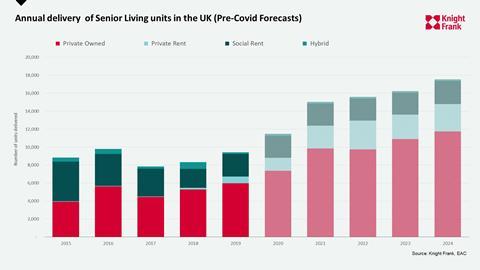

In addition, our senior population represents the wealthiest demographic in terms of property values. The fundamentals of affordability are based on this property wealth, alongside income from pensions and investments, making it an attractive proposition for investors. Finally, there is a substantial imbalance between the rate our population is aging and the delivery of seniors housing, with only 9,500 senior living homes completed in the UK in 2019.

Future trends

The Covid-19 pandemic will likely speed up existing trends in the sector. Knight Frank predicts that we will begin to see larger schemes coming forward with the capacity to provide a greater range of services, offering flexible access to senior housing and offsetting increases in staffing and operational costs.

We will also see developers select sites that have a closer proximity to urban locations, developing mixed-use schemes and re-purposing sites currently in other land uses, such as retail. In addition, independent living schemes offering increased numbers of medically trained staff will also be in higher demand. Such schemes will enable operators to incorporate assisted living alongside independent living.

Offerings including mixed-tenure and rental-only propositions will also become more widely available, as will more variations on event fee structures, providing increased tenant choice best suited to their financial profile, budget and preference.

Higher levels of staff training, larger stocks of PPE equipment and higher scrutiny of supply chains will be expected by residents and their families. In the future there will also be closer alignment between epidemiologists and the wider use of telehealth, the sector will better utilise technology in order to provide better care and service levels to residents.

However to continue moving into a mainstream asset class there are still concerns and issues that need clarifying. Including a uniform plan for meeting the housing needs of our aging population, with local authorities held to account to meet local needs, while seniors housing should be given support in planning policy. Ultimately, there needs to be wider understanding of the benefits of seniors housing. This includes financial savings to local authority care services; release of local family housing back to the market via downsizing; local employment generation; reduced impact on highways and other local services; rejuvenation of high streets with facilities open to the public; and lastly contribution to housing supply targets.

Tom Scaife is a partner at Knight Frank and head of the firm’s Senior Living team

No comments yet